Answered step by step

Verified Expert Solution

Question

1 Approved Answer

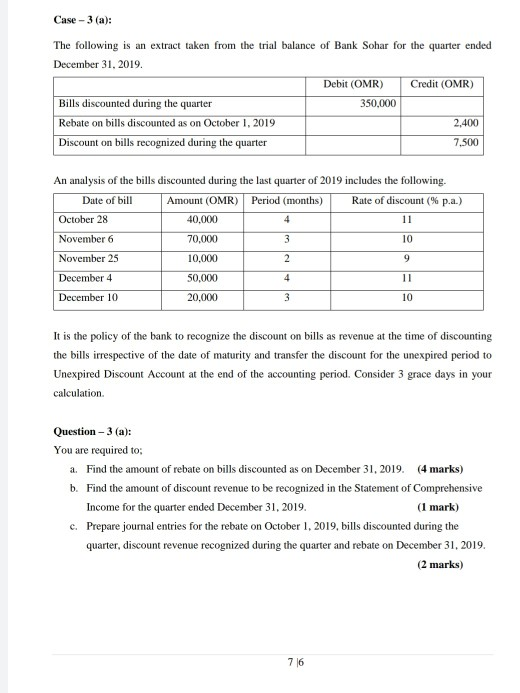

Case-3 (a): The following is an extract taken from the trial balance of Bank Sohar for the quarter ended December 31, 2019. Debit (OMR) Credit

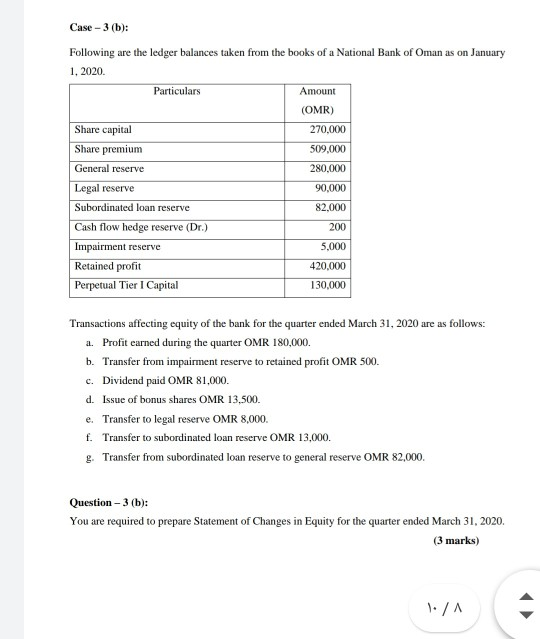

Case-3 (a): The following is an extract taken from the trial balance of Bank Sohar for the quarter ended December 31, 2019. Debit (OMR) Credit (OMR) Bills discounted during the quarter 350,000 Rebate on bills discounted as on October 1, 2019 2,400 Discount on bills recognized during the quarter 7,500 An analysis of the bills discounted during the last quarter of 2019 includes the following. Date of bill Amount (OMR) Period (months) Rate of discount (% p.a.) October 28 40,000 4 November 6 70,000 3 10 November 25 10,000 2 9 December 4 50,000 4 11 December 10 20,000 3 10 It is the policy of the bank to recognize the discount on bills as revenue at the time of discounting the bills irrespective of the date of maturity and transfer the discount for the unexpired period to Unexpired Discount Account at the end of the accounting period. Consider 3 grace days in your calculation Question-3 (a): You are required to: a. Find the amount of rebate on bills discounted as on December 31, 2019. (4 marks) b. Find the amount of discount revenue to be recognized in the Statement of Comprehensive Income for the quarter ended December 31, 2019. (1 mark) c. Prepare journal entries for the rebate on October 1, 2019, bills discounted during the quarter, discount revenue recognized during the quarter and rebate on December 31, 2019. (2 marks) 716 Case-3 (b): Following are the ledger balances taken from the books of a National Bank of Oman as on January 1. 2020 Particulars Amount (OMR) 270,000 509,000 280,000 90,000 Share capital Share premium General reserve Legal reserve Subordinated loan reserve Cash flow hedge reserve (Dr.) Impairment reserve Retained profit Perpetual Tier I Capital 82,000 200 5.000 420,000 130,000 Transactions affecting equity of the bank for the quarter ended March 31, 2020 are as follows: a. Profit earned during the quarter OMR 180,000. b. Transfer from impairment reserve to retained profit OMR 500. c. Dividend paid OMR 81,000. d. Issue of bonus shares OMR 13,500. e. Transfer to legal reserve OMR 8,000. f. Transfer to subordinated loan reserve OMR 13,000. g. Transfer from subordinated loan reserve to general reserve OMR 82,000. Question - 3 (b): You are required to prepare Statement of Changes in Equity for the quarter ended March 31, 2020. (3 marks) 1/A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started