Answered step by step

Verified Expert Solution

Question

1 Approved Answer

case study question: An assessment of whether they can meet their goals and objectives given their current circumstances and future savings capacity. as it says

case study question:

- An assessment of whether they can meet their goals and objectives given their current circumstances and future savings capacity.

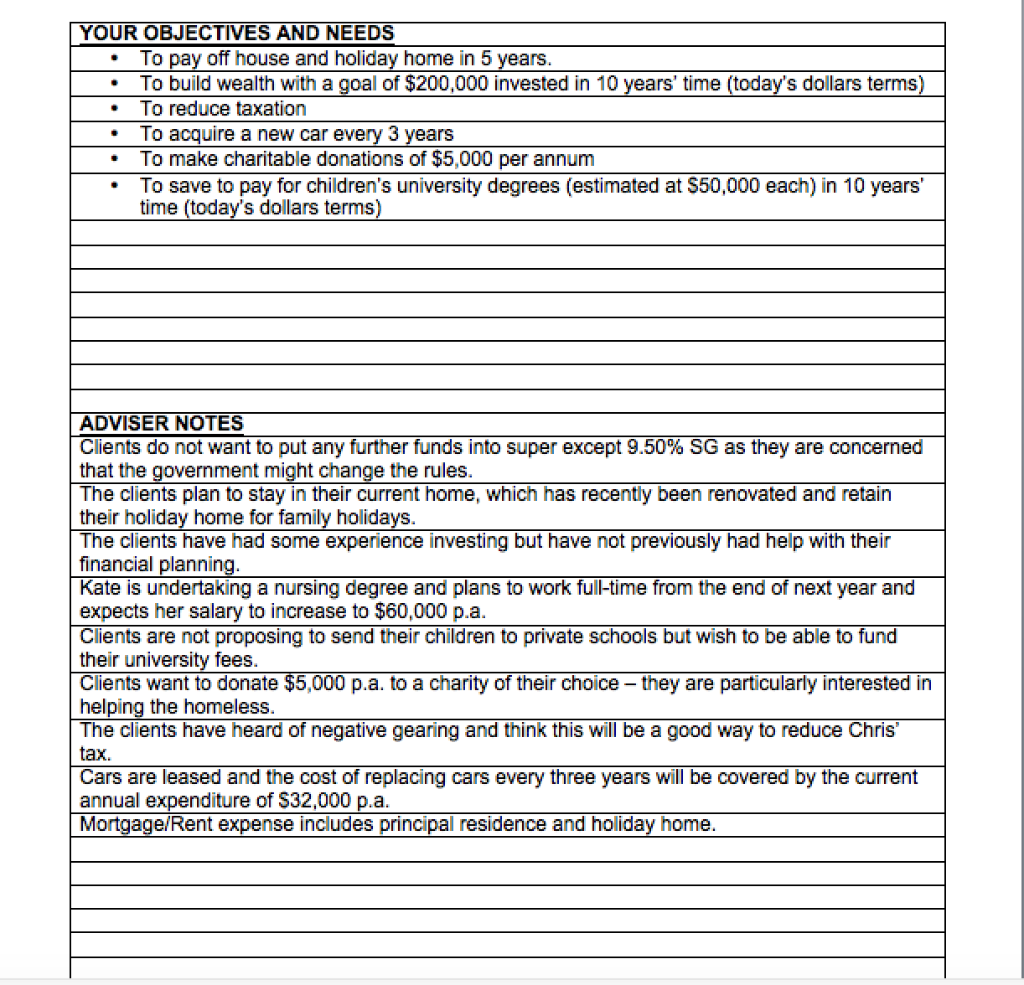

as it says on the clients data form, the goals and objectives are; To pay off house and holiday home in 5 years, To build wealth with a goal of $200,000 invested in 10 years time (todays dollars terms), To reduce taxation, To acquire a new car every 3 years, To make charitable donations of $5,000 per annum, To save to pay for childrens university degrees (estimated at $50,000 each) in 10 years time (todays dollars terms) ( there are 2 children).

