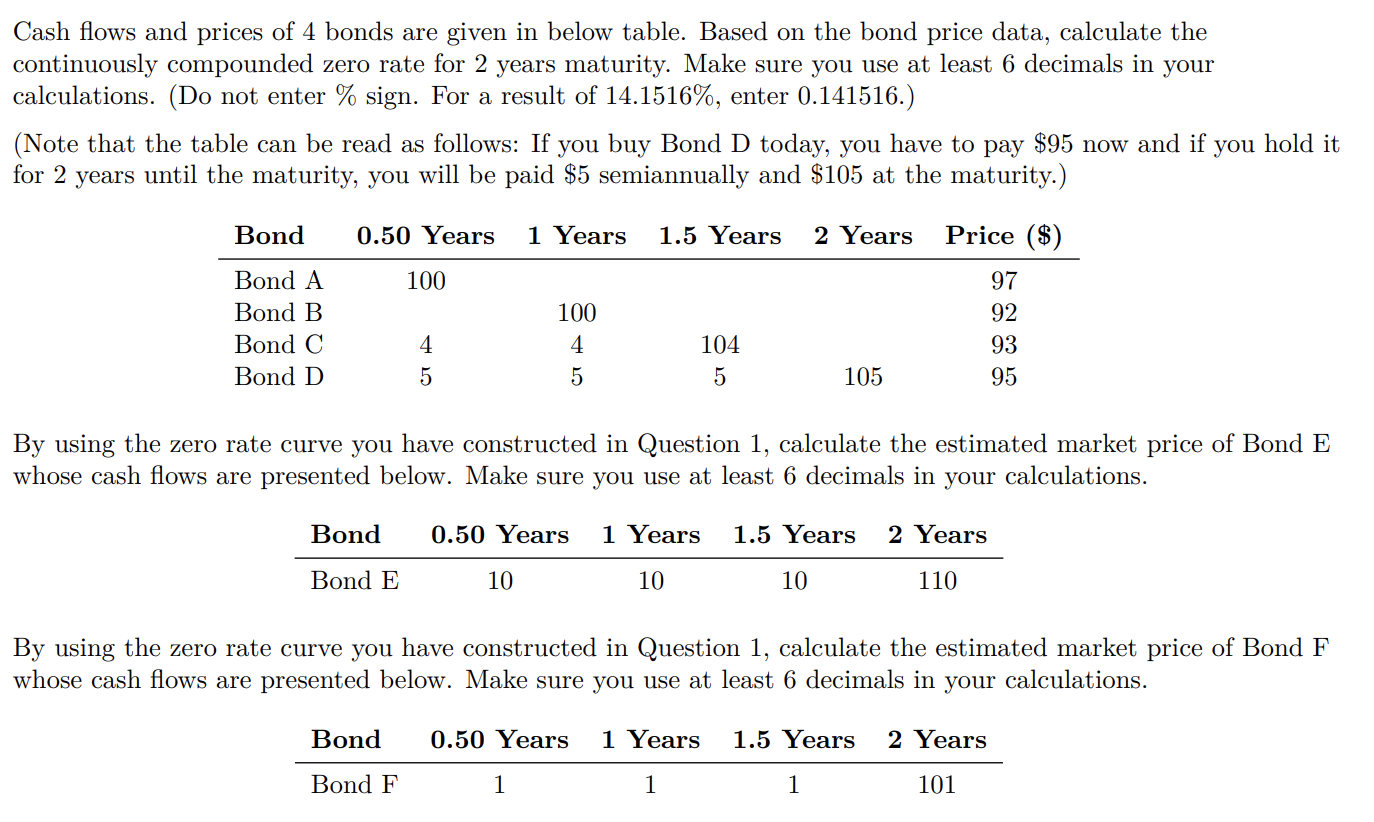

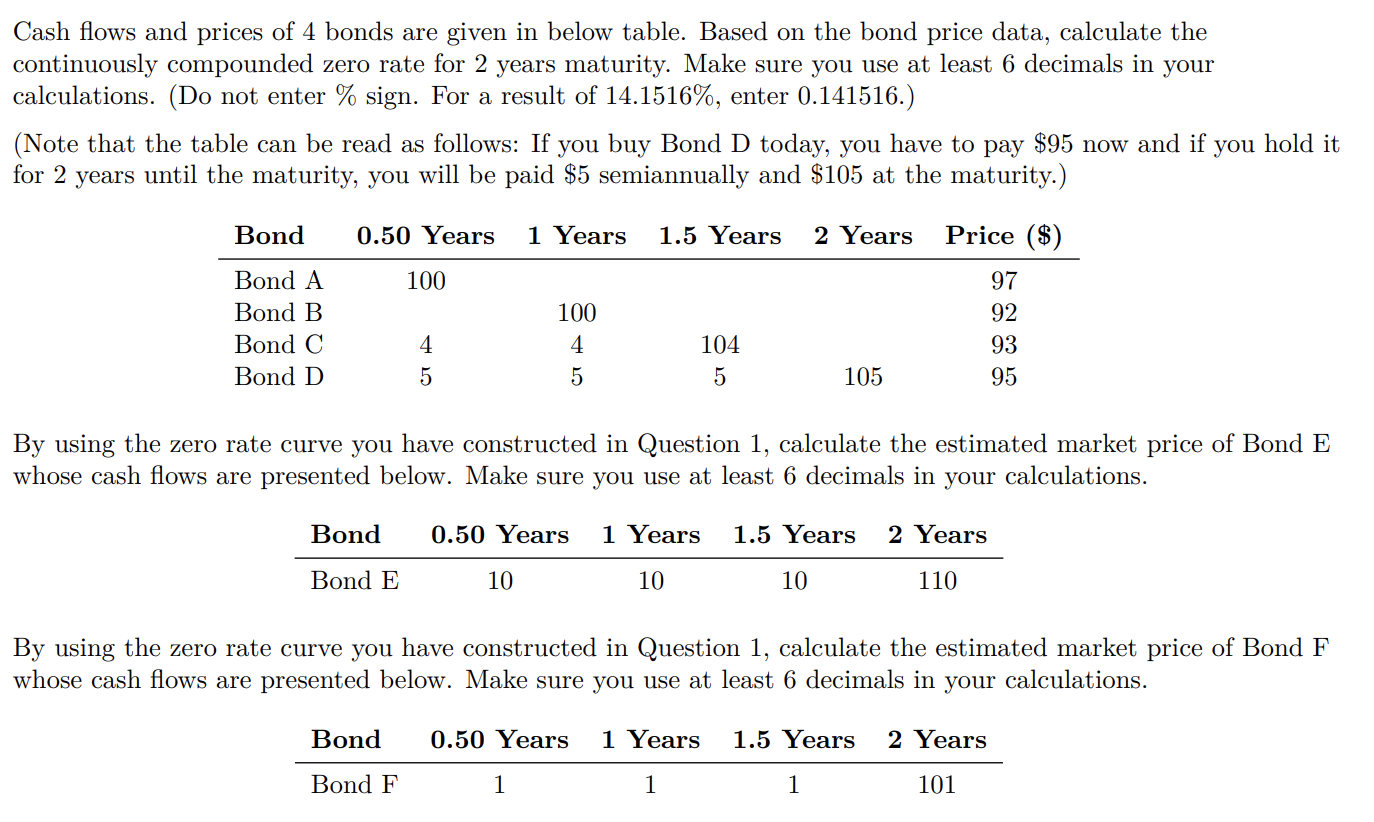

Cash flows and prices of 4 bonds are given in below table. Based on the bond price data, calculate the continuously compounded zero rate for 2 years maturity. Make sure you use at least 6 decimals in your calculations. (Do not enter % sign. For a result of 14.1516%, enter 0.141516.) (Note that the table can be read as follows: If you buy Bond D today, you have to pay $95 now and if you hold it for 2 years until the maturity, you will be paid $5 semiannually and $105 at the maturity.) Bond 0.50 Years 1 Years 1.5 Years 2 Years Price ($) 100 97 92 Bond A Bond B Bond C Bond D 100 4 5 4 5 93 104 5 105 95 By using the zero rate curve you have constructed in Question 1, calculate the estimated market price of Bond E whose cash flows are presented below. Make sure you use at least 6 decimals in your calculations. Bond 0.50 Years 1 Years 1.5 Years 2 Years Bond E 10 10 10 110 By using the zero rate curve you have constructed in Question 1, calculate the estimated market price of Bond F whose cash flows are presented below. Make sure you use at least 6 decimals in your calculations. Bond 0.50 Years 1 Years 1.5 Years 2 Years Bond F 1 1 1 101 Cash flows and prices of 4 bonds are given in below table. Based on the bond price data, calculate the continuously compounded zero rate for 2 years maturity. Make sure you use at least 6 decimals in your calculations. (Do not enter % sign. For a result of 14.1516%, enter 0.141516.) (Note that the table can be read as follows: If you buy Bond D today, you have to pay $95 now and if you hold it for 2 years until the maturity, you will be paid $5 semiannually and $105 at the maturity.) Bond 0.50 Years 1 Years 1.5 Years 2 Years Price ($) 100 97 92 Bond A Bond B Bond C Bond D 100 4 5 4 5 93 104 5 105 95 By using the zero rate curve you have constructed in Question 1, calculate the estimated market price of Bond E whose cash flows are presented below. Make sure you use at least 6 decimals in your calculations. Bond 0.50 Years 1 Years 1.5 Years 2 Years Bond E 10 10 10 110 By using the zero rate curve you have constructed in Question 1, calculate the estimated market price of Bond F whose cash flows are presented below. Make sure you use at least 6 decimals in your calculations. Bond 0.50 Years 1 Years 1.5 Years 2 Years Bond F 1 1 1 101