Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cash LO2 BRIEF EXERCISE 10.1 Jacobs Company borrowed $1,000,000 on a one-year, percent note payable from the local bank on 1 April. Interest was paid

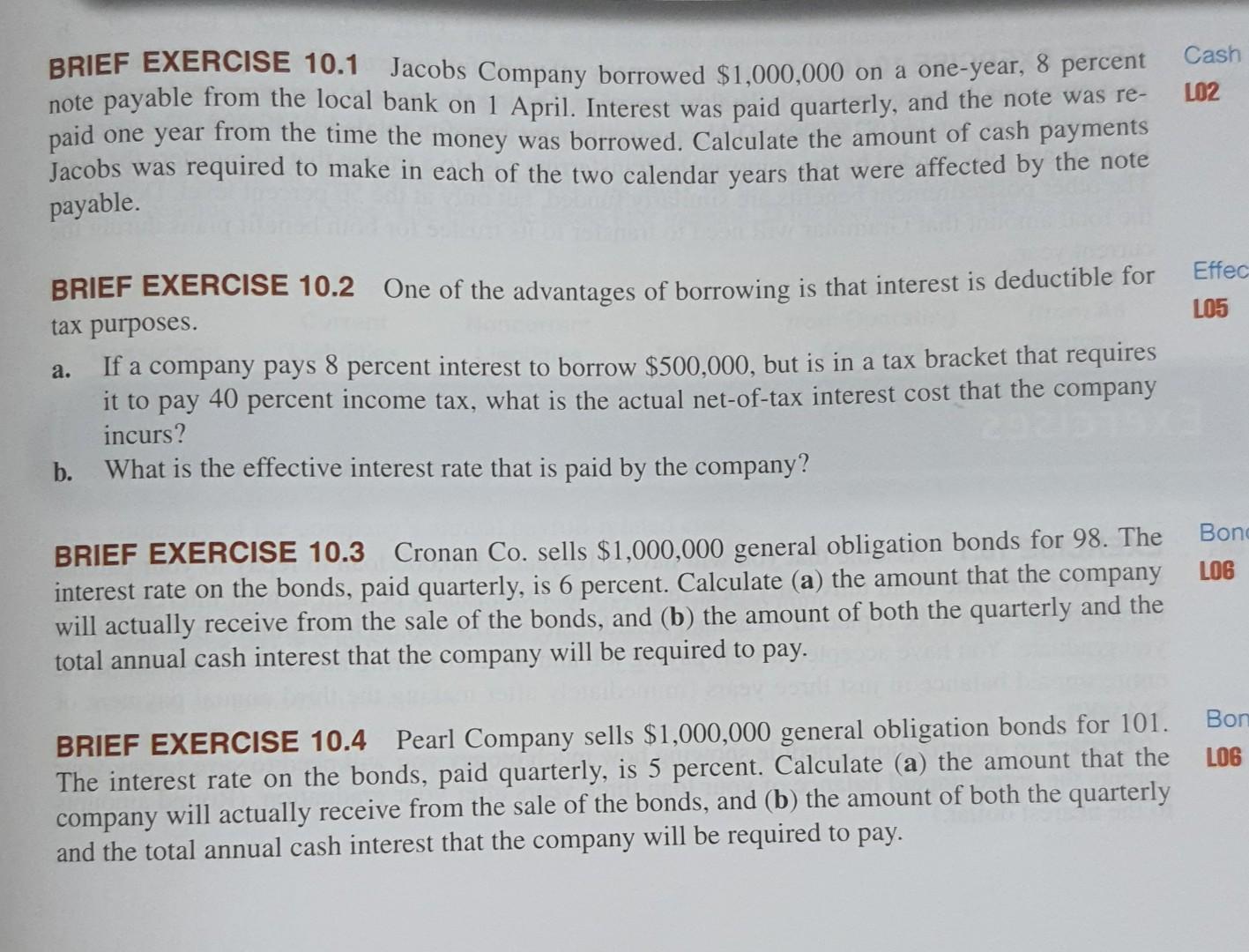

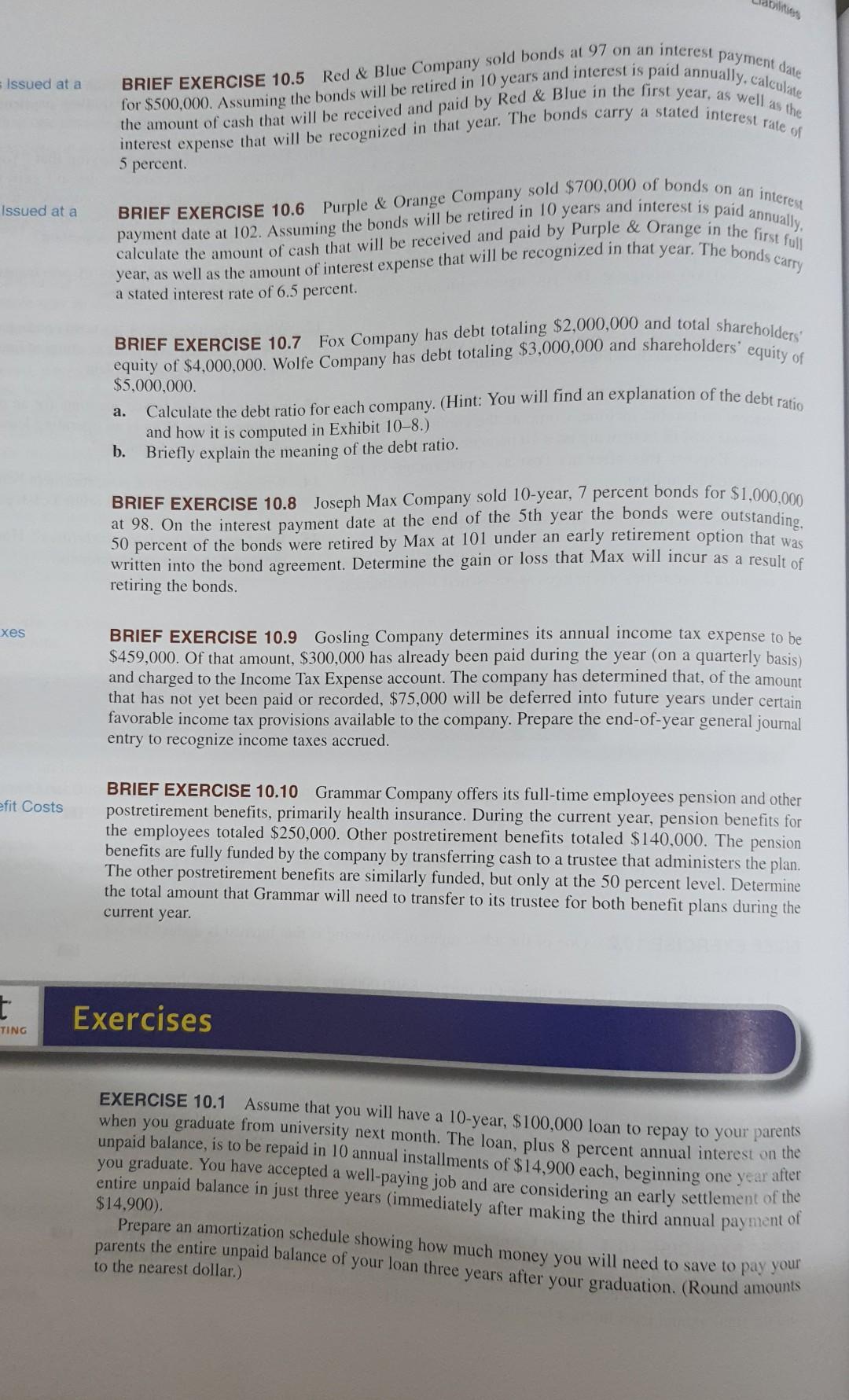

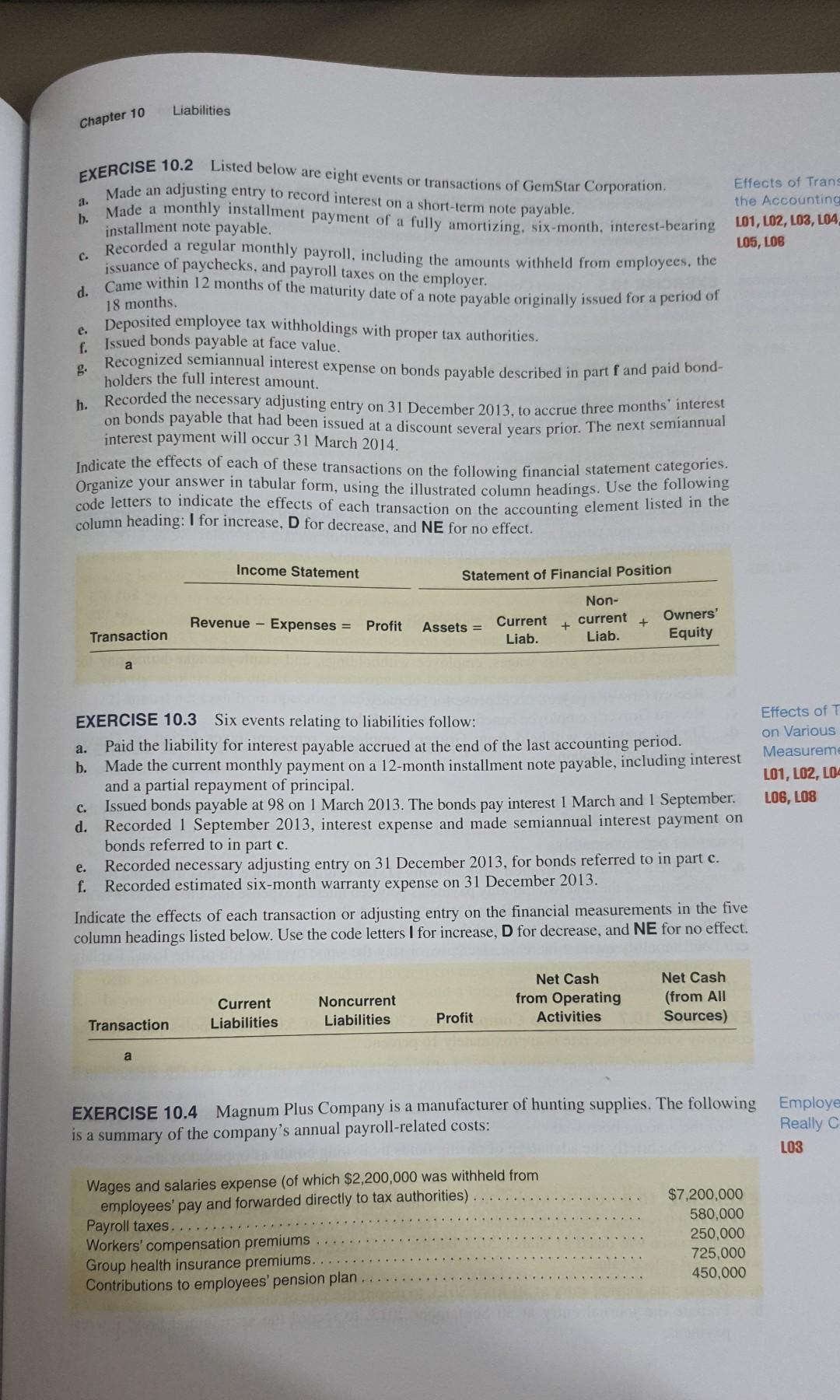

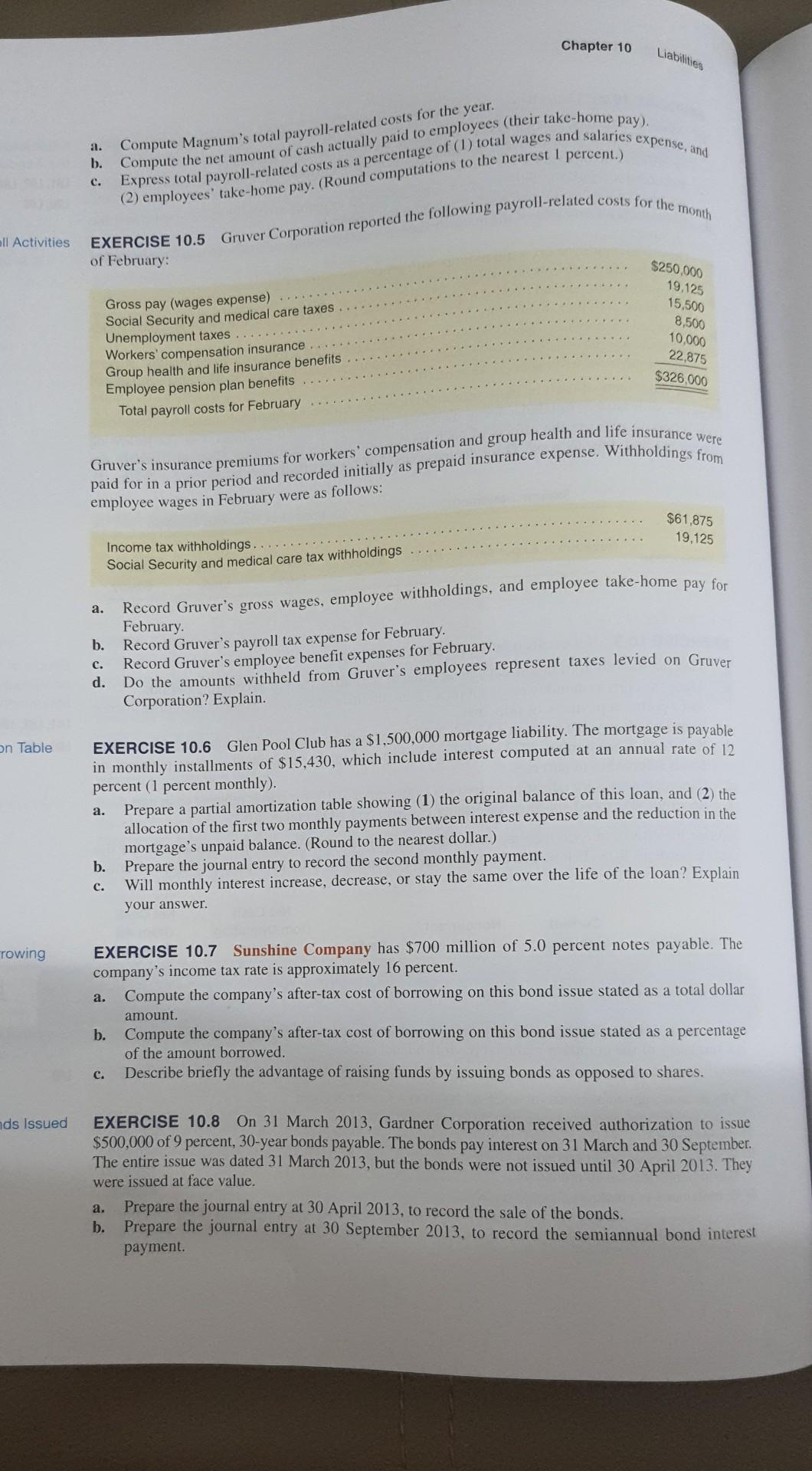

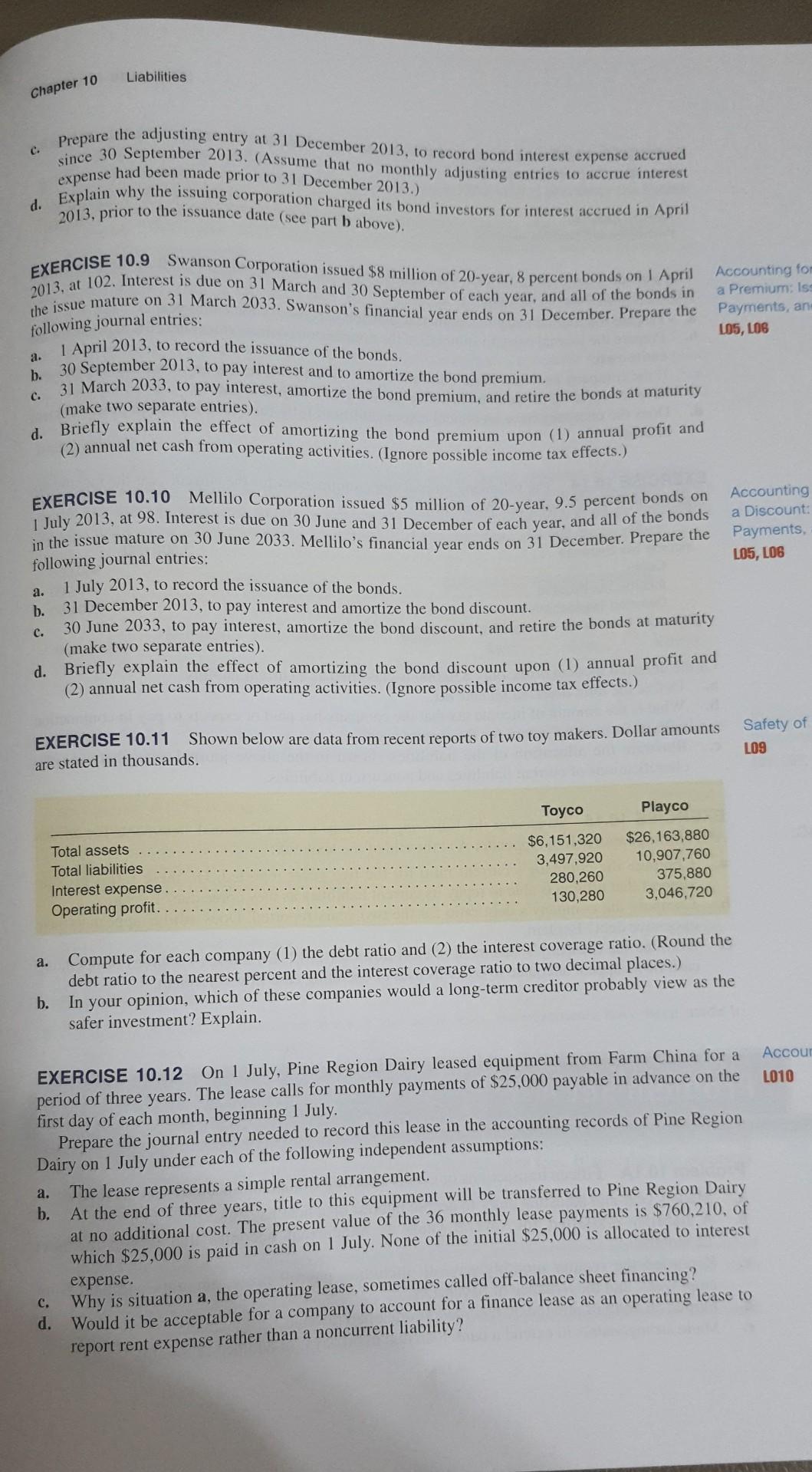

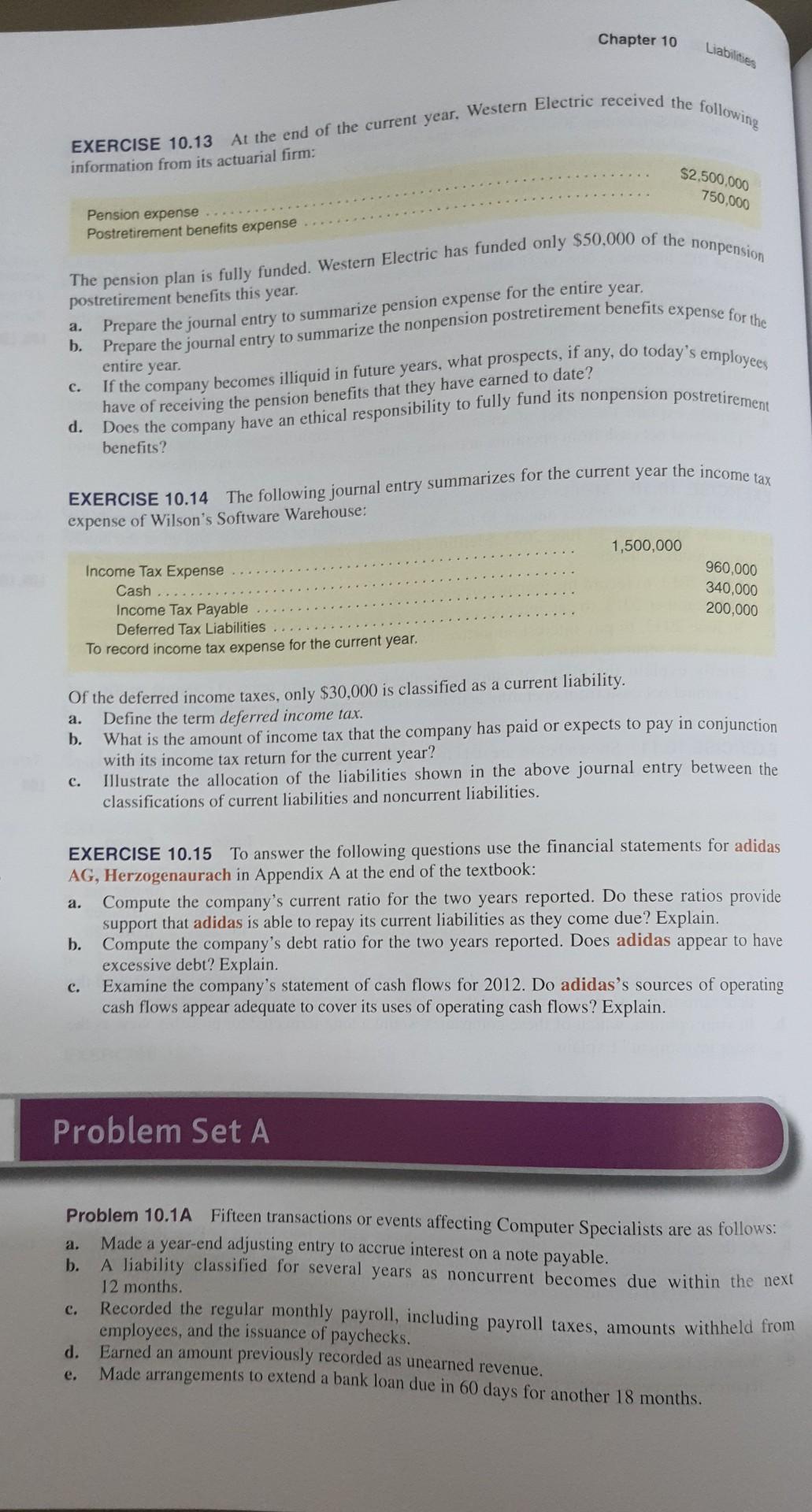

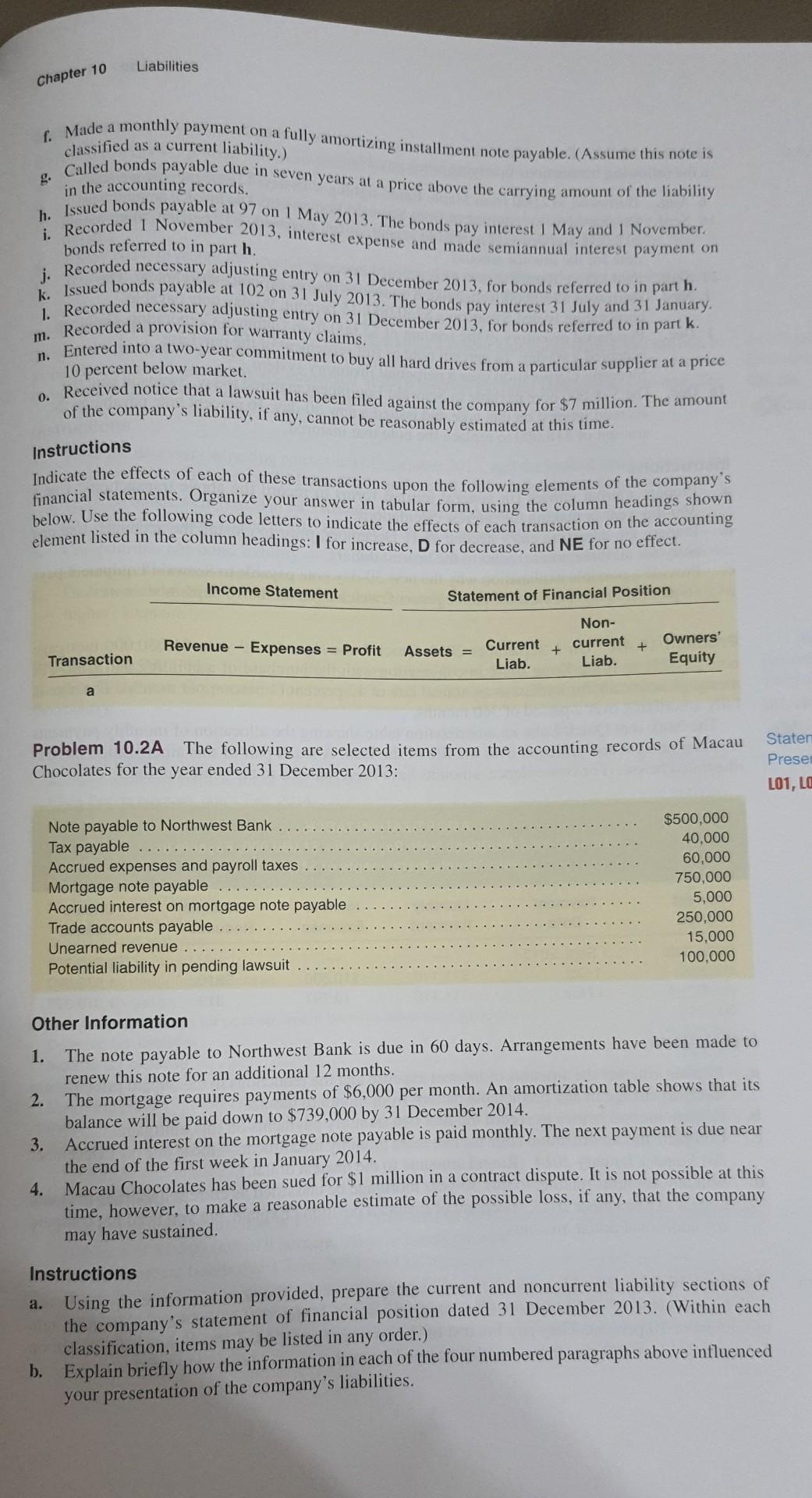

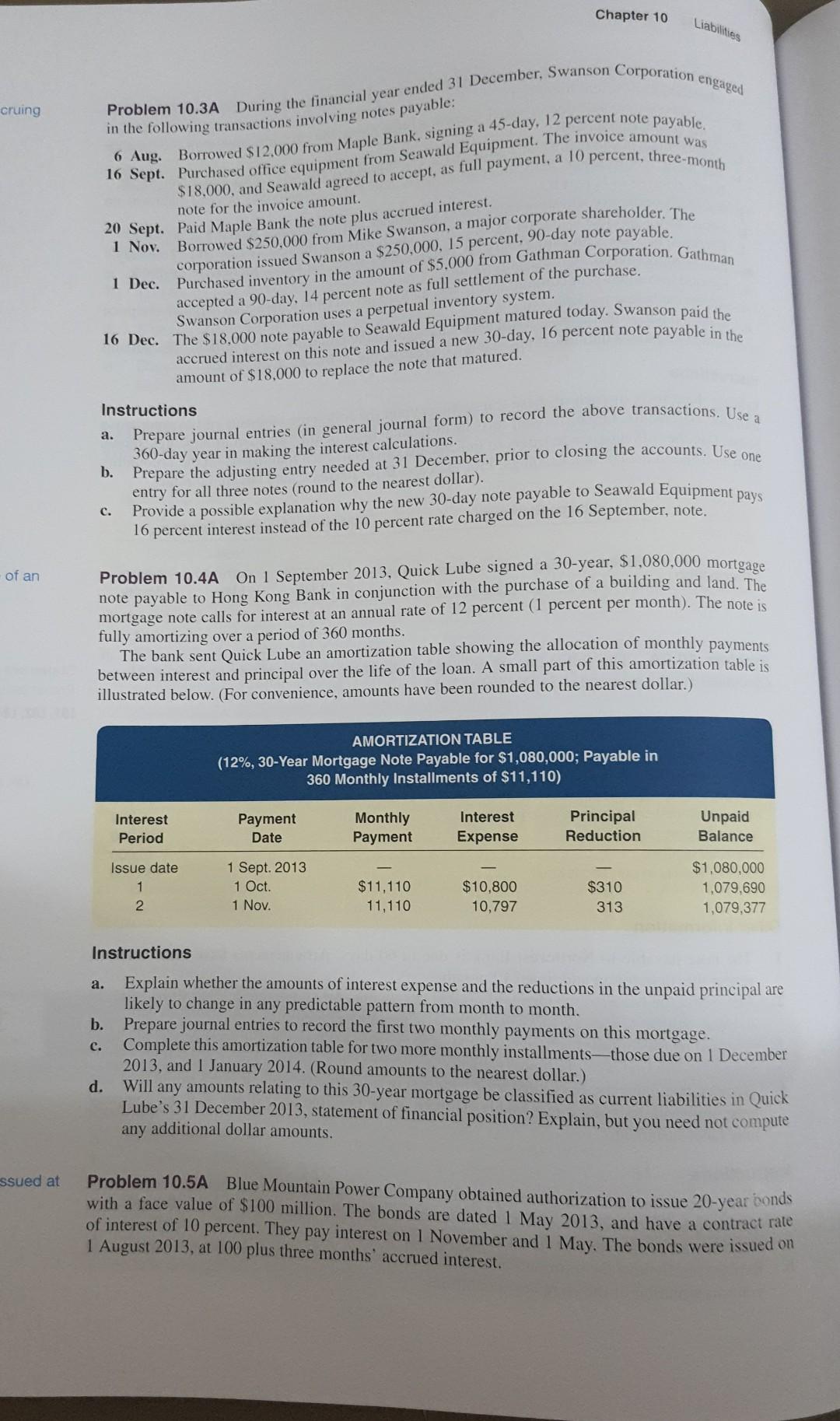

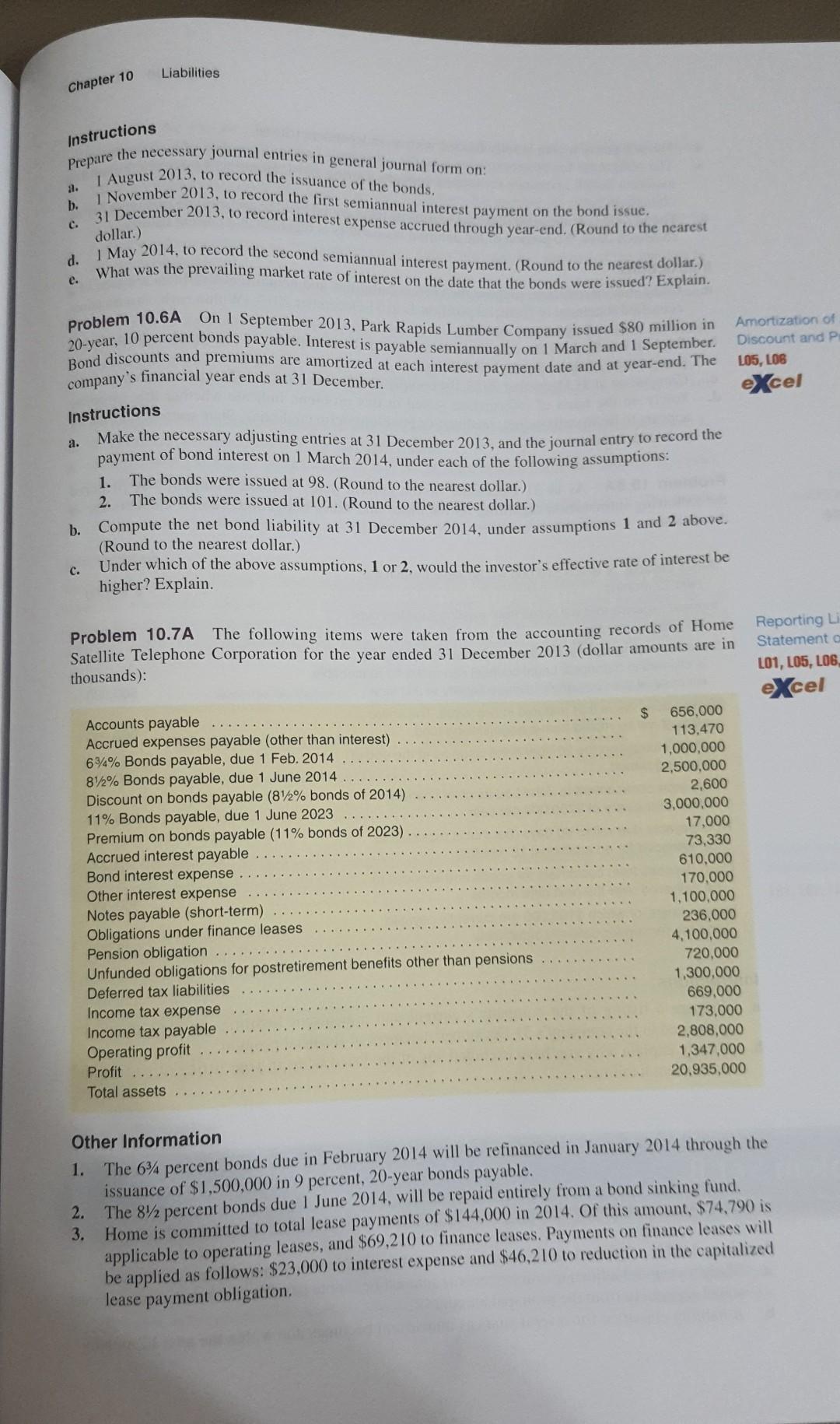

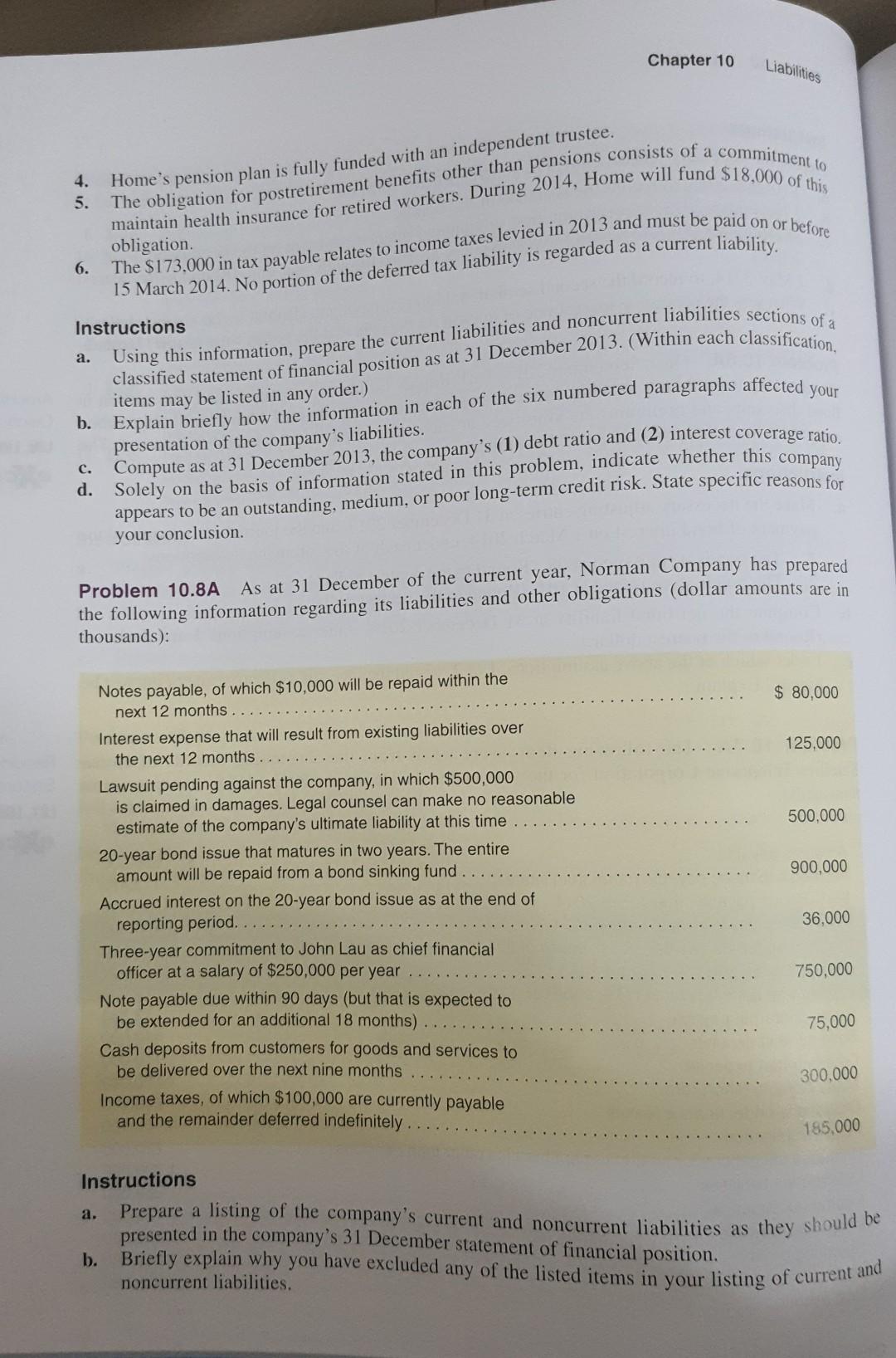

Cash LO2 BRIEF EXERCISE 10.1 Jacobs Company borrowed $1,000,000 on a one-year, percent note payable from the local bank on 1 April. Interest was paid quarterly, and the note was re- paid one year from the time the money was borrowed. Calculate the amount of cash payments Jacobs was required to make in each of the two calendar years that were affected by the note payable. Effec L05 a. BRIEF EXERCISE 10.2 One of the advantages of borrowing is that interest is deductible for tax purposes. If a company pays 8 percent interest to borrow $500,000, but is in a tax bracket that requires it to pay 40 percent income tax, what is the actual net-of-tax interest cost that the company incurs? b. What is the effective interest rate that is paid by the company? Bon LOG BRIEF EXERCISE 10.3 Cronan Co. sells $1,000,000 general obligation bonds for 98. The interest rate on the bonds, paid quarterly, is 6 percent. Calculate (a) the amount that the company will actually receive from the sale of the bonds, and (b) the amount of both the quarterly and the total annual cash interest that the company will be required to pay. Bon LOG BRIEF EXERCISE 10.4 Pearl Company sells $1,000,000 general obligation bonds for 101. The interest rate on the bonds, paid quarterly, is 5 percent. Calculate (a) the amount that the company will actually receive from the sale of the bonds, and (b) the amount of both the quarterly and the total annual cash interest that the company will be required to pay. Issued at a Red & Blue Company sold bonds at 97 on an interest payment date BRIEF EXERCISE 10.5 for $500,000. Assuming the bonds will be retired in 10 years and interest is paid annually, calculate the amount of cash that will be received and paid by Red & Blue in the first year, as well as the interest expense that will be recognized in that year. The bonds carry a stated interest rate of 5 percent. BRIEF EXERCISE 10.6 Purple & Orange Company sold $700,000 of bonds on an interest calculate the amount of cash that will be received and paid by Purple & Orange in the first full payment date at 102. Assuming the bonds will be retired in 10 years and interest is paid annually. year, as well as the amount of interest expense that will be recognized in that year. The bonds carry a stated interest rate of 6.5 percent. Issued at a BRIEF EXERCISE 10.7 Fox Company has debt totaling $2,000,000 and total shareholders Sisubito of $4,000,000. Wolfe Company has debt totaling $3,000,000 and shareholders' equity or $5,000,000 a. Calculate the debt ratio for each company. (Hint: You will find an explanation of the debt ratio and how it is computed in Exhibit 108.) b. Briefly explain the meaning of the debt ratio. BRIEF EXERCISE 10.8 Joseph Max Company sold 10-year, 7 percent bonds for $1,000,000 at 98. On the interest payment date at the end of the 5th year the bonds were outstanding 50 percent of the bonds were retired by Max at 101 under an early retirement option that was written into the bond agreement. Determine the gain or loss that Max will incur as a result of retiring the bonds. xes BRIEF EXERCISE 10.9 Gosling Company determines its annual