Answered step by step

Verified Expert Solution

Question

1 Approved Answer

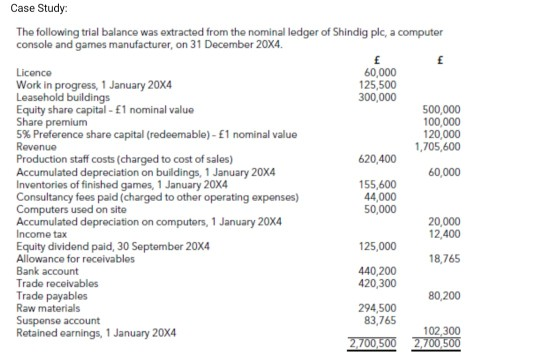

Case Study: The following trial balance was extracted from the nominal ledger of Shindig plc, a computer console and games manufacturer, on 31 December 20X4.

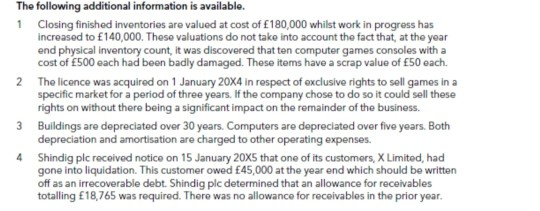

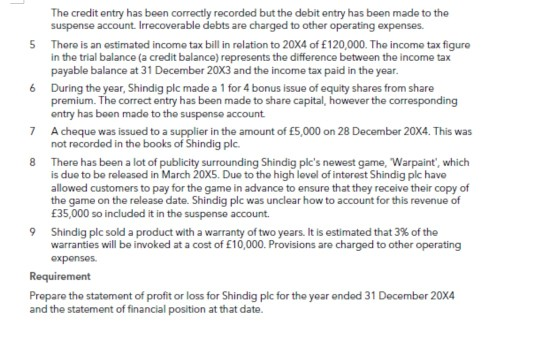

Case Study: The following trial balance was extracted from the nominal ledger of Shindig plc, a computer console and games manufacturer, on 31 December 20X4. Licence 60,000 Work in progress, 1 January 20X4 125,500 Leasehold buildings 300,000 Equity share capital - 1 nominal value 500,000 Share premium 100,000 5% Preference share capital (redeemable) - 1 nominal value 120,000 Revenue 1,705,600 Production staff costs (charged to cost of sales) 620,400 Accumulated depreciation on buildings, 1 January 20X4 60,000 Inventories of finished games, 1 January 20X4 155,600 Consultancy fees paid (charged to other operating expenses) 44,000 Computers used on site 50,000 Accumulated depreciation on computers, 1 January 20X4 20,000 Income tax 12.400 Equity dividend paid, 30 September 20X4 125,000 Allowance for receivables 18,765 Bank account 440,200 Trade receivables 420,300 Trade payables 80,200 Raw materials 294,500 Suspense account 83,765 Retained earnings, 1 January 20X4 102,300 2,700,500 2,700,500 The following additional information is available. 1 Closing finished inventories are valued at cost of 180,000 whilst work in progress has increased to 140,000. These valuations do not take into account the fact that, at the year end physical inventory count, it was discovered that ten computer games consoles with a cost of 500 each had been badly damaged. These items have a scrap value of 50 each. 2 The licence was acquired on 1 January 20X4 in respect of exclusive rights to sell games in a specific market for a period of three years. If the company chose to do so it could sell these rights on without there being a significant impact on the remainder of the business. 3 Buildings are depreciated over 30 years. Computers are depreciated over five years. Both depreciation and amortisation are charged to other operating expenses. 4 Shindig plc received notice on 15 January 20x5 that one of its customers, X Limited, had gone into liquidation. This customer owed 45,000 at the year end which should be written off as an irrecoverable debt. Shindig plc determined that an allowance for receivables totalling 18,765 was required. There was no allowance for receivables in the prior year. The credit entry has been correctly recorded but the debit entry has been made to the suspense account. Irrecoverable debts are charged to other operating expenses. 5 There is an estimated income tax bill in relation to 20x4 of 120,000. The income tax figure in the trial balance (a credit balance) represents the difference between the income tax payable balance at 31 December 20x3 and the income tax paid in the year. 6 During the year, Shindig plc made a 1 for 4 bonus issue of equity shares from share premium. The correct entry has been made to share capital, however the corresponding entry has boon made to the suspense account 7 A cheque was issued to a supplier in the amount of 5,000 on 28 December 20X4. This was not recorded in the books of Shindig plc. 8 There has been a lot of publicity surrounding Shindig ple's newest game, Warpaint', which is due to be released in March 20X5. Due to the high level of interest Shindig plc havo allowed customers to pay for the game in advance to ensure that they receive their copy of the game on the release date. Shindig plc was unclear how to account for this revenue of 35,000 so included it in the suspense account 9 Shindig plc sold a product with a warranty of two years. It is estimated that 3% of the warranties will be invoked at a cost of 10,000. Provisions are charged to other operating expenses. Requirement Prepare the statement of profit or loss for Shindig pic for the year onded 31 December 20X4 and the statement of financial position at that date

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started