Answered step by step

Verified Expert Solution

Question

1 Approved Answer

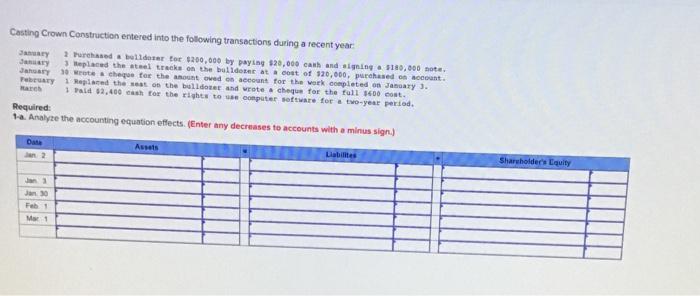

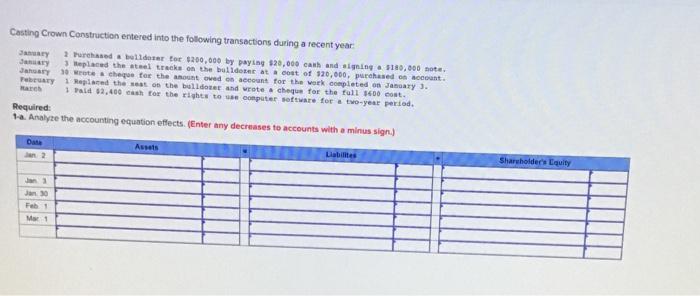

Casting Crown Construction entered into the following transactions during a recent year JAUTY 3 Purchased a boat for $200,000 by paying $20,000 cash and in