income tax expense to be $459,000. Of that amount, $300,000 has already been paid during the year (on a quarterly basis) and charged to the Income Tax Expense account. The company has determined that, of the amount that has not yet been paid or recorded, $75,000 will be deferred into future years under certain favorable income tax provisions available to the company. Prepare the end-of-year general journal entry to recognize income taxes accrued. efit Costs BRIEF EXERCISE 10.10 Grammar Company offers its full-time employees pension and other postretirement benefits, primarily health insurance. During the current year, pension benefits for the employees totaled $250,000. Other postretirement benefits totaled $140,000. The pension benefits are fully funded by the company by transferring cash to a trustee that administers the plan. The other postretirement benefits are similarly funded, but only at the 50 percent level. Determine the total amount that Grammar will need to transfer to its trustee for both benefit plans during the current year. t Exercises TING EXERCISE 10.1 8 Assume that you will have a 10-year, $100,000 loan to repay to your parents when you graduate from university next month. The loan, plus 8 percent annual interest on the unpaid balance, is to be repaid in 10 annual installments of $14,900 each, beginning one year after you graduate. You have accepted a well-paying job and are considering an early settlement of the entire unpaid balance in just three years (immediately after making the third annual payment of $14.900). Prepare an amortization schedule showing how much money you will need to save to pay your parents the entire unpaid balance of your loan three years after your graduation. (Round amounts to the nearest dollar.) Liabilities Chapter 10 2. b. c. a 18 months. e. EXERCISE 10.2 Listed below are eight events or transactions of GemStar Corporation. Effects of Trans Made an adjusting entry to record interest on a short-term note payable. the Accounting Made a monthly installment payment of a fully amortizing, six-month, interest-bearing L01, 102, LO3, L04_ installment note payable. L05, LOB Recorded a regular monthly payroll, including the amounts withheld from employees, the issuance of paychecks, and payroll taxes on the employer. d. Came within 12 months of the maturity date of a note payable originally issued for a period of Deposited employee tax withholdings with proper tax authorities. Issued bonds payable at face value. Recognized semiannual interest expense on bonds payable described in part f and paid bond- holders the full interest amount. h. Recorded the necessary adjusting entry on 31 December 2013, to accrue three months' interest on bonds payable that had been issued at a discount several years prior. The next semiannual interest payment will occur 31 March 2014. Indicate the effects of each of these transactions on the following financial statement categories. Organize your answer in tabular form, using the illustrated column headings. Use the following code letters to indicate the effects of each transaction on the accounting element listed in the column heading: I for increase, D for decrease, and NE for no effect. 