Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study There have been significant discussions on climate change recently and the Australian Federal Government is providing financial incentives to businesses that shift to

Case Study

There have been significant discussions on climate change recently and the Australian Federal Government is providing financial incentives to businesses that shift to clean energy. Your company, Battery for Life Ltd is conducting a feasibility study on whether to manufacture electric vehicle batteries EVBs The data relating to the product are provided below and you are required to use your accounting and statistics knowledge to evaluate if the company should manufacture EVBs or not.

In this case study, you are required to use accounting and statistical analyses to make a business decision on whether or not a product should be manufactured. It is highly recommended you use Microsoft Excel to complete all the required calculations.

QUESTION

Electric Vehicle Battery EVB

Use the data below to answer the questions:

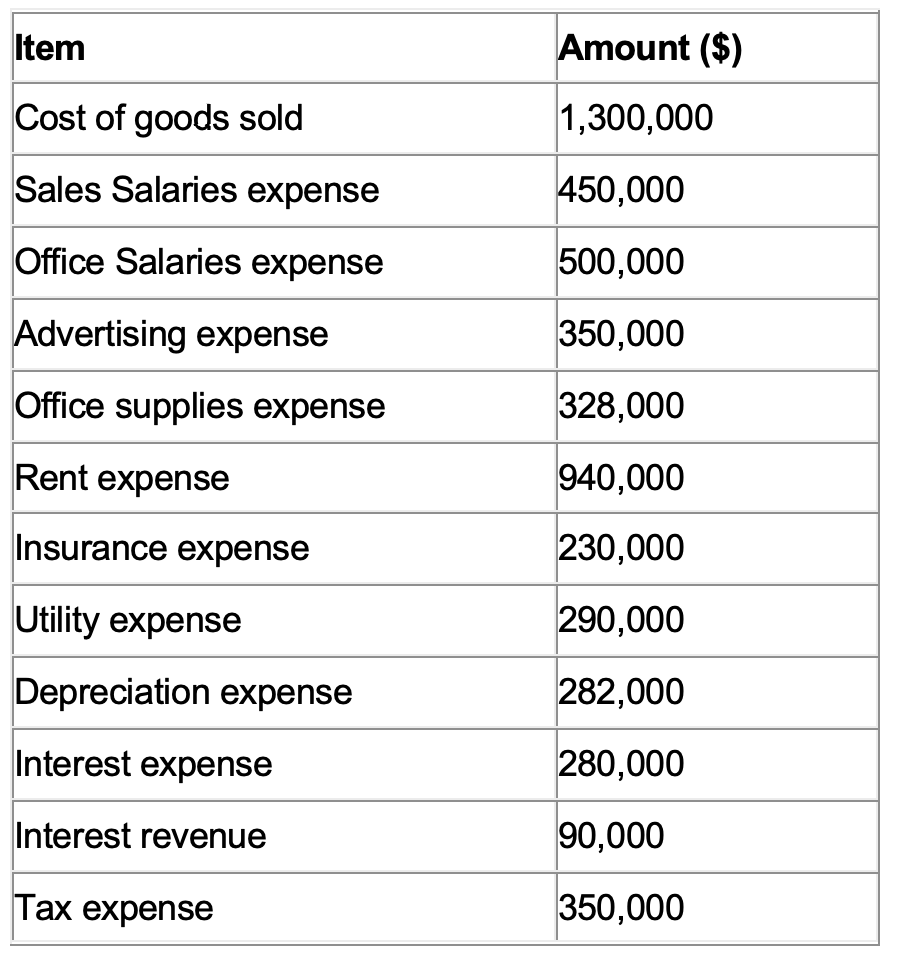

The projected total sales for the EVB for the year ended June are $ and the projected total costs and operating expenses are as follows:

Table B

Item Amount $

Cost of goods sold

Sales Salaries expense

Office Salaries expense

Advertising expense

Office supplies expense

Rent expense

Insurance expense

Utility expense

Depreciation expense

Interest expense

Interest revenue

Tax expense

Round your final answers to two decimal places.

What is the gross profit amount?

What are the total operating expenses?

What is the profit before interest and tax EBIT

What is the net profit?

Calculate the Gross Profit ratio, in percentage terms, for EVB in

Calculate the Net Profit ratio, in percentage terms, for EVB in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started