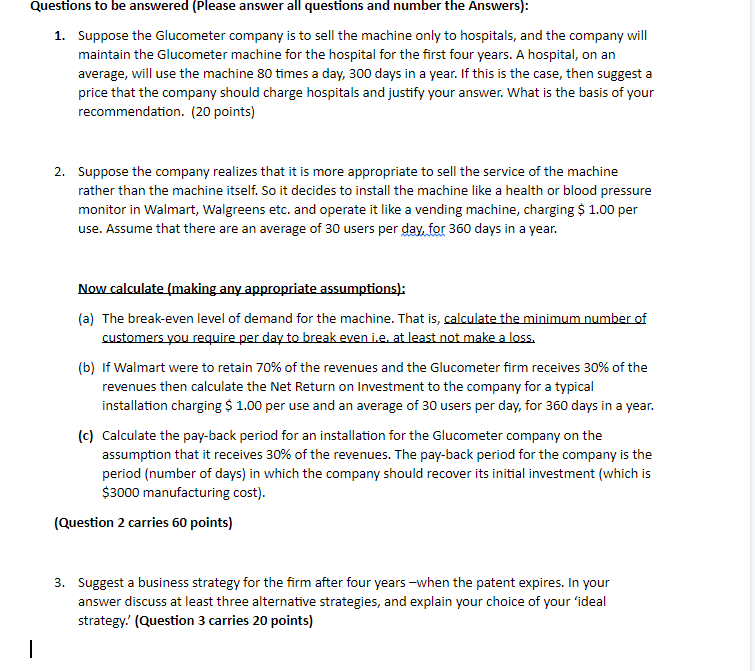

Question

Case/Situation: A new medical device has been developed to measure the blood sugar level. This is expected to be used widely by diabetics for self-monitoring.

Case/Situation:

A new medical device has been developed to measure the blood sugar level. This is expected to be used widely by diabetics for self-monitoring. The product is non-invasive, yet is accurate and is expected to substitute existing products in the market, particularly the diabetic strips that cost $1 per use, and involve a prick using a lancet. The current popular technology used by most consumers is the diabetic strip meter, where the strips cost just a dollar each, and the reusable meter has a low cost of $20 only; further the user needs to prick himself not very pleasant!

The new firm ABC has a patent for a new technological medical device referred to as a Glucometer, that expires after 4 years.

The New Device: The new Glucometer is iris response based (actually uses the iris in the eye); its manufactured cost is $3000 (for the machine), and annual maintenance costs for the machine average $500 per year. The machine does not require an attendant or any material inputs. All the patient has to do is look into a viewer and the device measures blood sugar levels using iris examination- the machines instrumentation, gives the results on a digital display panel. The simple looking machine looks like a small computer with a two eye viewer into which the user looks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started