8 Income Statement Statement of Financial Position Revenue - Expenses = Profit Assets = + Non- current + Liab. Current Liab. Owners' Equity Transaction a a. Effects of T on Various Measureme LO1, LO2, LOC LOG, LOS c. EXERCISE 10.3 Six events relating to liabilities follow: Paid the liability for interest payable accrued at the end of the last accounting period. b. Made the current monthly payment on a 12-month installment note payable, including interest and a partial repayment of principal. Issued bonds payable at 98 on 1 March 2013. The bonds pay interest 1 March and 1 September. d. Recorded 1 September 2013, interest expense and made semiannual interest payment on bonds referred to in part c. Recorded necessary adjusting entry on 31 December 2013, for bonds referred to in part c. f. Recorded estimated six-month warranty expense on 31 December 2013. Indicate the effects of each transaction or adjusting entry on the financial measurements in the five column headings listed below. Use the code letters I for increase, D for decrease, and NE for no effect. e. Current Liabilities Noncurrent Liabilities Net Cash from Operating Activities Net Cash (from All Sources) Transaction Profit a EXERCISE 10.4 Magnum Plus Company is a manufacturer of hunting supplies. The following is a summary of the company's annual payroll-related costs: Employe Really C L03 Wages and salaries expense (of which $2,200,000 was withheld from employees' pay and forwarded directly to tax authorities) Payroll taxes. Workers' compensation premiums Group health insurance premiums. Contributions to employees' pension plan $7,200,000 580,000 250.000 725,000 450,000 Chapter 10 Liabilities Compute Magnum's total payroll-related costs for the year. a. b. Compute the net amount of cash actually paid to employees (their take-home pay). Express total payroll-related costs as a percentage of (1) total wages and salaries expense, and c. (2) employees' take-home pay. (Round computations to the nearest I percent.) EXERCISE 10.5 Gruver Corporation reported the following payroll-related costs for the month of February all Activities Gross pay (wages expense) Social Security and medical care taxes Unemployment taxes Workers' compensation insurance.... Group health and life insurance benefits Employee pension plan benefits Total payroll costs for February $250,000 19.125 15,500 8,500 10,000 22,875 $326,000 Gruver's insurance premiums for workers' compensation and group health and life insurance were paid for in a prior period and recorded initially as prepaid insurance expense. Withholdings from employee wages in February were as follows: $61,875 19,125 a. Income tax withholdings Social Security and medical care tax withholdings Record Gruver's gross wages, employee withholdings, and employee take-home pay for February b. Record Gruver's payroll tax expense for February. Record Gruver's employee benefit expenses for February. d. Do the amounts withheld from Gruver's employees represent taxes levied on Gruver Corporation? Explain. c. on Table a. EXERCISE 10.6 Glen Pool Club has a $1,500,000 mortgage liability. The mortgage is payable in monthly installments of $15,430, which include interest computed at an annual rate of 12 percent (1 percent monthly). Prepare a partial amortization table showing (1) the original balance of this loan, and (2) the allocation of the first two monthly payments between interest expense and the reduction in the mortgage's unpaid balance. (Round to the nearest dollar.) b. Prepare the journal entry to record the second monthly payment. Will monthly interest increase, decrease, or stay the same over the life of the loan? Explain your answer. c. rowing a. EXERCISE 10.7 Sunshine Company has $700 million of 5.0 percent notes payable. The company's income tax rate is approximately 16 percent. Compute the company's after-tax cost of borrowing on this bond issue stated as a total dollar amount. b. Compute the company's after-tax cost of borrowing on this bond issue stated as a percentage of the amount borrowed. c. Describe briefly the advantage of raising funds by issuing bonds as opposed to shares. ads Issued EXERCISE 10.8 On 31 March 2013, Gardner Corporation received authorization to issue $500,000 of 9 percent, 30-year bonds payable. The bonds pay interest on 31 