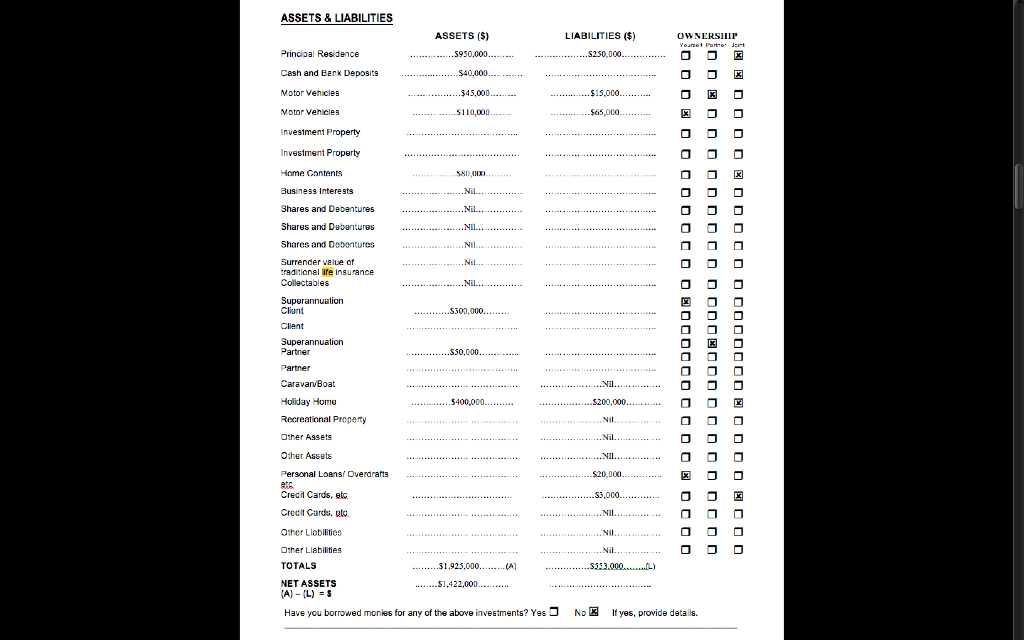

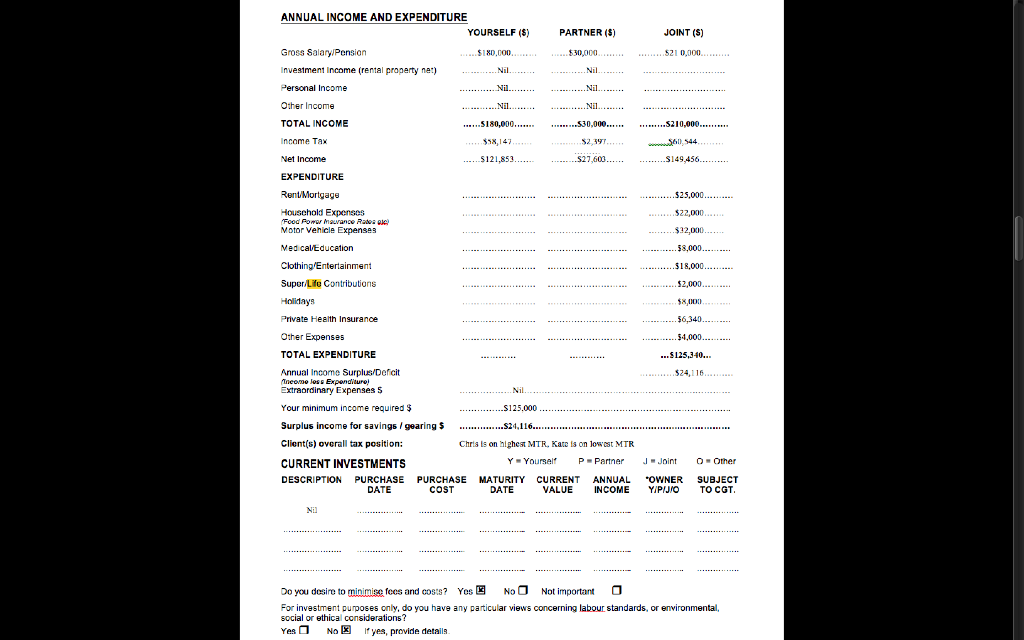

YOUR OBJECTIVES AND NEEDS To pay off house and holiday home in 5 years To build wealth with a goal of $200,000 invested in 10 years' time (today's dollars terms) . To reduce taxation To acquire a new car every 3 years To make charitable donations of $5,000 per annum To save to pay for children's university degrees (estimated at $50,000 each) in 10 years' time (today's dollars terms) ADVISER NOTES Clients do not want to put any further funds into super except 9.50% SG as they are concerned that the government might change the rules. The clients plan to stay in their current home, which has recently been renovated and retain their holiday home for family holidays The clients have had some experience investing but have not previously had help with their financial planning Kate is undertaking a nursing degree and plans to work ful-time from the end of next year and expects her salary to increase to $60,000 p.a Clients are not proposing to send their children to private schools but wish to be able to fund their university fees Clients want to donate $5,000 p.a. to a charity of their choice they are particularly interested in helping the homeless The clients have heard of negative gearing and think this will be a good way to reduce Chris' tax Cars are leased and the cost of replacing cars every three years will be covered by the current annual expenditure of $32,000 p.a. Mortgage/Rent expense includes principal residence and holiday home ASSETS&LIABILITIES ASSETS (S) LIABILITIES() OWNERSHIP Principal Residance Motor Vehicles Motor Vehicles investment Property Investment Property 15.0 si 10,000 $65,000. . . ome Contents Business Interests Shares and Debentures Shares and Debantures Shares and Debentures Surrender value of raditional lire insurance Superannuation Cliant Client Superannuation 000.... artner Partner CaravavBoat Holiday Home Recreational Property Other Assets Other Assets ersonal Loans/Overdrafts Credit Cards. Crecit Cards, etc Other Liabilities Other Lilabilities TOTALS NET ASSETS 000L Nil Nil. $1.925.000 (AI Have you borrowed monies for any of the above investments? YesNo If yes, provide details. ANNUAL INCOME AND EXPENDITURE JOINT (S) YOURSELF (S) PARTNER (S) Gross Salary Pension investment Income (rental property ne:) Personal Income Other Income TOTAL INCOME ncome Tax Net Income EXPENDITURE 521 0,000. 18D,0O0 .530,000 $58,147 $2,59 Houschold Expensos Motor Vehicle Expenses Med caltducation Clothing Entertainment Super Life Contributions Holidays Private Heeth Insurance Other Expenses TOTAL EXPENDITURE Annual Income Surplus Dercit Extraordinary Expenses S Your minimum income required$ Surplus income for savingsgearing .S24.116 Client(s) overall tax position: CURRENT INVESTMENTS DESCRIPTION PURCHASE PURCHASE MATURITY CURRENT ANNUAL OWNER SUBJECT 22,000 ..