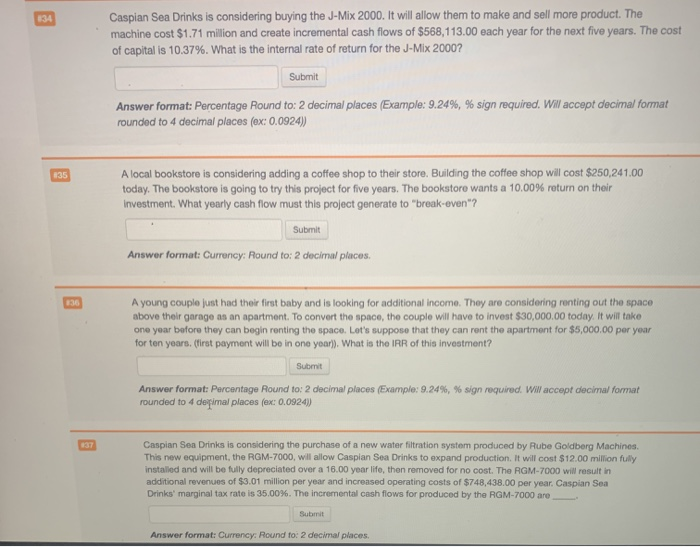

Caspian Sea Drinks is considering buying the J-Mix 2000. It will allow them to make and sell more product. The machine cost $1.71 million and create incremental cash flows of $568,113.00 each year for the next five years. The cost of capital is 10.37%. What is the internal rate of return for the J-Mix 2000? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. WW accept decimal format rounded to 4 decimal places (ex: 0.0924)) A local bookstore is considering adding a coffee shop to their store. Building the coffee shop will cost $250,241.00 today. The bookstore is going to try this project for five years. The bookstore wants a 10.00% return on their Investment. What yearly cash flow must this project generate to "break-even"? Submit Answer format: Currency: Round to: 2 decimal places. A young couple just had their first baby and is looking for additional income. They are considering renting out the space above their garage as an apartment. To convert the space, the couple will have to invest $30,000.00 today. It will take one year before they can begin renting the space. Let's suppose that they can rent the apartment for $5,000.00 per year for ten years. (first payment will be in one year)). What is the IRR of this investment? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 depimal places (ex: 0.09243) #37 Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube Goldberg Machines This new equipment, the RGM-7000, will allow Caspian Sea Drinks to expand production. It will cost $12.00 million fully installed and will be fully depreciated over a 16.00 year life, then removed for no cost. The RGM-7000 will result in additional revenues of $3.01 million per year and increased operating costs of $748,438.00 per year. Caspian Sea Drinks' marginal tax rate is 35.00%. The incremental cash flows for produced by the RGM-7000 are Submit Answer format: Currency: Round to: 2 decimal places