Answered step by step

Verified Expert Solution

Question

1 Approved Answer

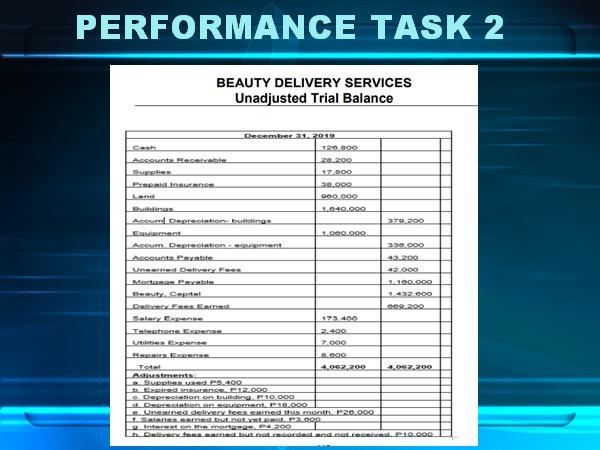

cash 120,800 accounts receivable 28,200 prepaid insurance 17,800 land 28,000 buildings 1,640,000 accum depreciation buildings 379,200 equipment 1,000,000 accum depreciation equipment 330,000 accounts payable 43,200

| cash | 120,800 | |

| accounts receivable | 28,200 | |

| prepaid insurance | 17,800 | |

| land | 28,000 | |

| buildings | 1,640,000 | |

| accum depreciation buildings | 379,200 | |

| equipment | 1,000,000 | |

| accum depreciation equipment | 330,000 | |

| accounts payable | 43,200 | |

| unearned delivery fees | 42,000 | |

| mortaege payable | 1,160,000 | |

| beauty capital | 1,432,000 | |

| delivery fees earned | 000,,200 | |

| salary expense | 173,400 | |

| telephone expense | 2,400 | |

| utilities expense | 7,000 | |

| repairs expense | 8,600 | |

| total | 4,067,700 | 4,067,700 |

| adjustment | ||

| a. Supplies used P5,400 | ||

| b. Expired insurance P12,000 | ||

| c. Depreciation on building P10,000 | ||

| d. Depreciation on equipment P18,000 | ||

| e. Unearned delivery fees earned this month P26,000 | ||

| f. Salaries earned but not yet paid P3,000 | ||

| g. Interest on the mortage P4,200 | ||

| h. Delivery fees earned but not recorded and not received P10.000 | ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started