Question

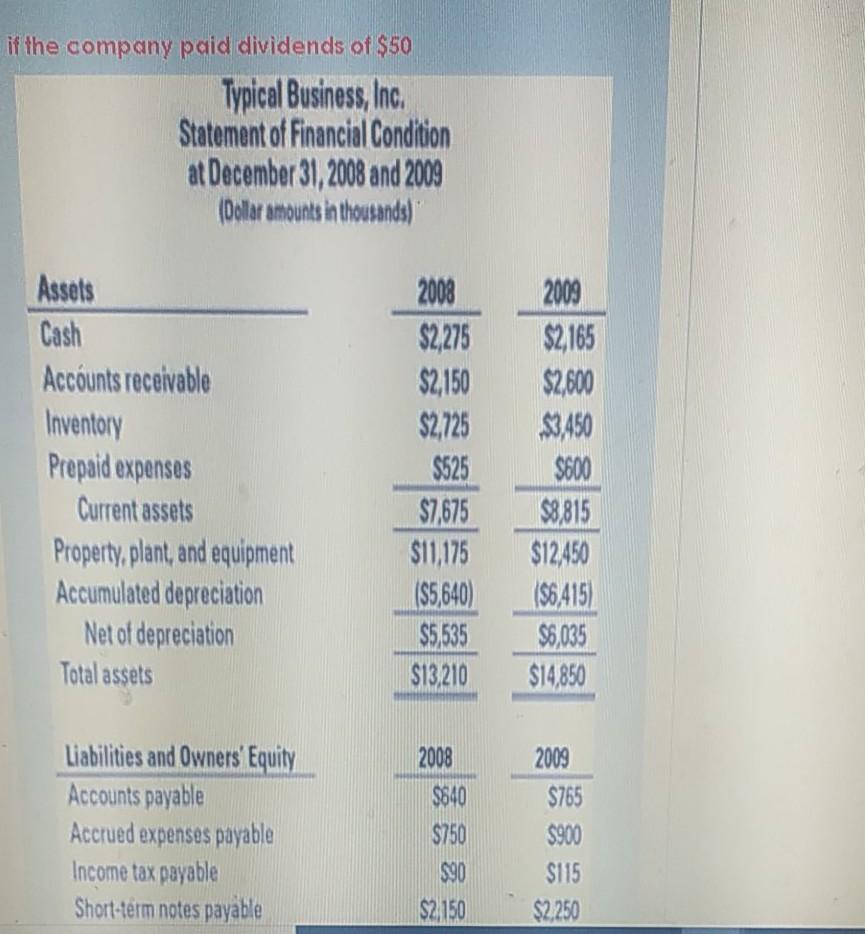

Cash $2275 $2 165 $2,150 $2,800 $2725 $3 450 SE00 $25 SO 815 Acounts recaivable Inventory Prepaid expenses Curent assets Property,plant, and equipment Accumulated depreciation

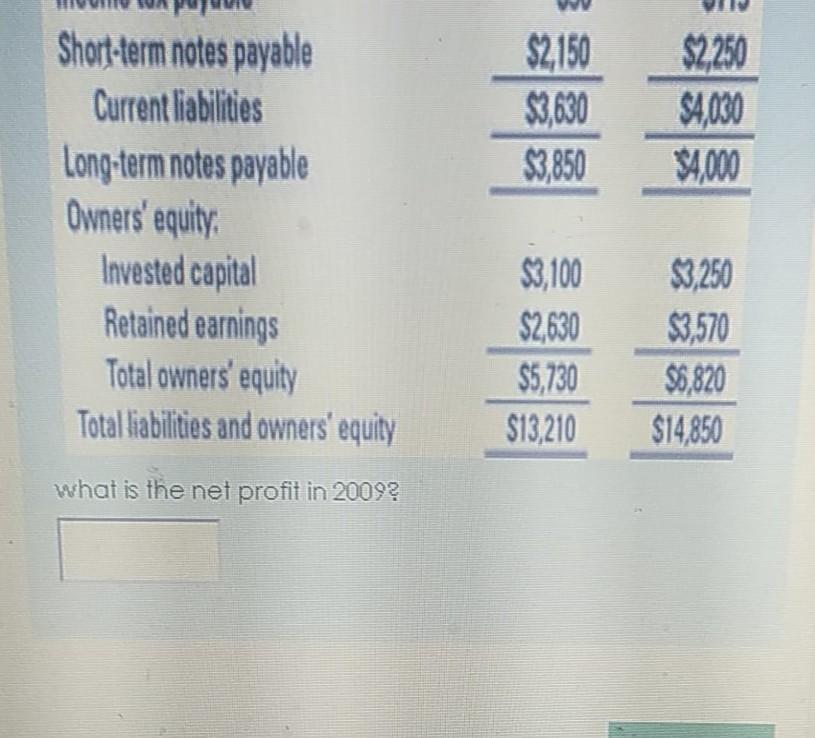

Cash $2275 $2 165 $2,150 $2,800 $2725 $3 450 SE00 $25 SO 815 Acounts recaivable Inventory Prepaid expenses Curent assets Property,plant, and equipment Accumulated depreciation Net of depreciation $7.675 S11,175 $12,450 96,415) IS5.640 S5.535 S6,.035 Total assets S13,210 S14850 2009 2008 S40 $T65 S750 $900 $90 S15 Libilities and Owners Equity Accounts payable Accrued expenses payable Income tax payable Short-term notes payable Current liabilities Long-term notes payable Owners equity $2,150 $3.630 $2,250 SA00 S4,00 $3,850 Invested capital $3,100 $3,250 $3.570 S6,820 Retained earnings Total owners' equity Total liabilties and owners equty $2630 S$,730 $13,210

what is the net profit in 2009?

if the company paid dividends of $50 Typical Business, Inc. Statement of Financial Condition at December 31, 2008 and 2009 (Dollat amounts in thousands) 2009 $2,165 $2,600 Assets Cash Accounts receivable Inventory Prepaid expenses Current assets Property, plant , and equipment Accumulated depreciation Net of depreciation Total assets 2008 $2,275 $2,150 $2,725 $525 $7,675 $11,175 ($5,640) $5,535 $13,210 $600 $8,815 $12,450 (56,415) $6,035 $14,850 Liabilities and Owners' Equity Accounts payable Accrued expenses payable Income tax payable Short-term notes payable 2008 $640 $750 $90 $2150 2009 $765 5900 $115 $2,250 $2,150 $3,630 $3,850 $2.250 $4,030 54,000 Short-term notes payable Current liabilities Long-term notes payable Owners' equity Invested capital Retained earnings Total owners' equity Total liabilities and owners' equity 5,100 $2,630 $5,730 $13,210 $3,250 $3,570 55,820 $14,850 what is the net profil in 2009Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started