Question

CC301 Tax Law T122 / My courses/ ACC301_0122 / General / T122 Practice Workbook Assessment Question 1 Not complete Marked out of 2 Flag

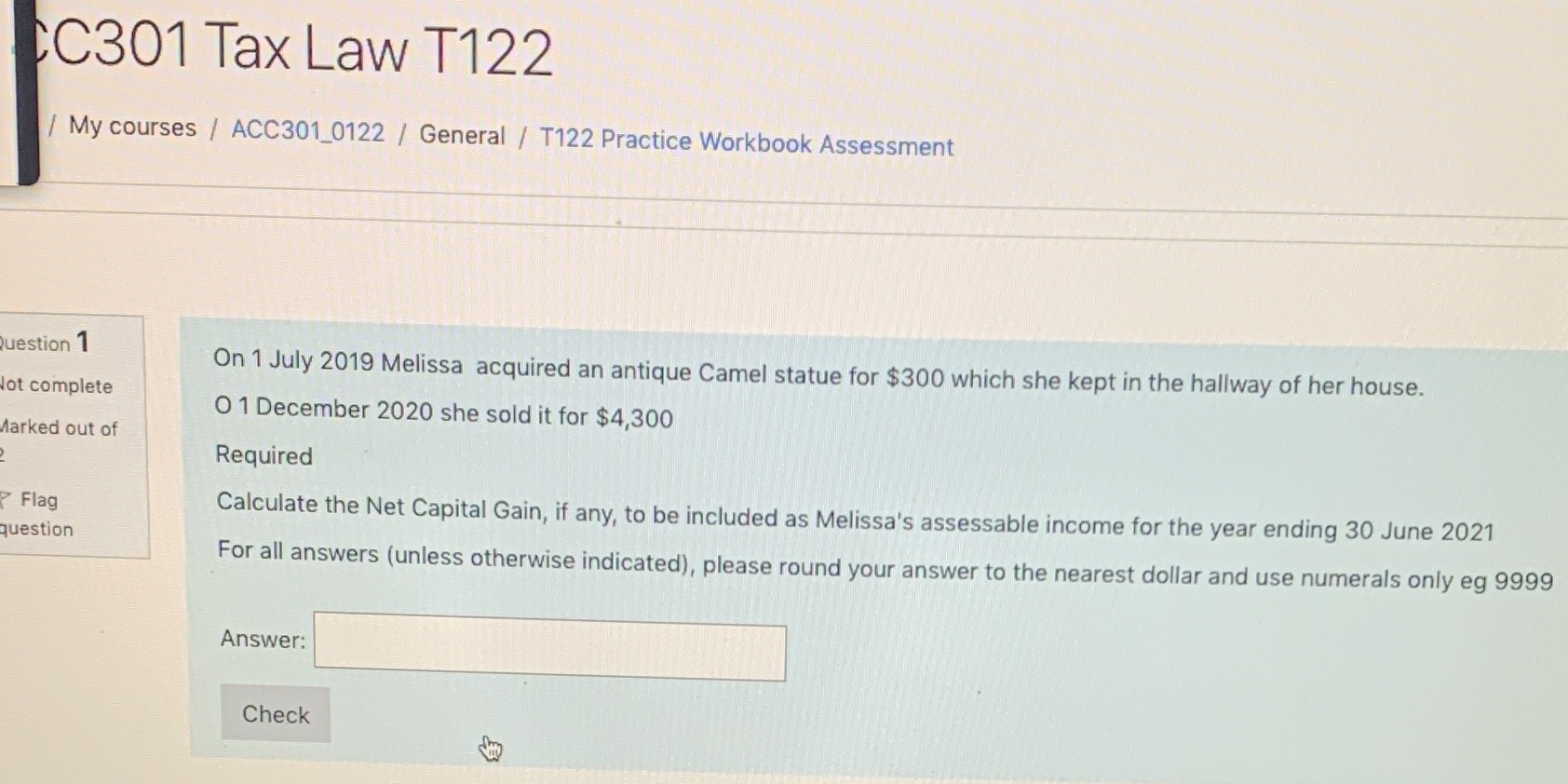

CC301 Tax Law T122 / My courses/ ACC301_0122 / General / T122 Practice Workbook Assessment Question 1 Not complete Marked out of 2 Flag question On 1 July 2019 Melissa acquired an antique Camel statue for $300 which she kept in the hallway of her house. 01 December 2020 she sold it for $4,300 Required Calculate the Net Capital Gain, if any, to be included as Melissa's assessable income for the year ending 30 June 2021 For all answers (unless otherwise indicated), please round your answer to the nearest dollar and use numerals only eg 9999 Answer: Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the net capital gain to be included as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

South-Western Federal Taxation 2020 Comprehensive

Authors: David M. Maloney, William A. Raabe, James C. Young, Annette Nellen, William H. Hoffman

43rd Edition

357109147, 978-0357109144

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App