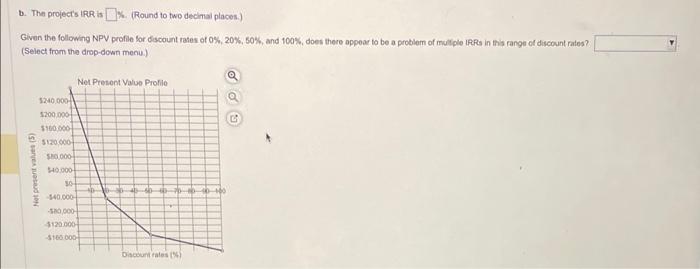

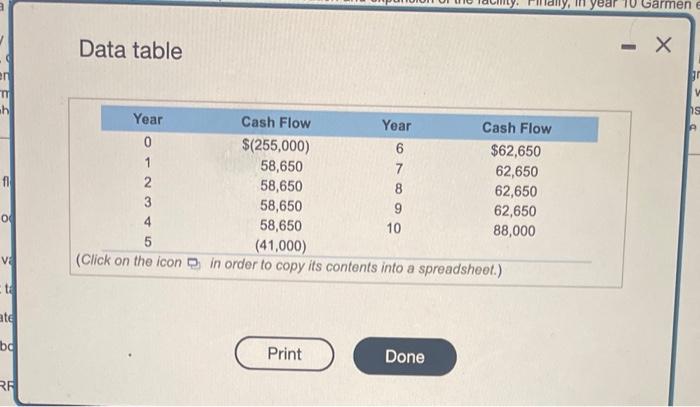

CComprehensive problen) Gamen Technologies lnc. operates a smal chain of speciaty retal stores throdghout the southweniom part of the U.S. The company makkeEs technologrbased consumer products both in their stores and over the Intemet, with sales spit roughly equaly between the two channols of datribution. The company'i producks range from radar dotection devioes and GPS mapping systema used in aulomobles to home-based westher monitoring stabons. The company recendy began imvesfigating the possiblo acquation of a regional warehousing facilty that covld be used both to stock its retal shops and to make drect shipments to the frmis on-ine custamen. The warehouse facily would require an erpendhure of 5255 . 000 far a rented space in Okahoma CAy, Oklahoma, and wovld provide a source of cash fow spanning the next to years. The estimated cash flow se as follows: The negative cash ficw h year 5 reflects the cost of a planned renovation and eupansion of the faclly. Finaly, in year 10 Garmen estimates some recorvery of its investment at the close of the lease and consequently a higher-than-usual cakh fow. Garmen uses a dscount rate of 10.1 percent in evaluating is investments. a. As a preiminary ttep in andyeing the new investmen, Garmen's management has decided to evaluale the prepecro anticipated payback period. What is the projecrs axpected pyostack period? there may be a problere whth the IRR because the ogh on the cash fows charges three tenes over its sfe. Catadate the IRR for the projoct Evaluale the NpV arofie of the propect for dacount rate c. Caculate the propecis NoV. What boes the NoN indcate about the potertial valus created by the project? Descrte to Mr Gamen whal NPY mears, fecognteing that he was trained as an engineer and has no formal business education a. Given the cash flow information in the table, the payback period of the project is years. (Round to two decimal places.) The payback method tells you: (Select the best choice below.) A. how much value you are adding or taking from the firm. B. how long it takes you to recover your outhows of cash. C. What the rate of retum is for the investment. D. all of the above. b. The projects IRR is \%. (Round to two decimal places.) Given the following NPV profie for discount rates of 0%,20%,50%, and 100\%, does there appear to be a problem of multple Ifris in this range of discount rates? (Select from the drop-down menu.) c. The project's NPV is $. (Round to the nearest dollar.) A positive NPV implies: (Select the best choice below.) A. there is no change in value to the company if the project is undertaken. B. value is added to the company if the project is undertaken. C. nothing about the value of the company. D. value is subtracted from the company if the project is undertaken. Data table