March and 30 September. The entire issue was dated 31 March 2013, but the bonds were not issued until 30 April 2013. They were issued at face value. Prepare the journal entry at 30 April 2013, to record the sale of the bonds. b. Prepare the journal entry at 30 September 2013, to record the semiannual bond interest payment a. Liabilities Chapter 10 c. Prepare the adjusting entry at 31 December 2013. to record bond interest expense accrued since 30 September 2013. (Assume that no monthly adjusting entries to accrue interest expense had been made prior to 31 December 2013.) d. Explain why the issuing corporation charged its bond investors for interest accrued in April 2013, prior to the issuance date (see part b above). Accounting for a Premium: Is Payments, an L05, LOG following journal entries: a. b. EXERCISE 10.9 Swanson Corporation issued $8 million of 20-year, 8 percent bonds on 1 April 2013, at 102. Interest is due on 31 March and 30 September of each year, and all of the bonds in the issue mature on 31 March 2033. Swanson's financial year ends on 31 December. Prepare the 1 April 2013, to record the issuance of the bonds. 30 September 2013, to pay interest and to amortize the bond premium. 31 March 2033, to pay interest , amortize the bond premium, and retire the bonds at maturity (make two separate entries). d. Briefly explain the effect of amortizing the bond premium upon (1) annual profit and (2) annual net cash from operating activities. (Ignore possible income tax effects.) c. EXERCISE 10.10 Accounting a Discount: Payments LOS, LOS Mellilo Corporation issued $5 million of 20-year, 9.5 percent bonds on 1 July 2013, at 98. Interest is due on 30 June and 31 December of each year, and all of the bonds in the issue mature on 30 June 2033. Mellilo's financial year ends on 31 December. Prepare the following journal entries: 1 July 2013, to record the issuance of the bonds. 31 December 2013, to pay interest and amortize the bond discount. 30 June 2033, to pay interest, amortize the bond discount, and retire the bonds at maturity (make two separate entries). d. Briefly explain the effect of amortizing the bond discount upon (1) annual profit and (2) annual net cash from operating activities. (Ignore possible income tax effects.) a. b. c. EXERCISE 10.11 Shown below are data from recent reports of two toy makers. Dollar amounts are stated in thousands. Safety of LOS Toyco Playco Total assets Total liabilities Interest expense Operating profit. $6,151,320 3,497,920 280,260 130,280 $26,163,880 10,907,760 375,880 3,046,720 a. Compute for each company (1) the debt ratio and (2) the interest coverage ratio. (Round the debt ratio to the nearest percent and the interest coverage ratio to two decimal places.) b. In your opinion, which of these companies would a long-term creditor probably view as the safer investment? Explain. Accour L010 EXERCISE 10.12 On 1 July, Pine Region Dairy leased equipment from Farm China for a period of three years. The lease calls for monthly payments of $25,000 payable in advance on the first day of each month, beginning 1 July. Prepare the journal entry needed to record this lease in the accounting records of Pine Region Dairy on 1 July under each of the following independent assumptions: a. The lease represents a simple rental arrangement. b. At the end of three years, title to this equipment will be transferred to Pine Region Dairy at no additional cost. The present value of the 36 monthly lease payments is $760,210, of which $25,000 is paid in cash on 1 July. None of the initial $25,000 is allocated to interest expense. c. Why is situation a, the operating lease, sometimes called off-balance sheet financing? d. Would it be acceptable for a company to account for a finance