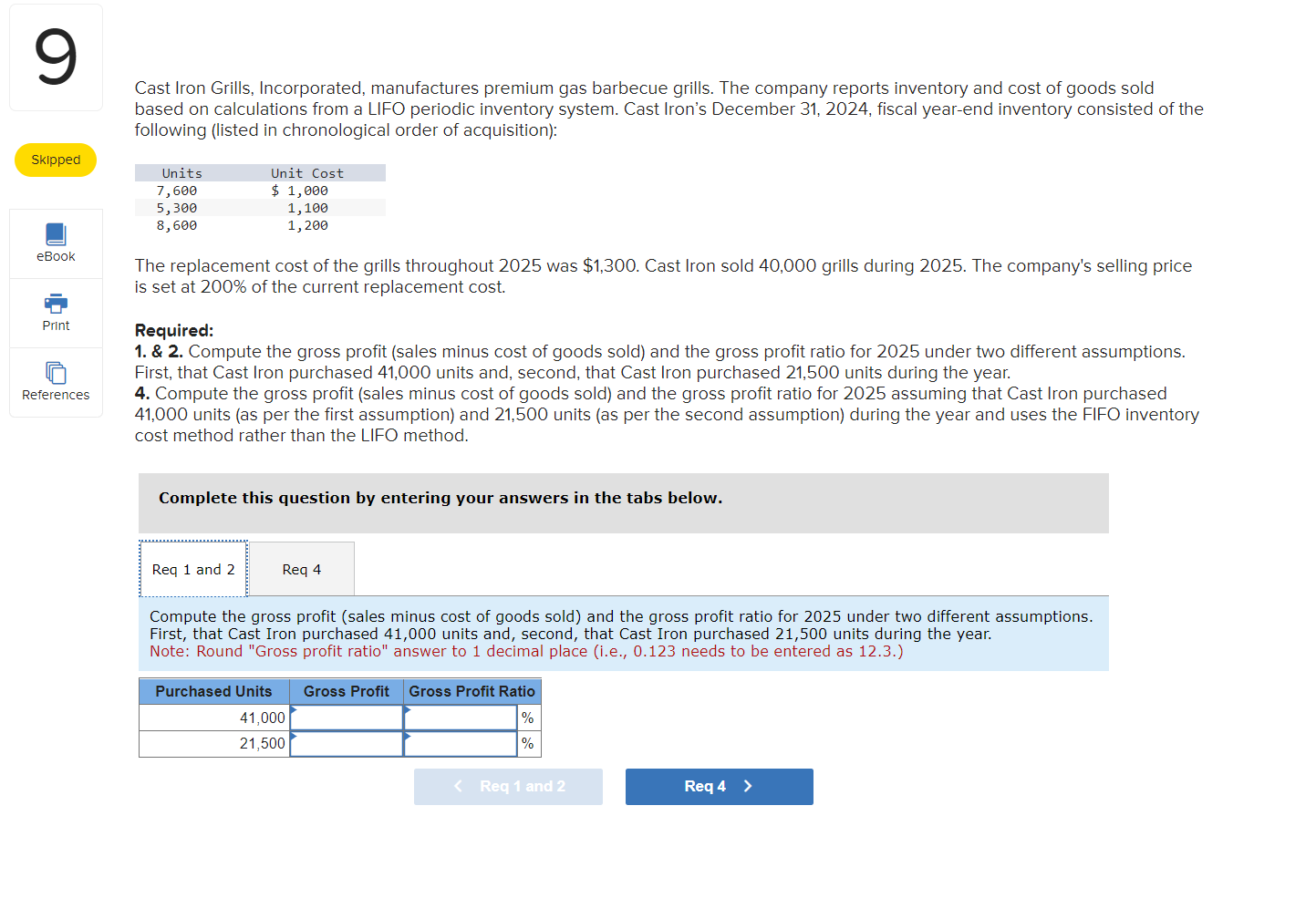

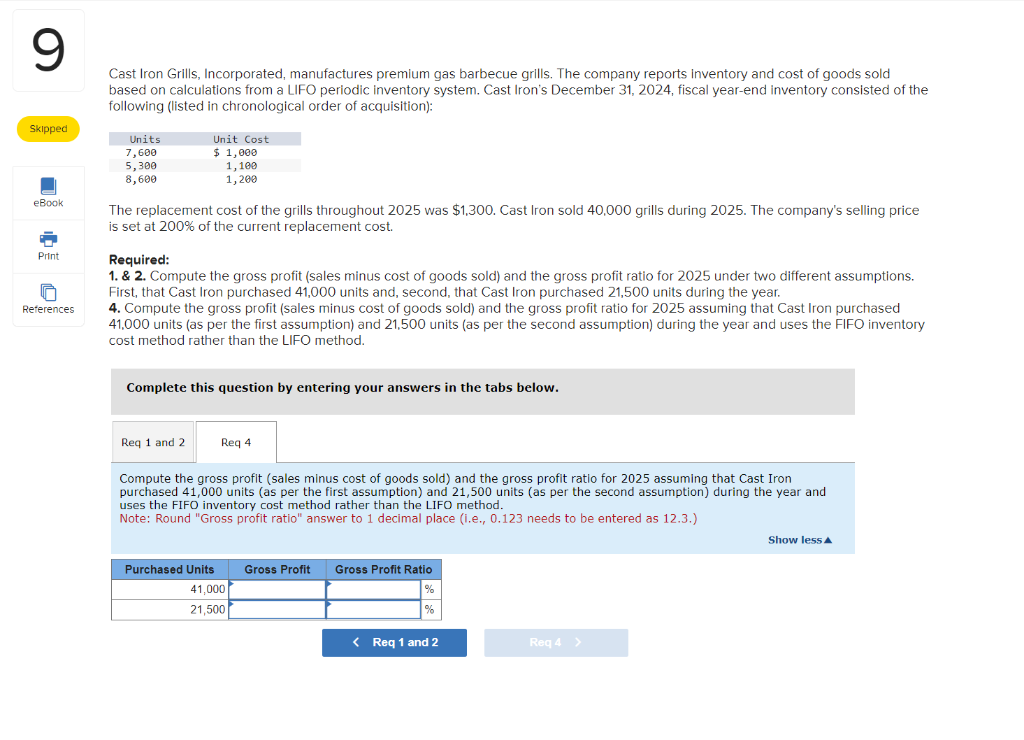

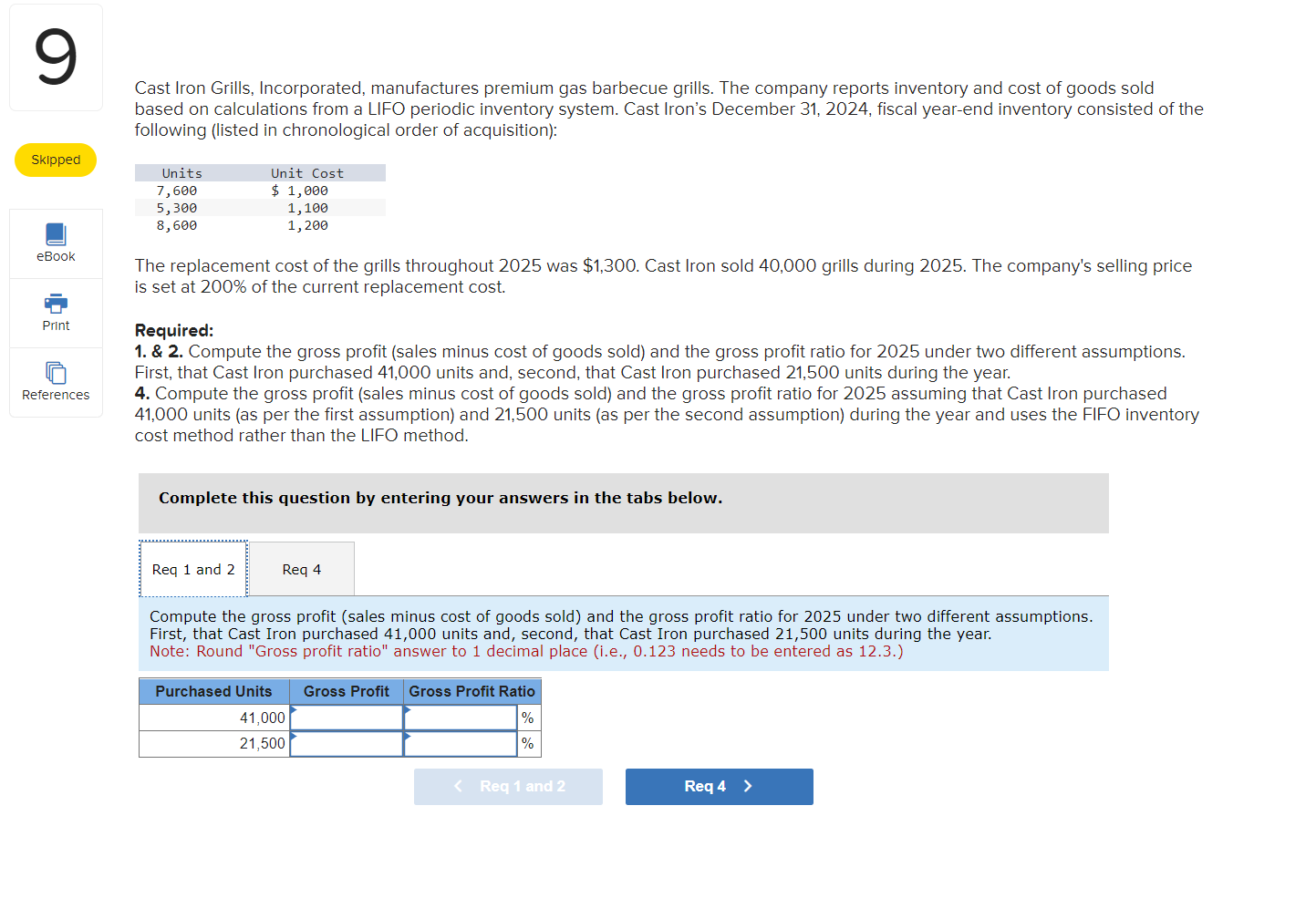

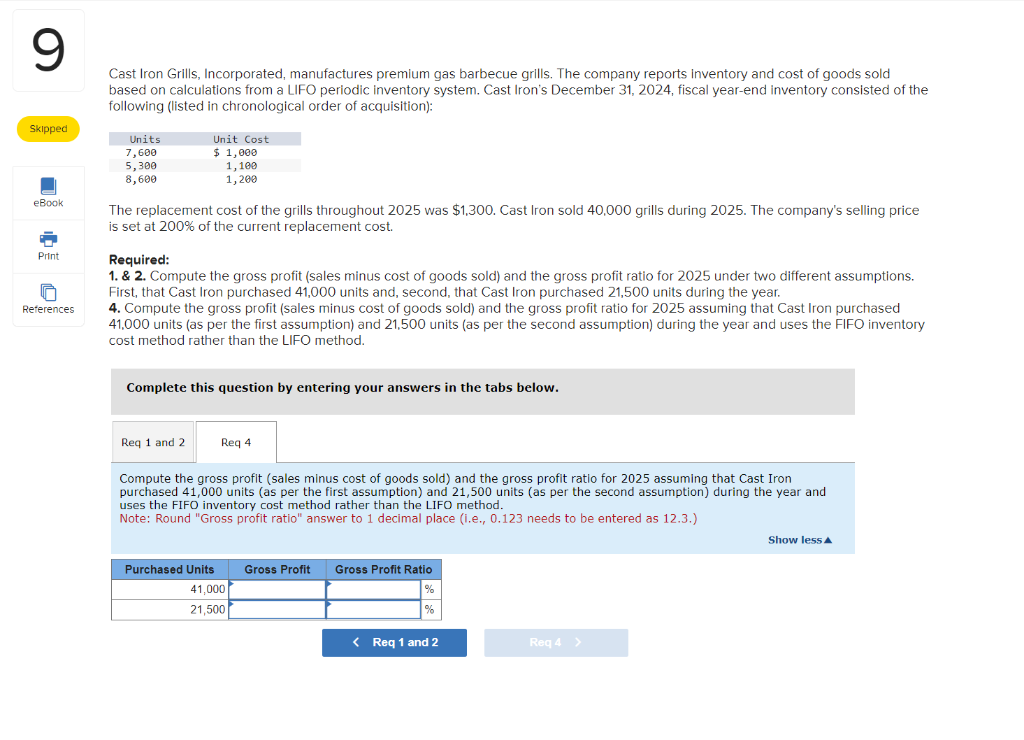

Cast Iron Grills, Incorporated, manufactures premium gas barbecue grills. The company reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. Cast Iron's December 31, 2024, fiscal year-end inventory consisted of the following (listed in chronological order of acquisition): The replacement cost of the grills throughout 2025 was $1,300. Cast Iron sold 40,000 grills during 2025 . The company's selling price is set at 200% of the current replacement cost. Required: 1. \& 2. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2025 under two different assumptions. First, that Cast Iron purchased 41,000 units and, second, that Cast Iron purchased 21,500 units during the year. 4. