Answered step by step

Verified Expert Solution

Question

1 Approved Answer

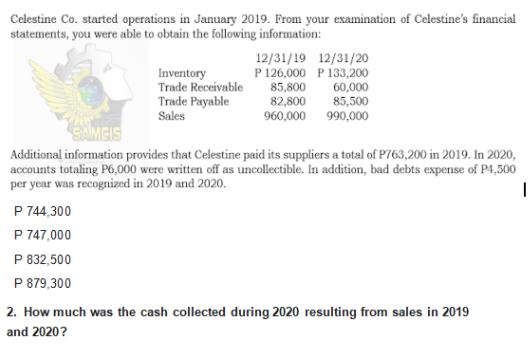

Celestine Co. started operations in January 2019. From your examination of Celestine's financial statements, you were able to obtain the following information: P 744,300

Celestine Co. started operations in January 2019. From your examination of Celestine's financial statements, you were able to obtain the following information: P 744,300 P 747,000 12/31/19 12/31/20 P 126,000 P 133,200 60,000 85,500 990,000 P 832,500 P 879,300 Inventory Trade Receivable 85,800 Trade Payable Sales SAMGIS Additional information provides that Celestine paid its suppliers a total of P763,200 in 2019. In 2020, accounts totaling P6,000 were written off as uncollectible. In addition, bad debts expense of P4,500 per year was recognized in 2019 and 2020. I 82,800 960,000 2. How much was the cash collected during 2020 resulting from sales in 2019 and 2020?

Step by Step Solution

★★★★★

3.26 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Determine the cash collected during 2020 resulting from sales in 2019 and 20...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started