Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study: Tax Credits and Incentives for Businesses Introduction: Tax credits and incentives play a crucial role in encouraging business investment, innovation, and economic growth.

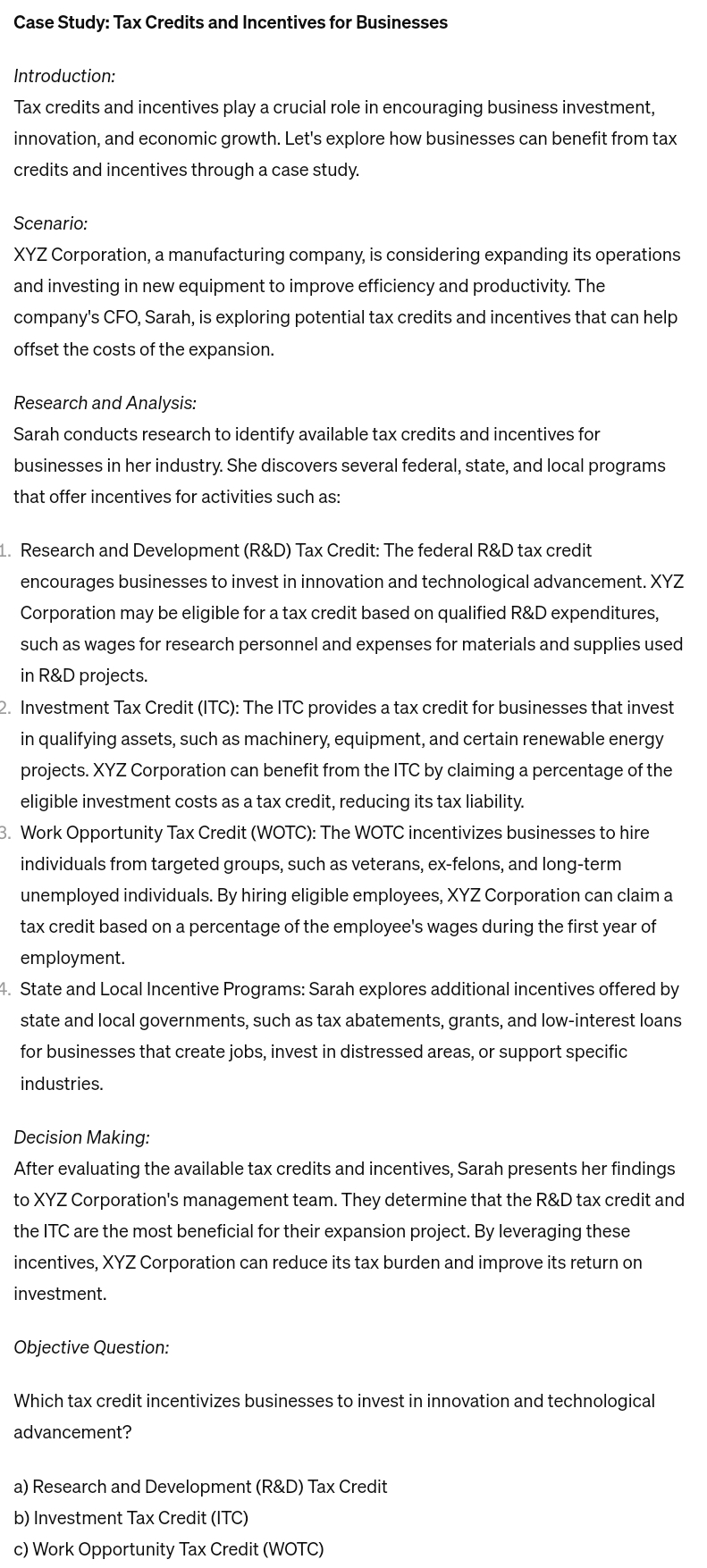

Case Study: Tax Credits and Incentives for Businesses

Introduction:

Tax credits and incentives play a crucial role in encouraging business investment, innovation, and economic growth. Let's explore how businesses can benefit from tax credits and incentives through a case study.

Scenario:

XYZ Corporation, a manufacturing company, is considering expanding its operations and investing in new equipment to improve efficiency and productivity. The company's CFO, Sarah, is exploring potential tax credits and incentives that can help offset the costs of the expansion.

Research and Analysis:

Sarah conducts research to identify available tax credits and incentives for businesses in her industry. She discovers several federal, state, and local programs that offer incentives for activities such as:

Research and Development R&D Tax Credit: The federal R&D tax credit encourages businesses to invest in innovation and technological advancement. XYZ Corporation may be eligible for a tax credit based on qualified R&D expenditures, such as wages for research personnel and expenses for materials and supplies used in R&D projects.

Investment Tax Credit ITC: The ITC provides a tax credit for businesses that invest in qualifying assets, such as machinery, equipment, and certain renewable energy projects. XYZ Corporation can benefit from the ITC by claiming a percentage of the eligible investment costs as a tax credit, reducing its tax liability.

Work Opportunity Tax Credit WOTC: The WOTC incentivizes businesses to hire individuals from targeted groups, such as veterans, exfelons, and longterm unemployed individuals. By hiring eligible employees, XYZ Corporation can claim a tax credit based on a percentage of the employee's wages during the first year of employment.

State and Local Incentive Programs: Sarah explores additional incentives offered by state and local governments, such as tax abatements, grants, and lowinterest loans for businesses that create jobs, invest in distressed areas, or support specific industries.

Decision Making:

After evaluating the available tax credits and incentives, Sarah presents her findings to XYZ Corporation's management team. They determine that the R&D tax credit and the ITC are the most beneficial for their expansion project. By leveraging these incentives, XYZ Corporation can reduce its tax burden and improve its return on investment.

Objective Question:

Which tax credit incentivizes businesses to invest in innovation and technological advancement?

a Research and Development R&D Tax Credit

b Investment Tax Credit ITC

c Work Opportunity Tax Credit WOTC

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started