Question

CC9-1 (Algo) Accounting for the Use and Disposal of Long-Lived Assets [LO 9-3, LO 9-5] Skip to question [The following information applies to the questions

CC9-1 (Algo) Accounting for the Use and Disposal of Long-Lived Assets [LO 9-3, LO 9-5]

Skip to question

[The following information applies to the questions displayed below.]

Nicoles Getaway Spa (NGS) purchased a hydrotherapy tub system to add to the wellness programs at NGS. The machine was purchased at the beginning of the year at a cost of $16,500. The estimated useful life was five years and the residual value was $500. Assume that the estimated productive life of the machine is 10,000 hours. Expected annual production was year 1, 2,450 hours; year 2, 2,350 hours; year 3, 2,100 hours; year 4, 2,100 hours; and year 5, 1,000 hours.

CC9-1 (Algo) Part 3

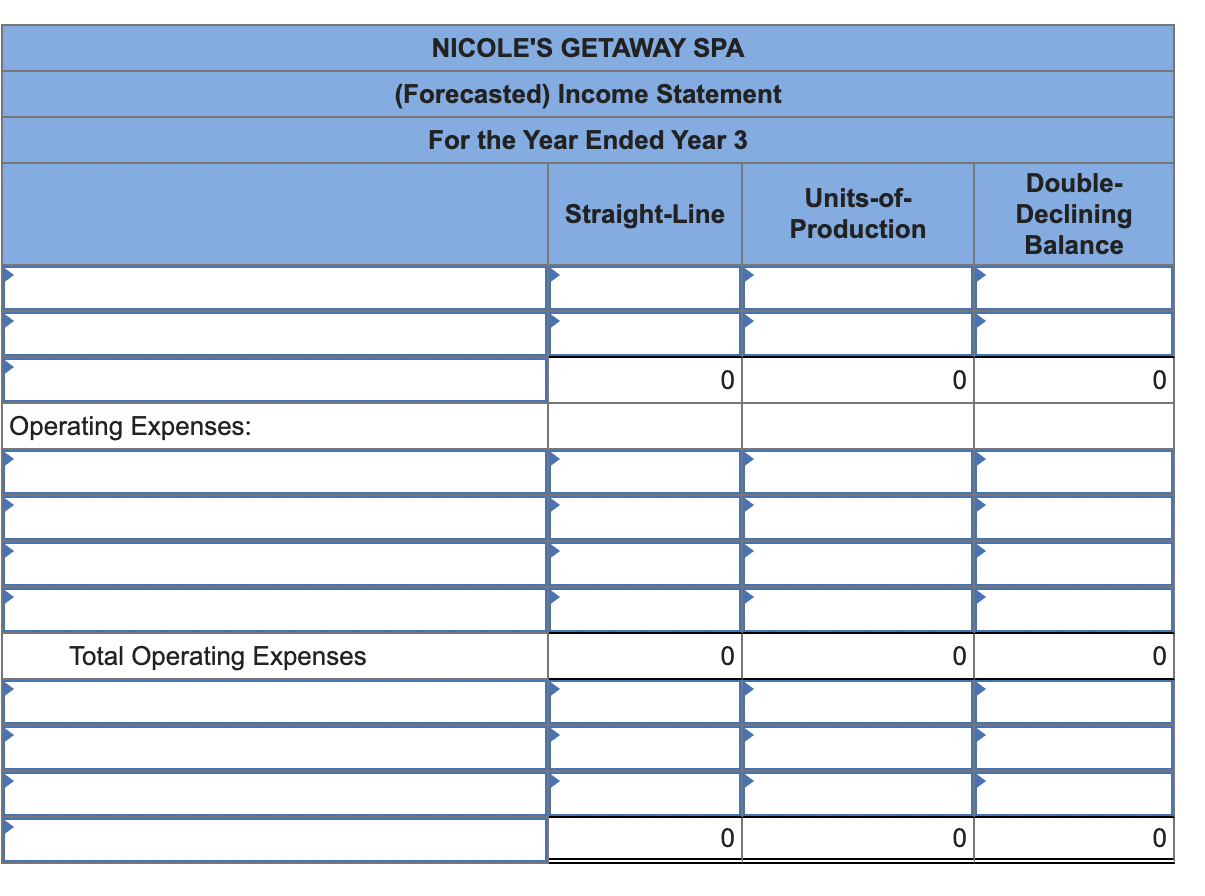

Assume NGS sold the hydrotherapy tub system for $4,950 at the end of year 3. The following amounts were forecast for year 3: Sales Revenues $54,000; Cost of Goods Sold $42,000; Other Operating Expenses $5,200; and Interest Expense $800. Create an income statement for year 3 for each of the different depreciation methods, ending at Income before Income Tax Expense. (Don't forget to include a loss or gain on disposal for each method.). (Do not round intermediate calculations. Any losses should be indicated with a minus sign. Round your answers to the nearest dollar amount.)

NICOLE'S GETAWAY SPA (Forecasted) Income Statement For the Year Ended Year 3 Straight-Line Units-of- Production Double- Declining Balance 0 0 0 Operating Expenses: Total Operating Expenses 0 0 0 0 O 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started