lease as an operating lease to report rent expense rather than a noncurrent liability? Chapter 10 Liabilities EXERCISE 10.13 information from its actuarial firm: At the end of the current year, Western Electric received the following $2,500,000 750,000 Pension expense Postretirement benefits expense The pension plan is fully funded. Western Electric has funded only $50,000 of the nonpension postretirement benefits this year. a. b. Prepare the journal entry to summarize the nonpension postretirement benefits expense for the c. If the company becomes illiquid in future years, what prospects, if any, do today's employees have of receiving the pension benefits that they have earned to date? d. Does the company have an ethical responsibility to fully fund its nonpension postretirement benefits? Prepare the journal entry to summarize pension expense for the entire year. entire year. EXERCISE 10.14 The following journal entry summarizes for the current year the income tax expense of Wilson's Software Warehouse: 1,500,000 Income Tax Expense Cash Income Tax Payable Deferred Tax Liabilities To record income tax expense for the current year. 960,000 340,000 200,000 of the deferred income taxes, only $30,000 is classified as a current liability. a. Define the term deferred income tax. b. What is the amount of income tax that the company has paid or expects to pay in conjunction with its income tax return for the current year? c. Illustrate the allocation of the liabilities shown in the above journal entry between the classifications of current liabilities and noncurrent liabilities. a. EXERCISE 10.15 To answer the following questions use the financial statements for adidas AG, Herzogenaurach in Appendix A at the end of the textbook: Compute the company's current ratio for the two years reported. Do these ratios provide support that adidas is able to repay its current liabilities as they come due? Explain. b. Compute the company's debt ratio for the two years reported. Does adidas appear to have excessive debt? Explain. Examine the company's statement of cash flows for 2012. Do adidas's sources of operating cash flows appear adequate to cover its uses of operating cash flows? Explain. C. Problem Set A a. b. Problem 10.1A Fifteen transactions or events affecting Computer Specialists are as follows: Made a year-end adjusting entry to accrue interest on a note payable. A liability classified for several years as noncurrent becomes due within the next 12 months. Recorded the regular monthly payroll , including payroll taxes, amounts withheld from employees, and the issuance of paychecks. Earned an amount previously recorded as unearned revenue. Made arrangements to extend a bank loan due in 60 days for another 18 months. c. d. e. Liabilities Chapter 10 f. Made a monthly payment on a fully amortizing installment note payable. (Assume this note is classified as a current liability.) Called bonds payable due in seven years at a price above the carrying amount of the liability in the accounting records. h. Issued bonds payable at 97 on 1 May 2013. The bonds pay interest | May and 1 November. bonds referred to in part h. j. Recorded necessary adjusting entry on 31 December 2013, for bonds referred to in part h. Recorded 1 November 2013, interest expense and made semiannual interest payment on m. Recorded a provision for warranty claims. Issued bonds payable at 102 on 31 July 2013. The bonds pay interest 31 July and 31 January 1. Recorded necessary adjusting entry on 31 December 2013, for bonds referred to in part k. m. Entered into a two-year commitment to buy all hard drives from a particular supplier at a price 10 percent below market. o. Received notice that a lawsuit has been filed against the company for $7 