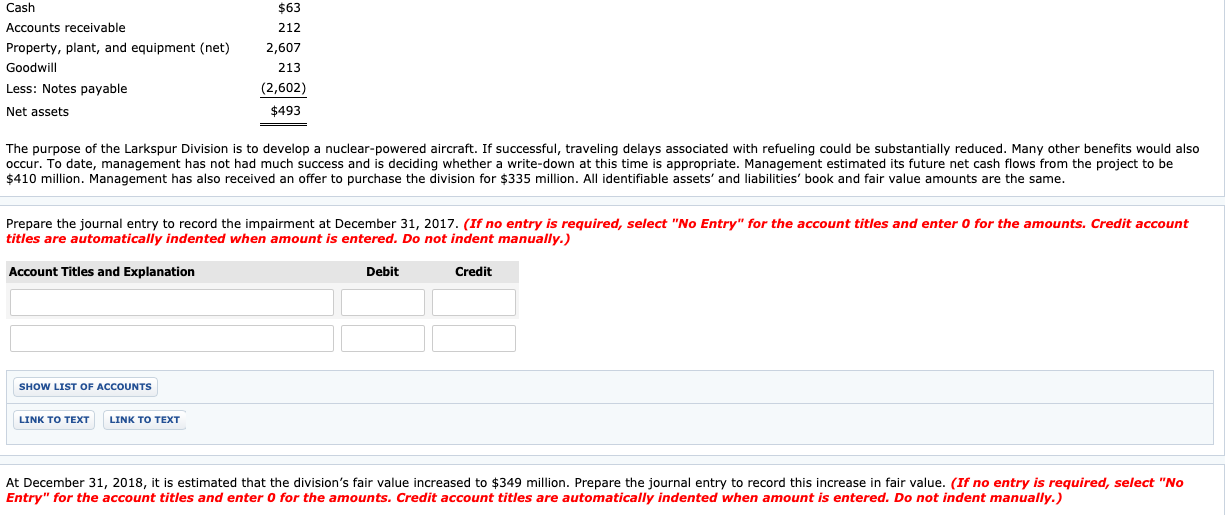

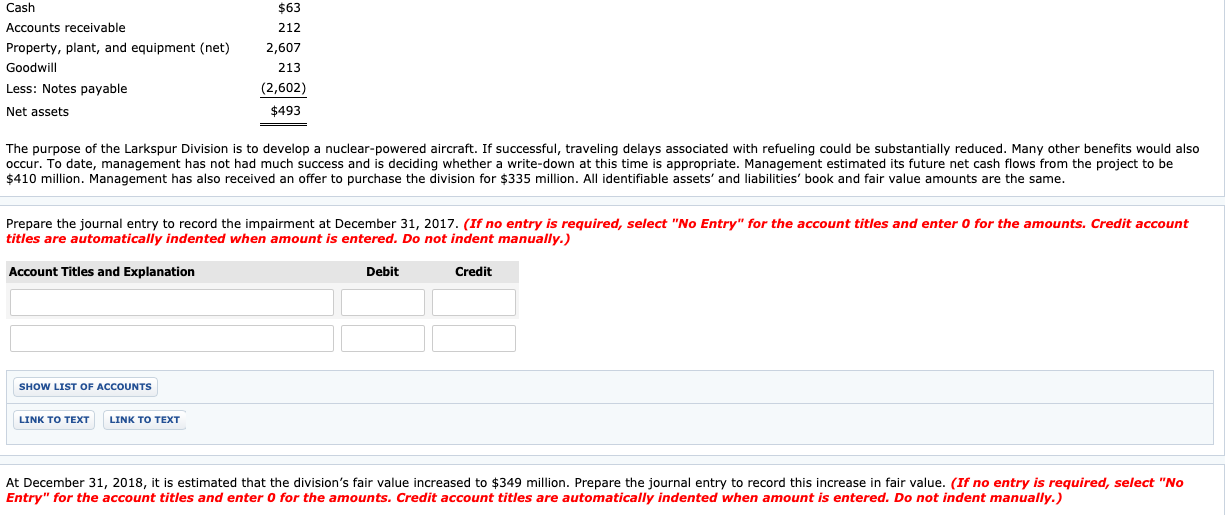

Cash Accounts receivable Property, plant, and equipment (net) Goodwill Less: Notes payable Net assets $63 212 2,607 213 (2,602) $493 The purpose of the Larkspur Division is to develop a nuclear-powered aircraft. If successful, traveling delays associated with refueling could be substantially reduced. Many other benefits would also occur. To date, management has not had much success and is deciding whether a write-down at this time is appropriate. Management estimated its future net cash flows from the project to be $410 million. Management has also received an offer to purchase the division for $335 million. All identifiable assets' and liabilities' book and fair value amounts are the same. Prepare the journal entry to record the impairment at December 31, 2017. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT At December 31, 2018, it is estimated that the division's fair value increased to $349 million. Prepare the journal entry to record this increase in fair value. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Cash Accounts receivable Property, plant, and equipment (net) Goodwill Less: Notes payable Net assets $63 212 2,607 213 (2,602) $493 The purpose of the Larkspur Division is to develop a nuclear-powered aircraft. If successful, traveling delays associated with refueling could be substantially reduced. Many other benefits would also occur. To date, management has not had much success and is deciding whether a write-down at this time is appropriate. Management estimated its future net cash flows from the project to be $410 million. Management has also received an offer to purchase the division for $335 million. All identifiable assets' and liabilities' book and fair value amounts are the same. Prepare the journal entry to record the impairment at December 31, 2017. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit SHOW LIST OF ACCOUNTS LINK TO TEXT LINK TO TEXT At December 31, 2018, it is estimated that the division's fair value increased to $349 million. Prepare the journal entry to record this increase in fair value. (If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)