Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Case Study Vision Express (VX Co. hereafter) is a well-known and specialized company in manufacturing sunglasses. The VX Co. uses a standard costing system to

Case Study

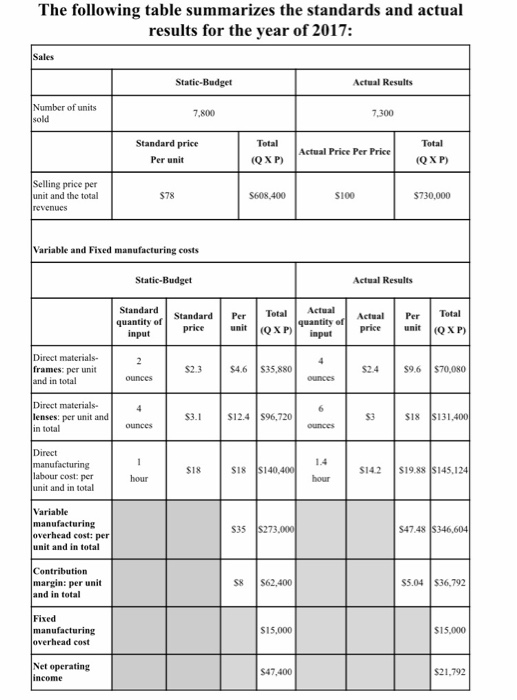

Vision Express (VX Co. hereafter) is a well-known and specialized company in manufacturing sunglasses. The VX Co. uses a standard costing system to set attainable standards for direct materials and direct labour. Direct material is made of two components: Frame and Lenses. The company also reviews and revises standards annually as necessary. Department managers, namely: the purchase manager, the production manager and the marketing manager, whose evaluations and bonuses are affected by the departments performance, are held responsible to explain variances as to whether they are favourable or unfavourable in their department performance reports .

Additional information:

Recently, the manufacturing variances have attracted the attention of the Chief Financial Officer (CFO) of VX Co. For no apparent reasons, some favourable/unfavourable variances have occurred. Assuming that you are the management accountant of VX Co., the CFO has required you to perform the following two tasks:

First, the CFO has asked you to compute the following variances on excel sheet:

* I want answers for ..

For level analysis:

- sales-volume Variance

For direct labor

- labor efficiency Variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started