million. The amount of the company's liability, if any, cannot be reasonably estimated at this time. Instructions 's Indicate the effects of each of these transactions upon the following elements of the company financial statements. Organize your answer in tabular form, using the column headings shown below. Use the following code letters to indicate the effects of each transaction on the accounting element listed in the column headings: I for increase, D for decrease, and NE for no effect. Income Statement Statement of Financial Position Revenue - Expenses = Profit Non- current Liab. Assets = Current Liab. + + Owners Equity Transaction a Problem 10.2A The following are selected items from the accounting records of Macau Chocolates for the year ended 31 December 2013: Stater Prese L01, LO Note payable to Northwest Bank Tax payable Accrued expenses and payroll taxes Mortgage note payable Accrued interest on mortgage note payable Trade accounts payable Unearned revenue Potential liability in pending lawsuit $500,000 40.000 60,000 750,000 5,000 250,000 15,000 100,000 Other Information 1. The note payable to Northwest Bank is due in 60 days. Arrangements have been made to renew this note for an additional 12 months. 2. The mortgage requires payments of $6,000 per month. An amortization table shows that its balance will be paid down to $739,000 by 31 December 2014. 3. Accrued interest on the mortgage note payable is paid monthly. The next payment is due near the end of the first week in January 2014. 4. Macau Chocolates has been sued for $1 million in a contract dispute. It is not possible at this time, however, to make a reasonable estimate of the possible loss, if any, that the company may have sustained. a. Instructions Using the information provided, prepare the current and noncurrent liability sections of the company's statement of financial position dated 31 December 2013. (Within each classification, items may be listed in any order.) b. Explain briefly how the information in each of the four numbered paragraphs above influenced your presentation of the company's liabilities. Chapter 10 Liabilities cruing in the following transactions involving notes payable: Problem 10.3A During the financial year ended 31 December, Swanson Corporation engaged 16 Sept. Purchased office equipment from Seawald Equipment. The invoice amount was 6 Aug. Borrowed $12.000 from Maple Bank, signing a 45-day, 12 percent note payable. $18,000, and Seawald agreed to accept, as full payment, a 10 percent, three-month note for the invoice amount 1 Dec. Purchased inventory in the amount of $5.000 from Gathman Corporation. Gathman 20 Sept. Paid Maple Bank the note plus accrued interest. 1 Nov. Borrowed $250.000 from Mike Swanson, a major corporate shareholder. The corporation issued Swanson a $250,000, 15 percent, 90-day note payable. accepted a 90-day, 14 percent note as full settlement of the purchase. Swanson Corporation uses a perpetual inventory system. accrued interest on this note and issued a new 30-day , 16 percent note payable in the amount of $18,000 to replace the note that matured. 16 Dec. The $18,000 note payable to Seawald Equipment matured today. Swanson paid the Instructions Prepare journal entries in general journal form) to record the above transactions. Use a a. 360-day year in making the interest calculations. b. Prepare the adjusting entry needed at 31 December, prior to closing the accounts. Use one entry for all three notes (round to the nearest dollar). Provide a possible explanation why the new 30-day note payable to Seawald Equipment pays 16 percent interest instead of the 10 percent rate charged on the 16 September, note. c. of an Problem 10.41 On 1 September 2013, Quick Lube signed a 30-year, $1,080,000 