case1-3

two companies competing in the same industry are being evaluted by a bank that can lend moneny to only one of them

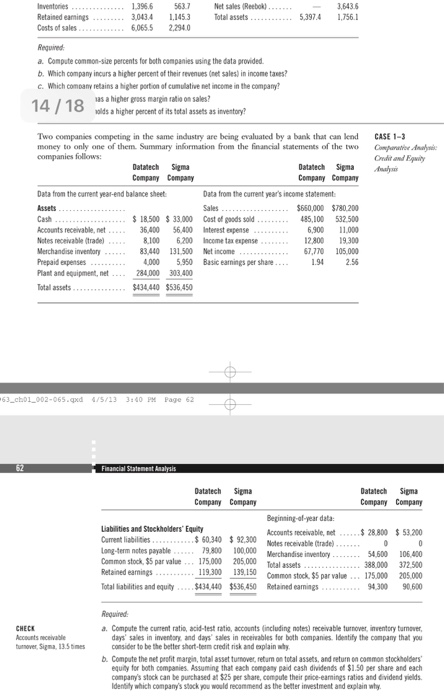

3.643 eamings.3043.4 ,1453 Total assets Cests of sales 065.52.294.0 Required a. Compute common-siuze percents for both companies using the data provided b. Which company incurs a higher percent of their revenues (net sales) in income taxes cWhich comoanv retains a higher porton of cumulative net income in the company? 14 as a higher pross margin ratio on sales? olds a higher percent of its total assets as inventory? Two companies competing in the same industry are being evaluated by a bank that can lend CASE 1-3 money to only one of them. Summary information from the financial statements of the two Compunaice Aa companies follows Cnit and Epiy Datatech Sigma Company Cempany Oatatech Sigma A Company Company Data from the current year-end balance sheet Data from the cument years income statement Sales Cash Accounts receivable, net.. Notes receivable (trade) Merchandise inventory Prepaid expenses Plant and equipment, net Total assets $ 18.500 33,000 Cast of goods sold....85,100 532500 ,900 11,000 12800 19.300 7,77O 105,000 1.94 2.56 36,400 56.400 Interest expense 8100 6200 Income tax expense 83,440 131500 Net income 000 5950 Basic earnings per shane 284000 303.400 $434440 $536,450 63 cho1 002 Oatatech Sipma Company Company Oatatech Sipma Company Company Beginning-af-year data: Liablities and Steckholders Equity Carrent liabilities Long-term notes payable .9.800 100,000 Common stock, $5 par value. 175,000 205,000 Retained earnings Total liabilities and equity..$434,440 $536,450 Retained earnings 328800 53200 Accounts receivable, net 60.340 $92,300 Notes receivable Ctrade) rchandise inventory Total assets 388000 372.500 mn stock $5 par valse175000 205.000 4.300 90.600 1 9.300 139,150 Required a. Compute the current ratio, acid-test ratio, accounts (including notes) receivable turnover, inventory turnover CHECE Accounts ceivable tunover, Sigma, 13.5bmes days' sales in inventory and days sales in neceivables for both companies. Identify the company that you consider to be the better short-term credit risk and explain why b. Compute the net profit margin, botal asset turnover, retun on total assets, and return on common stockholders equity for both companies. Assuming that each company paid cash dividends of $1.50 per share and each company's stock can be puichased at $25 per share, compute their price-earnings raties and dividend yields Identily which company's stack you would recommend as the better investment and explain why 3.643 eamings.3043.4 ,1453 Total assets Cests of sales 065.52.294.0 Required a. Compute common-siuze percents for both companies using the data provided b. Which company incurs a higher percent of their revenues (net sales) in income taxes cWhich comoanv retains a higher porton of cumulative net income in the company? 14 as a higher pross margin ratio on sales? olds a higher percent of its total assets as inventory? Two companies competing in the same industry are being evaluated by a bank that can lend CASE 1-3 money to only one of them. Summary information from the financial statements of the two Compunaice Aa companies follows Cnit and Epiy Datatech Sigma Company Cempany Oatatech Sigma A Company Company Data from the current year-end balance sheet Data from the cument years income statement Sales Cash Accounts receivable, net.. Notes receivable (trade) Merchandise inventory Prepaid expenses Plant and equipment, net Total assets $ 18.500 33,000 Cast of goods sold....85,100 532500 ,900 11,000 12800 19.300 7,77O 105,000 1.94 2.56 36,400 56.400 Interest expense 8100 6200 Income tax expense 83,440 131500 Net income 000 5950 Basic earnings per shane 284000 303.400 $434440 $536,450 63 cho1 002 Oatatech Sipma Company Company Oatatech Sipma Company Company Beginning-af-year data: Liablities and Steckholders Equity Carrent liabilities Long-term notes payable .9.800 100,000 Common stock, $5 par value. 175,000 205,000 Retained earnings Total liabilities and equity..$434,440 $536,450 Retained earnings 328800 53200 Accounts receivable, net 60.340 $92,300 Notes receivable Ctrade) rchandise inventory Total assets 388000 372.500 mn stock $5 par valse175000 205.000 4.300 90.600 1 9.300 139,150 Required a. Compute the current ratio, acid-test ratio, accounts (including notes) receivable turnover, inventory turnover CHECE Accounts ceivable tunover, Sigma, 13.5bmes days' sales in inventory and days sales in neceivables for both companies. Identify the company that you consider to be the better short-term credit risk and explain why b. Compute the net profit margin, botal asset turnover, retun on total assets, and return on common stockholders equity for both companies. Assuming that each company paid cash dividends of $1.50 per share and each company's stock can be puichased at $25 per share, compute their price-earnings raties and dividend yields Identily which company's stack you would recommend as the better investment and explain why