Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Sales and Use Tax Requirements for Businesses Sales and use taxes are crucial components of state and local revenue systems in the United

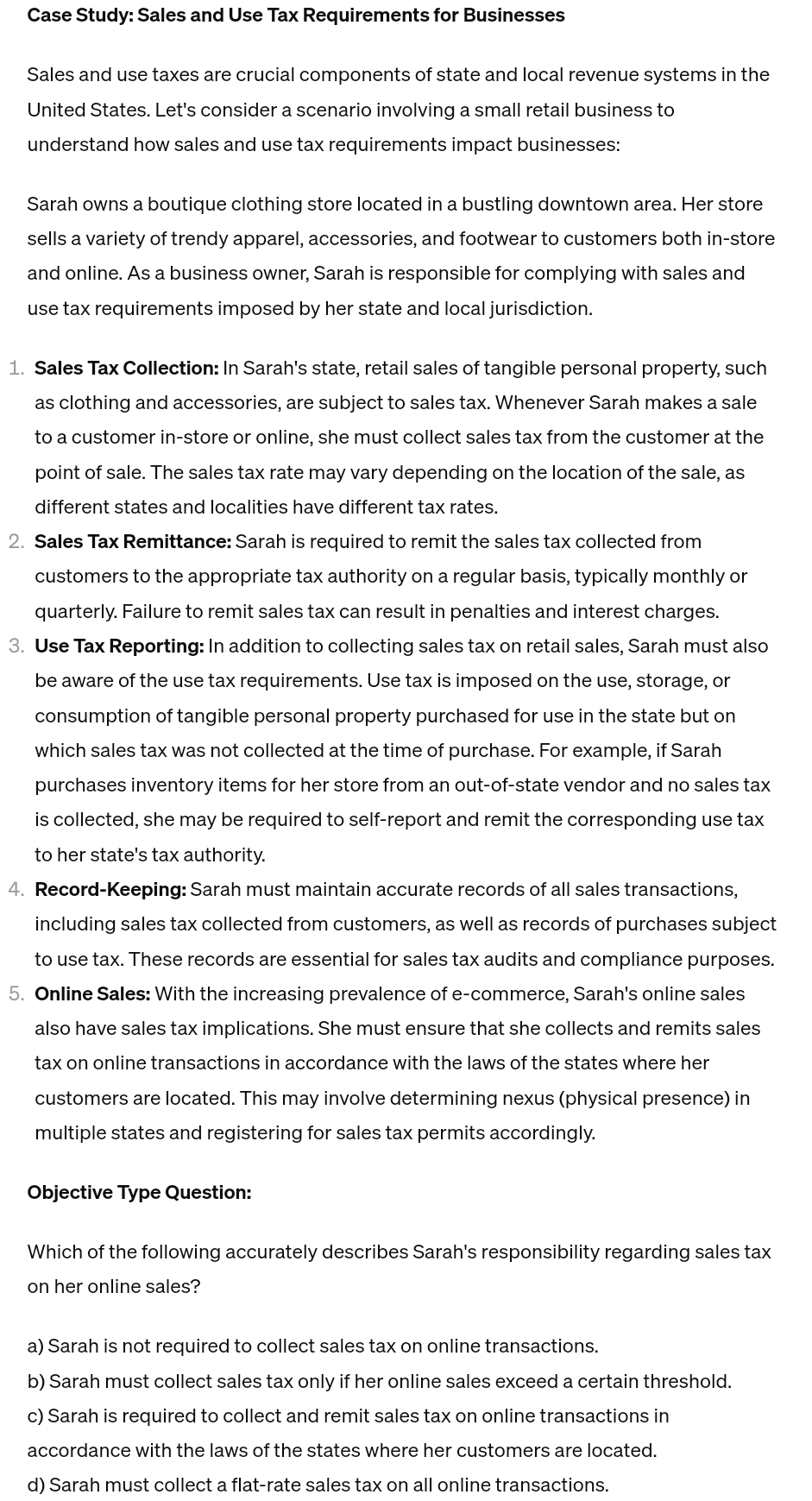

Case Study: Sales and Use Tax Requirements for Businesses

Sales and use taxes are crucial components of state and local revenue systems in the United States. Let's consider a scenario involving a small retail business to understand how sales and use tax requirements impact businesses:

Sarah owns a boutique clothing store located in a bustling downtown area. Her store sells a variety of trendy apparel, accessories, and footwear to customers both instore and online. As a business owner, Sarah is responsible for complying with sales and use tax requirements imposed by her state and local jurisdiction.

Sales Tax Collection: In Sarah's state, retail sales of tangible personal property, such as clothing and accessories, are subject to sales tax. Whenever Sarah makes a sale to a customer instore or online, she must collect sales tax from the customer at the point of sale. The sales tax rate may vary depending on the location of the sale, as different states and localities have different tax rates.

Sales Tax Remittance: Sarah is required to remit the sales tax collected from customers to the appropriate tax authority on a regular basis, typically monthly or quarterly. Failure to remit sales tax can result in penalties and interest charges.

Use Tax Reporting: In addition to collecting sales tax on retail sales, Sarah must also be aware of the use tax requirements. Use tax is imposed on the use, storage, or consumption of tangible personal property purchased for use in the state but on which sales tax was not collected at the time of purchase. For example, if Sarah purchases inventory items for her store from an outofstate vendor and no sales tax is collected, she may be required to selfreport and remit the corresponding use tax to her state's tax authority.

RecordKeeping: Sarah must maintain accurate records of all sales transactions, including sales tax collected from customers, as well as records of purchases subject to use tax. These records are essential for sales tax audits and compliance purposes.

Online Sales: With the increasing prevalence of ecommerce, Sarah's online sales also have sales tax implications. She must ensure that she collects and remits sales tax on online transactions in accordance with the laws of the states where her customers are located. This may involve determining nexus physical presence in multiple states and registering for sales tax permits accordingly.

Objective Type Question:

Which of the following accurately describes Sarah's responsibility regarding sales tax on her online sales?

a Sarah is not required to collect sales tax on online transactions.

b Sarah must collect sales tax only if her online sales exceed a certain threshold.

c Sarah is required to collect and remit sales tax on online transactions in accordance with the laws of the states where her customers are located.

d Sarah must collect a flatrate sales tax on all online transactions.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started