mortgage note payable to Hong Kong Bank in conjunction with the purchase of a building and land. The mortgage note calls for interest at an annual rate of 12 percent (1 percent per month). The note is fully amortizing over a period of 360 months. The bank sent Quick Lube an amortization table showing the allocation of monthly payments between interest and principal over the life of the loan. A small part of this amortization table is illustrated below. (For convenience, amounts have been rounded to the nearest dollar.) AMORTIZATION TABLE (12%, 30-Year Mortgage Note Payable for $1,080,000; Payable in 360 Monthly Installments of $11,110) Interest Period Payment Date Monthly Payment Interest Expense Principal Reduction Unpaid Balance Issue date 1 2 1 Sept. 2013 1 Oct. 1 Nov. $11,110 11,110 $10,800 10,797 $310 313 $1,080,000 1,079,690 1,079,377 a. Instructions Explain whether the amounts of interest expense and the reductions in the unpaid principal are likely to change in any predictable pattern from month to month. b. Prepare journal entries to record the first two monthly payments on this mortgage. Complete this amortization table for two more monthly installmentsthose due on 1 December 2013, and I January 2014. (Round amounts to the nearest dollar.) d. Will any amounts relating to this 30-year mortgage be classified as current liabilities in Quick Lube's 31 December 2013, statement of financial position? Explain, but you need not compute any additional dollar amounts. c. ssued at Problem 10.5A Blue Mountain Power Company obtained authorization to issue 20-year bonds with a face value of $100 million. The bonds are dated 1 May 2013, and have a contract rate of interest of 10 percent. They pay interest on 1 November and i May. The bonds were issued on 1 August 2013, at 100 plus three months' accrued interest. Liabilities Chapter 10 Instructions 2. b. c. Prepare the necessary journal entries in general journal form on: 1 August 2013, to record the issuance of the bonds. November 2013, to record the first semiannual interest payment on the bond issue 31 December 2013, to record interest expense accrued through year-end (Round to the nearest dollar.) 1 May 2014, to record the second semiannual interest payment. (Round to the nearest dollar: What was the prevailing market rate of interest on the date that the bonds were issued? Explain. d. e. problem 10.61 On 1 September 2013, Park Rapids Lumber Company issued $80 million in 20-year, 10 percent bonds payable. Interest is payable semiannually on March and 1 September. Bond discounts and premiums are amortized at each interest payment date and at year-end. The Amortization of Discount and P LOS, LOS company's financial year ends at 31 December. excel Instructions a. 1. Make the necessary adjusting entries at 31 December 2013. and the journal entry to record the payment of bond interest on 1 March 2014, under each of the following assumptions: The bonds were issued at 98. (Round to the nearest dollar.) 2. The bonds were issued at 101. (Round to the nearest dollar.) b. Compute the net bond liability at 31 December 2014, under assumptions 1 and 2 above. (Round to the nearest dollar.) Under which of the above assumptions, 1 or 2, would the investor's effective rate of interest be higher? Explain. C. Problem 10.74 The following items were taken from the accounting records of Home Satellite Telephone Corporation for the year ended 31 December 2013 (dollar amounts are in thousands): Reporting Li Statement a L01, L05, LOG excel $ Accounts payable Accrued expenses payable (other than interest) 694% Bonds payable, due 1 Feb. 2014 87% Bonds payable, due 1 June 2014 Discount on bonds payable (812% bonds of 2014) 11% Bonds payable, due 1 June 2023 Premium on bonds