Case Study: Please complete the following case study using both a DCF and Multiples approach to determine a valuation for the firm. Please submit an Excel worksheet to demonstrate your work and conclusions. Use outside resources and/or specific assumptions to supplement any information not found within the case.

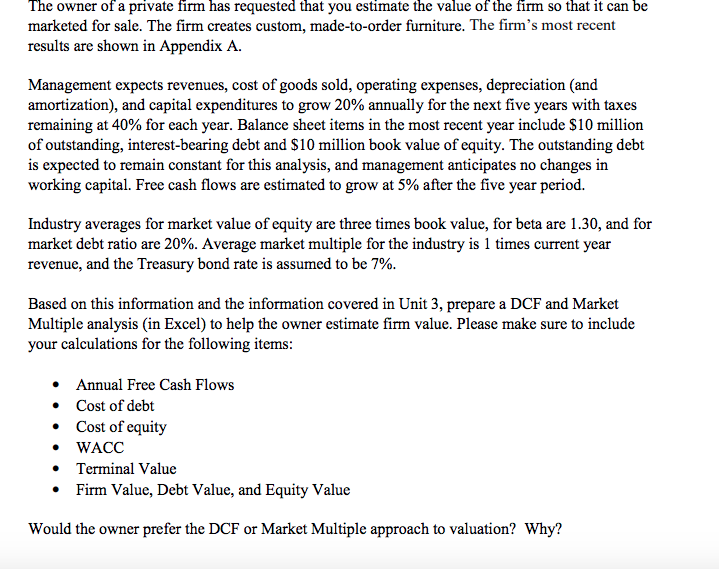

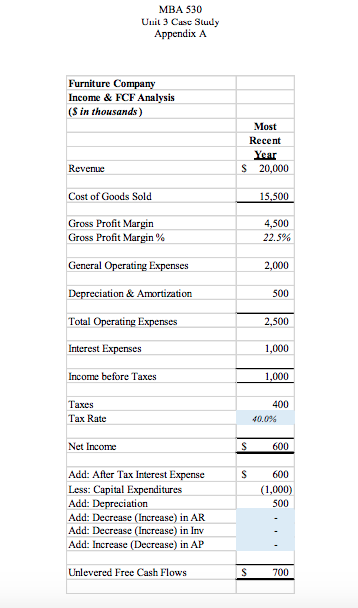

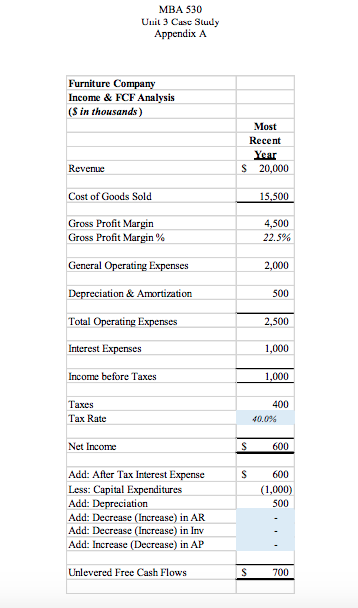

The owner of a private firm has requested that you estimate the value of the firm so that it can be marketed for sale. The firm creates custom, made-to-order furniture. The firm's most recent results are shown in Appendix A. Management expects revenues, cost of goods sold, operating expenses, depreciation (and amortization), and capital expenditures to grow 20% annually for the next five years with taxes remaining at 40% for each year. Balance sheet items in the most recent year include $10 million of outstanding, interest-bearing debt and $10 million book value of equity. The outstanding debt is expected to remain constant for this analysis, and management anticipates no changes in working capital. Free cash flows are estimated to grow at 5% after the five year period. Industry averages for market value of equity are three times book value, for beta are 1.30, and for market debt ratio are 20%. Average market multiple for the industry is 1 times current year revenue, and the Treasury bond rate is assumed to be 7%. Based on this information and the information covered in Unit 3, prepare a DCF and Market Multiple analysis (in Excel) to help the owner estimate firm value. Please make sure to include your calculations for the following items: Annual Free Cash Flows Cost of debt Cost of equity WACC Terminal Value Firm Value, Debt Value, and Equity Value Would the owner prefer the DCF or Market Multiple approach to valuation? Why? MBA 530 Uuil 3 Case Study Appendix A Furniture Company Income & FCF Analysis (s in thousands) Most Recent Year $ 20,000 Revenue Cost of Goods Sold 15,500 Gross Profit Margin Gross Profit Margin% 4,500 22.5% General Operating Expenses 2,000 Depreciation & Amortization 500 Total Operating Expenses 2,500 Interest Expenses 1,000 Income before Taxes 1,000 Taxes Tax Rate 400 40.096 Net Income S 600 s 600 (1,000) 500 Add: After Tax Interest Expense Less: Capital Expenditures Add: Depreciation Add: Decrease (Increase) in AR Add: Decrease Increase) in Inv Add: Increase (Decrease) in AP Unlevered Free Cash Flows S 700 The owner of a private firm has requested that you estimate the value of the firm so that it can be marketed for sale. The firm creates custom, made-to-order furniture. The firm's most recent results are shown in Appendix A. Management expects revenues, cost of goods sold, operating expenses, depreciation (and amortization), and capital expenditures to grow 20% annually for the next five years with taxes remaining at 40% for each year. Balance sheet items in the most recent year include $10 million of outstanding, interest-bearing debt and $10 million book value of equity. The outstanding debt is expected to remain constant for this analysis, and management anticipates no changes in working capital. Free cash flows are estimated to grow at 5% after the five year period. Industry averages for market value of equity are three times book value, for beta are 1.30, and for market debt ratio are 20%. Average market multiple for the industry is 1 times current year revenue, and the Treasury bond rate is assumed to be 7%. Based on this information and the information covered in Unit 3, prepare a DCF and Market Multiple analysis (in Excel) to help the owner estimate firm value. Please make sure to include your calculations for the following items: Annual Free Cash Flows Cost of debt Cost of equity WACC Terminal Value Firm Value, Debt Value, and Equity Value Would the owner prefer the DCF or Market Multiple approach to valuation? Why? MBA 530 Uuil 3 Case Study Appendix A Furniture Company Income & FCF Analysis (s in thousands) Most Recent Year $ 20,000 Revenue Cost of Goods Sold 15,500 Gross Profit Margin Gross Profit Margin% 4,500 22.5% General Operating Expenses 2,000 Depreciation & Amortization 500 Total Operating Expenses 2,500 Interest Expenses 1,000 Income before Taxes 1,000 Taxes Tax Rate 400 40.096 Net Income S 600 s 600 (1,000) 500 Add: After Tax Interest Expense Less: Capital Expenditures Add: Depreciation Add: Decrease (Increase) in AR Add: Decrease Increase) in Inv Add: Increase (Decrease) in AP Unlevered Free Cash Flows S 700