Answered step by step

Verified Expert Solution

Question

1 Approved Answer

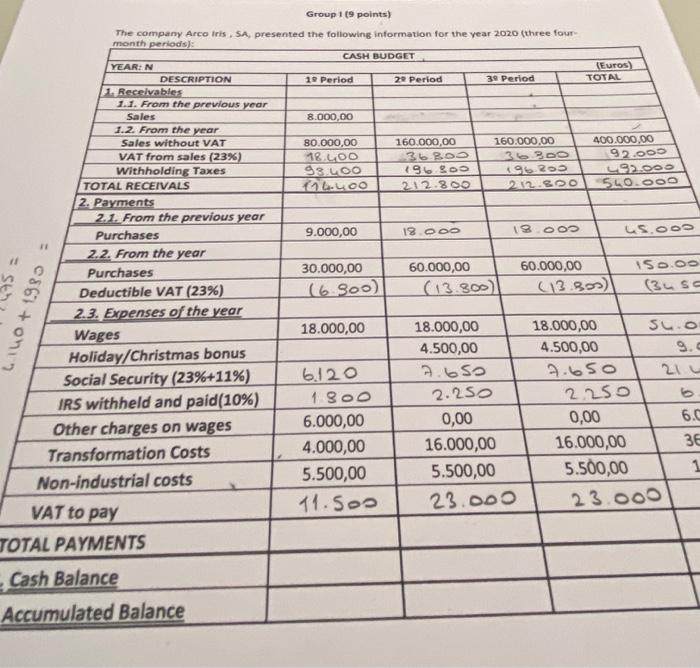

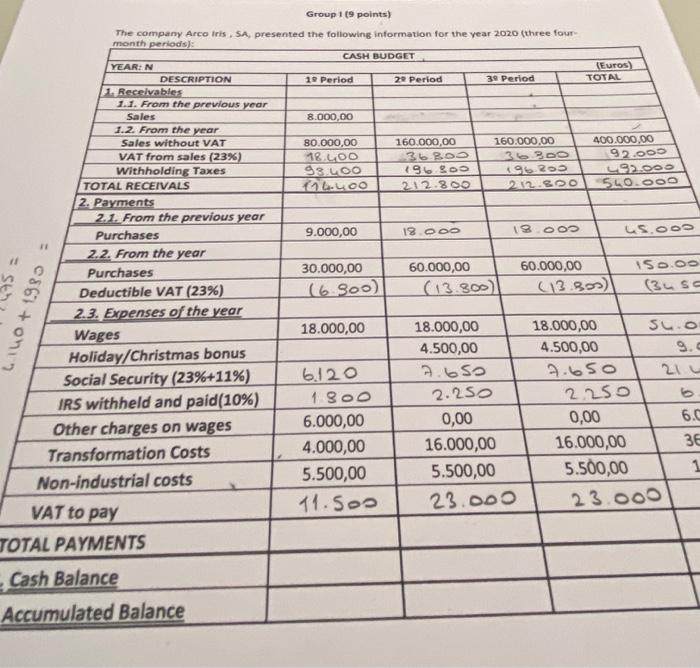

CASH BUDGET Can you make it correct by explaining? I have only this image. Group 1 (9 points) The company Arco Iris SA, presented the

CASH BUDGET

Can you make it correct by explaining?

I have only this image.

Group 1 (9 points) The company Arco Iris SA, presented the following information for the year 2020 (three four month periods) CASH BUDGET YEAR: N (Euros) DESCRIPTION 10 Period 22 Period 39 Period TOTAL 1 Receivables 1.1. From the previous year Sales 8.000,00 1.2. From the year Sales without VAT 80.000,00 160.000,00 160.000,00 400.000,00 VAT from sales (23%) 18.LOO 31 BOD 35 300 92.000 Withholding Taxes 99.00 196.900 96 29 92.000 TOTAL RECEIVALS .LOO 212.800 212.SO SLO.O00 2. Payments 2.1. From the previous year Purchases 9.000,00 19 OO 5.00 11 2.2. From the year Purchases 30.000,00 60.000,00 60.000,00 150.00 Deductible VAT (23%) (6 900) (13.300) (13.30s) (3 sc 2.3. Expenses of the year Wages 18.000,00 18.000,00 18.000,00 S.. Holiday/Christmas bonus 4.500,00 4.500,00 9.c Social Security (23%+11%) 6.120 7.650 7.65o 21 IRS withheld and paid (10%) 1 Soo 2.250 2.250 Other charges on wages 6.000,00 0,00 0,00 6.C Transformation Costs 4.000,00 16.000,00 16.000,00 Non-industrial costs 5.500,00 5.500,00 5.500,00 VAT to pay 11.50 23.000 23.000 TOTAL PAYMENTS SE 0861 + onun 38 1 Cash Balance Accumulated Balance Group 1 (9 points) The company Arco Iris SA, presented the following information for the year 2020 (three four month periods) CASH BUDGET YEAR: N (Euros) DESCRIPTION 10 Period 22 Period 39 Period TOTAL 1 Receivables 1.1. From the previous year Sales 8.000,00 1.2. From the year Sales without VAT 80.000,00 160.000,00 160.000,00 400.000,00 VAT from sales (23%) 18.LOO 31 BOD 35 300 92.000 Withholding Taxes 99.00 196.900 96 29 92.000 TOTAL RECEIVALS .LOO 212.800 212.SO SLO.O00 2. Payments 2.1. From the previous year Purchases 9.000,00 19 OO 5.00 11 2.2. From the year Purchases 30.000,00 60.000,00 60.000,00 150.00 Deductible VAT (23%) (6 900) (13.300) (13.30s) (3 sc 2.3. Expenses of the year Wages 18.000,00 18.000,00 18.000,00 S.. Holiday/Christmas bonus 4.500,00 4.500,00 9.c Social Security (23%+11%) 6.120 7.650 7.65o 21 IRS withheld and paid (10%) 1 Soo 2.250 2.250 Other charges on wages 6.000,00 0,00 0,00 6.C Transformation Costs 4.000,00 16.000,00 16.000,00 Non-industrial costs 5.500,00 5.500,00 5.500,00 VAT to pay 11.50 23.000 23.000 TOTAL PAYMENTS SE 0861 + onun 38 1 Cash Balance Accumulated Balance Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started