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2025 assuming that Cast Iron purchased 41,000 units (as per the first assumption) and 21,500 units (as per the second assumption) during the year and uses the FIFO inventory cost method rather than the LIFO method. Complete this question by entering your answers in the tabs below. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2025 under two different assumptions. First, that Cast Iron purchased 41,000 units and, second, that Cast Iron purchased 21,500 units during the year. Note: Round "Gross profit ratio" answer to 1 decimal place (i.e., 0.123 needs to be entered as 12.3.) Cast Iron Grills, Incorporated, manufactures premium gas barbecue grills. The company reports inventory and cost of goods sold based on calculations from a LIFO periodic inventory system. Cast Iron's December 31, 2024, fiscal year-end inventory consisted of the following (listed in chronological order of acquisition): The replacement cost of the grills throughout 2025 was $1,300. Cast Iron sold 40,000 grills during 2025 . The company's selling price is set at 200% of the current replacement cost. Required: 1. \& 2. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2025 under two different assumptions. First, that Cast Iron purchased 41,000 units and, second, that Cast Iron purchased 21,500 units during the year. 4. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2025 assuming that Cast Iron purchased 41,000 units (as per the first assumption) and 21,500 units (as per the second assumption) during the year and uses the FIFO inventory cost method rather than the LIFO method. Complete this question by entering your answers in the tabs below. Compute the gross profit (sales minus cost of goods sold) and the gross profit ratio for 2025 assuming that Cast Iron purchased 41,000 units (as per the first assumption) and 21,500 units (as per the second assumption) during the year and uses the FIFO inventory cost method rather than the LIFO method. Note: Round "Gross profit ratio" answer to 1 decimal place (i.e., 0.123 needs to be entered as 12.3.)