payable (11% bonds of 2023) Accrued interest payable Bond interest expense Other interest expense Notes payable (short-term) Obligations under finance leases Pension obligation Unfunded obligations for postretirement benefits other than pensions Deferred tax liabilities Income tax expense Income tax payable Operating profit Profit Total assets 656,000 113.470 1,000,000 2,500,000 2,600 3,000,000 17,000 73,330 610,000 170,000 1,100,000 236.000 4,100,000 720,000 1,300,000 669,000 173,000 2,808,000 1,347,000 20,935,000 1. Other Information The 6% percent bonds due in February 2014 will be refinanced in January 2014 through the issuance of $1,500,000 in 9 percent, 20-year bonds payable. 2. The 8/2 percent bonds due 1 June 2014, will be repaid entirely from a bond sinking fund. 3. Home is committed to total lease payments of $144,000 in 2014. Of this amount, $74.790 is applicable to operating leases, and $69,210 to finance leases. Payments on finance leases will be applied as follows: $23,000 to interest expense and $46,210 to reduction in the capitalized lease payment obligation. Chapter 10 Liabilities 4. 5. Home's pension plan is fully funded with an independent trustee. The obligation for postretirement benefits other than pensions consists of a commitment to maintain health insurance for retired workers. During 2014, Home will fund $18,000 of this obligation The $173.000 in tax payable relates to income taxes levied in 2013 and must be paid on or before 6. 15 March 2014. No portion of the deferred tax liability is regarded as a current liability. Instructions Using this information, prepare the current liabilities and noncurrent liabilities sections of a a. your b. classified statement of financial position as at 31 December 2013. (Within each classification items may be listed in any order.) Explain briefly how the information in each of the six numbered paragraphs affected presentation of the company's liabilities. Compute as at 31 December 2013, the company's (1) debt ratio and (2) interest coverage ratio. d. Solely on the basis of information stated in this problem, indicate whether this company appears to be an outstanding, medium, or poor long-term credit risk. State specific reasons for c. your conclusion. Problem 10.8A As at 31 December of the current year, Norman Company has prepared the following information regarding its liabilities and other obligations (dollar amounts are in thousands): $ 80,000 125.000 500.000 900,000 Notes payable, of which $10,000 will be repaid within the next 12 months .. Interest expense that will result from existing liabilities over the next 12 months. Lawsuit pending against the company, in which $500,000 is claimed in damages. Legal counsel can make no reasonable estimate of the company's ultimate liability at this time 20-year bond issue that matures in two years. The entire amount will be repaid from a bond sinking fund.. Accrued interest on the 20-year bond issue as at the end of reporting period. Three-year commitment to John Lau as chief financial officer at a salary of $250,000 per year Note payable due within 90 days (but that is expected to be extended for an additional 18 months) Cash deposits from customers for goods and services to be delivered over the next nine months Income taxes, of which $100,000 are currently payable and the remainder deferred indefinitely 36,000 750,000 75,000 300,000 185.000 a. Instructions Prepare a listing of the company's current and noncurrent liabilities as they should be presented in the company's 31 December statement of financial position. b. Briefly explain why you have excluded any of the listed items in your listing of current and noncurrent liabilities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started