$32,000 18,000 2,000 $125,340. $24,116 Chris is on highest MTR, Kate is on lowest MTR Y Yourself P Partner J Joint other DATE COST DATE VALUEINCOME YIPIJO TO CGT Yes No O Do you desire to minim fees and costs? Not important For invastment purposes only, do you have any particular views concerning labour standards, or environmental, social or ethical considerations? YsNo fyes, provide details YOUR OBJECTIVES AND NEEDS To pay off house and holiday home in 5 years To build wealth with a goal of $200,000 invested in 10 years' time (today's dollars terms) . To reduce taxation To acquire a new car every 3 years To make charitable donations of $5,000 per annum To save to pay for children's university degrees (estimated at $50,000 each) in 10 years' time (today's dollars terms) ADVISER NOTES Clients do not want to put any further funds into super except 9.50% SG as they are concerned that the government might change the rules. The clients plan to stay in their current home, which has recently been renovated and retain their holiday home for family holidays The clients have had some experience investing but have not previously had help with their financial planning Kate is undertaking a nursing degree and plans to work ful-time from the end of next year and expects her salary to increase to $60,000 p.a Clients are not proposing to send their children to private schools but wish to be able to fund their university fees Clients want to donate $5,000 p.a. to a charity of their choice they are particularly interested in helping the homeless The clients have heard of negative gearing and think this will be a good way to reduce Chris' tax Cars are leased and the cost of replacing cars every three years will be covered by the current annual expenditure of $32,000 p.a. Mortgage/Rent expense includes principal residence and holiday home ASSETS&LIABILITIES ASSETS (S) LIABILITIES() OWNERSHIP Principal Residance Motor Vehicles Motor Vehicles investment Property Investment Property 15.0 si 10,000 $65,000. . . ome Contents Business Interests Shares and Debentures Shares and Debantures Shares and Debentures Surrender value of raditional lire insurance Superannuation Cliant Client Superannuation 000.... artner Partner CaravavBoat Holiday Home Recreational Property Other Assets Other Assets ersonal Loans/Overdrafts Credit Cards. Crecit Cards, etc Other Liabilities Other Lilabilities TOTALS NET ASSETS 000L Nil Nil. $1.925.000 (AI Have you borrowed monies for any of the above investments? YesNo If yes, provide details. ANNUAL INCOME AND EXPENDITURE JOINT (S) YOURSELF (S) PARTNER (S) Gross Salary Pension investment Income (rental property ne:) Personal Income Other Income TOTAL INCOME ncome Tax Net Income EXPENDITURE 521 0,000. 18D,0O0 .530,000 $58,147 $2,59 Houschold Expensos Motor Vehicle Expenses Med caltducation Clothing Entertainment Super Life Contributions Holidays Private Heeth Insurance Other Expenses TOTAL EXPENDITURE Annual Income Surplus Dercit Extraordinary Expenses S Your minimum income required$ Surplus income for savingsgearing .S24.116 Client(s) overall tax position: CURRENT INVESTMENTS DESCRIPTION PURCHASE PURCHASE MATURITY CURRENT ANNUAL OWNER SUBJECT 22,000 ..$32,000 18,000 2,000 $125,340. $24,116 Chris is on highest MTR, Kate is on lowest MTR Y Yourself P Partner J Joint other DATE COST DATE VALUEINCOME YIPIJO TO CGT Yes No O Do you desire to minim fees and costs? Not important For invastment purposes only, do you have any particular views concerning labour standards, or environmental, social or ethical considerations? YsNo fyes, provide detailsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started