Question

Case Study Sports World Incorporated Introduction Sports World Incorporated (SWI) is a wholesaler of sporting clothing and equipment specializing in skiing, hockey, figure skating, and

Case Study

Case Study

Sports World Incorporated

Introduction

Sports World Incorporated (SWI) is a wholesaler of sporting clothing and equipment specializing in skiing, hockey, figure skating, and mountain climbing with operating locations in British Columbia and Alberta. SWI hired a new accountant who prepared financial statements to be presented to the auditors. As a publicly-traded company, SWI follows IFRS.

SWI has adopted the following accounting policies.

Basis of Accounting Accrual basis where revenues are recorded when earned and expenses are recorded as incurred regardless of the timing of cash flows.

Accounts Receivable Allowance method using the % credit sales method. At year-end, a detailed analysis of receivable balances occurs to write-off receivables known to be uncollectible and ensure the remaining receivables are properly valued at net realizable value.

Inventory Inventory is accounted for using the perpetual inventory system with a FIFO cost flow assumption. Inventory is valued at the lower of cost and net realizable value. Impairment is assessed on an annual basis.

Investments Investments in shares with no significant influence are accounted for under the FV-OCI method. Investments in bonds are accounted for under the amortized cost model.

Long-Term Assets All long-term assets are accounted for under the cost model and are being depreciated using the straight-line method (with exception to land and goodwill). Impairment testing occurs on an annual basis using the Rational Entity Impairment Model.

Revenue Recognition Revenue is recognized when legal title to inventory transfers between buyer and seller. The company sells to customers on 2/10, net 30 day basis. Customers can return products for refund or customer credit within 30 days of the date of purchase.

Upon incorporation, SWI was authorized to issue an unlimited number of common shares and 50,000 $2.00 non-cumulative preferred shares. At December 31, 2022 the company had 250,000 common shares and 10,000 preferred shares issued and outstanding. SWI declared and paid cash dividends of $90,000 during the year. No shares were issued or retired during 2022.

SWI has an operating bank account held at TD Bank as well as a payroll account at Royal Bank of Canada. SWI has dealt with TD Bank since incorporation, but the payroll service agency who processes SWIs monthly payroll insisted on SWI opening an account at Royal Bank since this is their preferred financial institution. As a result, SWI makes monthly bank transfers between the operating account and the payroll account to ensure all employees get paid. Both bank accounts have overdraft protection.

Case Requirements

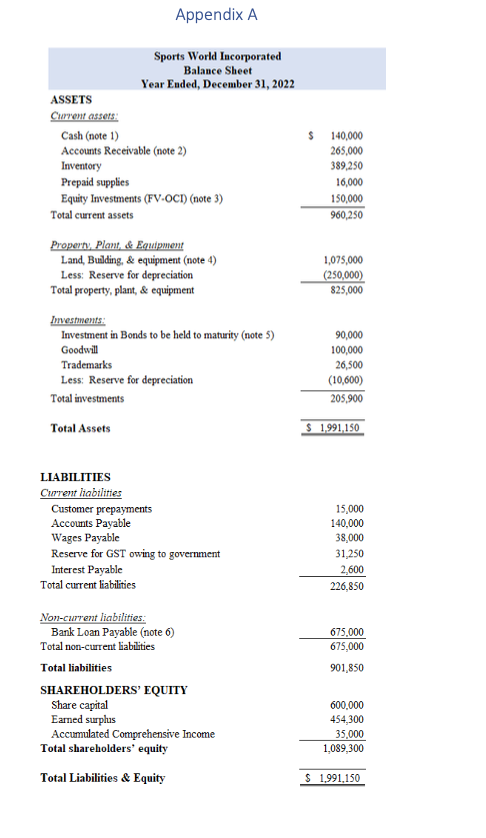

You are an auditor with Mandryk & Associates LLP. The main accountant employed by SWI was recently hospitalized due to COVID-19 and as such, could not prepare the financial statements for the year-ended, December 31, 2022. Instead, a junior accountant was approached to draft the financial statements which have been given to you for your review (Appendix A).

Prepare a written report that addresses the following questions using the headings in bold below. The responses under each of the headings should be written in paragraph form and provide clear answers & recommendations.

Note to Students: Your responses will be evaluated for depth in discussion. Please state facts and opinions that are substantiated with critical thought and reasoning. Where possible, use case facts in your answer. Remember, part of the skills you will need in your career are the ability to evaluate alternatives, make recommendations, and communicate your findings in a professional way. Be clear and concise quality of answers will be more important than quantity of words that lack depth in discussion.

Case Questions

The Conceptual Framework

1. Accounting standards are built around the conceptual framework. Briefly explain the purpose of the conceptual framework and the role it plays in providing information that is useful for decision making. [4 marks]

2. Examine the draft financial statements. In general, what aspects of the conceptual framework have been violated? What recommendations would you make for improvement? [6 marks]

Correcting the Financial Statements

3. Prepare a corrected classified statement of financial position (balance sheet). [25 marks]

4. Prepare a corrected multi-step income statement. [30 marks] Hint: When preparing corrected financial statements, ensure all proper terminology is being used. Correct for any errors you identify with respect to valuation, recognition, and/or classification. Be sure to consider all information provided to you. This includes information in the case introduction as well as the extra information provided to you by the junior accountant (summarized in the notes following the financial statements).

Subsequent Information

5. The junior accountant identified that the spreadsheet used to calculate depreciation on capital assets was set up incorrectly. The formulas used to calculate depreciation expense didnt deduct estimated residual values and this mistake occurred in the current and the prior years. Briefly explain how the junior accountant should deal with this situation and the impact it will have on the financial statements. [5 marks]

Notes & extra information provided to you from discussions with the Junior Accountant:

1. The cash balance shown on the financial statements includes a $35,000 overdraft in the payroll account.

2. Accounts receivable includes a provision of $85,000 for uncollectible accounts.

3. Management is holding the FV-OCI investments for strategic reasons, and as such does not plan on selling the investments in the near future.

4. A few years ago the corporation acquired land and building for $500,000 and $350,000 respectively. The total amount of depreciation recorded on the building as year-end is $70,000.

5. The bonds are 5-year bonds which have been acquired at a premium during the year. The bonds will be held to maturity.

6. The bank loan is an interest-bearing instalment loan secured by land and the building. The loan principal to be repaid over the next 12 months is $125,000.

7. During the year, the company issued refunds to customers for inventory returns in the amount of $60,000. Also, a total of $4,550 in sales discounts were provided to credit customers for early payment. Both these amounts are included in sales revenues.

8. The company successfully received $14,150 in supplier rebates on inventory purchases and recorded these as extra revenues in the income statement.

9. When inventory was purchased, SWI paid $13,500 was spent on freight to have the inventory shipped to its warehouses. The remaining freight charges related to shipping costs for SWIs largest customers.

10. Included in this balance is $6,500 of amortization for the trademark.

11. SWI declared and paid cash dividends of $90,000 during the year.

Appendix A Appendix AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started