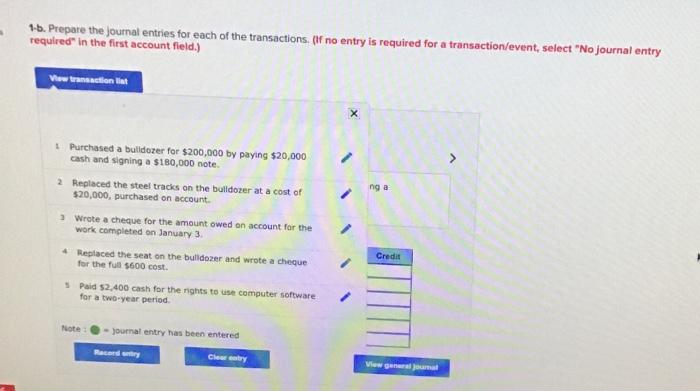

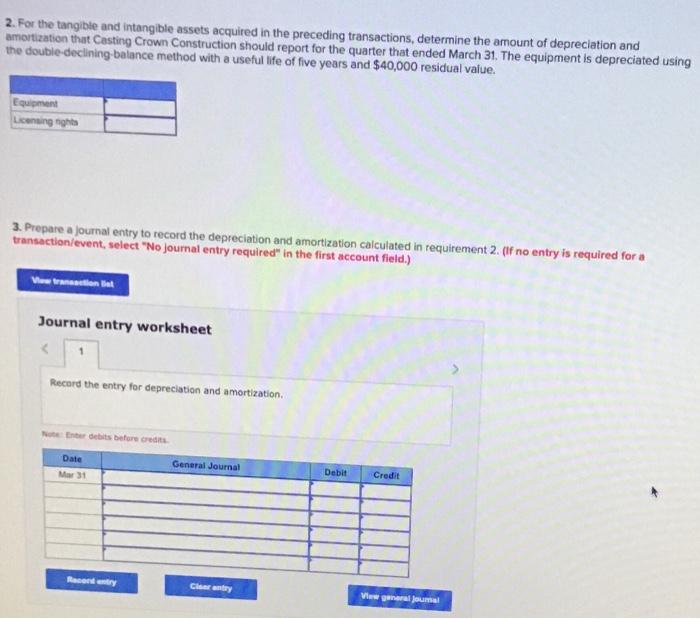

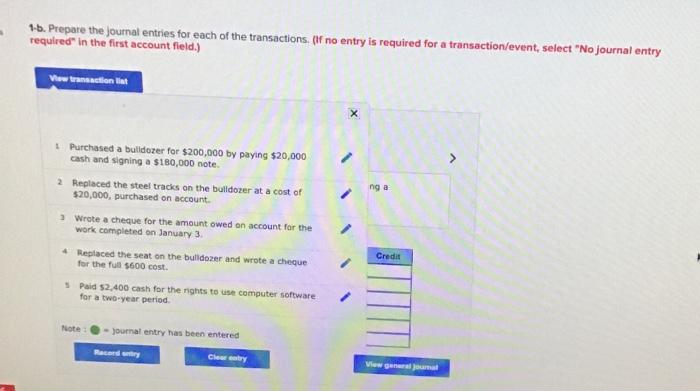

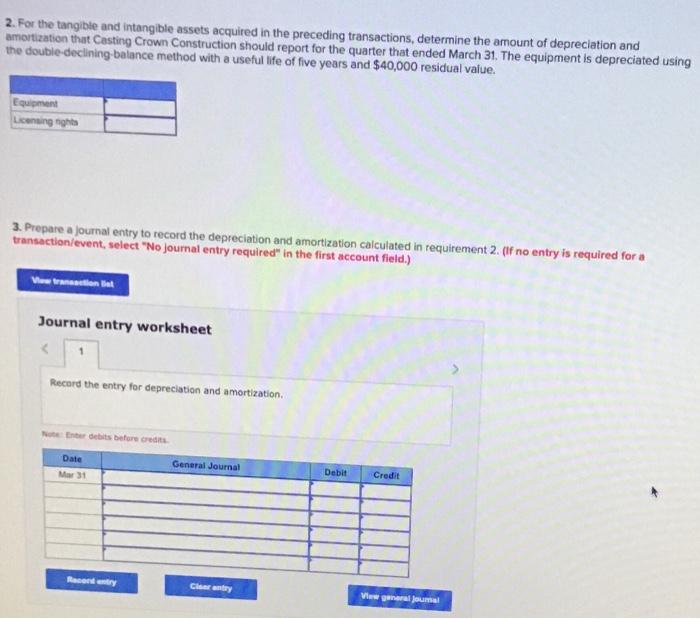

Casting Crown Construction entered into the following transactions during a recent year JAUTY 3 Purchased a boat for $200,000 by paying $20,000 cash and in 5180,000 ste. 3 placed the tal tracks on the builder at a cost of $20,000. perchased account. January 10 watch for the mounts for the work completed on January 3. Peruary 1 Replace the set on the ballet and wrote a cheque for the full 1600 cost. 1 Tald 63.400 cash for the right to computer software for two-year period. Required 1. Analyze the accounting equation effects. (Enter any decreases to accounts with a minus sign) Date 2 Assets Liabilites Shareholder's Equity Jan 30 Feb1 Mac 1-b. Prepare the journal entries for each of the transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View action to 1 Purchased a bulldozer for $200,000 by paying $20,000 cash and signing a $100,000 note 2 Replaced the steel tracks on the bulldozer at a cost of $20,000, purchased on account ng a 3 Wrote a cheque for the amount owed on account for the work completed on January 3 Replaced the seat on the bulldozer and wrote a cheque for the fu 5600 cost. Paid $2,400 cash for the rights to use computer software for a two-year period Credit Note - Journal entry has been entered Cherry Miam gana 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Casting Crown Construction should report for the quarter that ended March 31. The equipment is depreciated using the double-declining balance method with a useful life of five years and $40,000 residual value. Equipment Licensing 3. Prepare a journal entry to record the depreciation and amortization calculated in requirement 2. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for depreciation and amortization dit betrece Date General Journal Mar 31 Debit Credit City View general

Casting Crown Construction entered into the following transactions during a recent year JAUTY 3 Purchased a boat for $200,000 by paying $20,000 cash and in 5180,000 ste. 3 placed the tal tracks on the builder at a cost of $20,000. perchased account. January 10 watch for the mounts for the work completed on January 3. Peruary 1 Replace the set on the ballet and wrote a cheque for the full 1600 cost. 1 Tald 63.400 cash for the right to computer software for two-year period. Required 1. Analyze the accounting equation effects. (Enter any decreases to accounts with a minus sign) Date 2 Assets Liabilites Shareholder's Equity Jan 30 Feb1 Mac 1-b. Prepare the journal entries for each of the transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View action to 1 Purchased a bulldozer for $200,000 by paying $20,000 cash and signing a $100,000 note 2 Replaced the steel tracks on the bulldozer at a cost of $20,000, purchased on account ng a 3 Wrote a cheque for the amount owed on account for the work completed on January 3 Replaced the seat on the bulldozer and wrote a cheque for the fu 5600 cost. Paid $2,400 cash for the rights to use computer software for a two-year period Credit Note - Journal entry has been entered Cherry Miam gana 2. For the tangible and intangible assets acquired in the preceding transactions, determine the amount of depreciation and amortization that Casting Crown Construction should report for the quarter that ended March 31. The equipment is depreciated using the double-declining balance method with a useful life of five years and $40,000 residual value. Equipment Licensing 3. Prepare a journal entry to record the depreciation and amortization calculated in requirement 2. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the entry for depreciation and amortization dit betrece Date General Journal Mar 31 Debit Credit City View general

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started