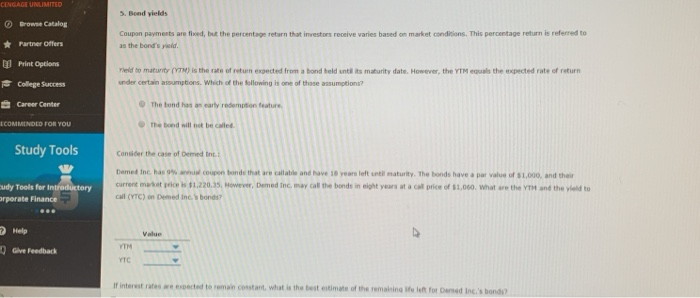

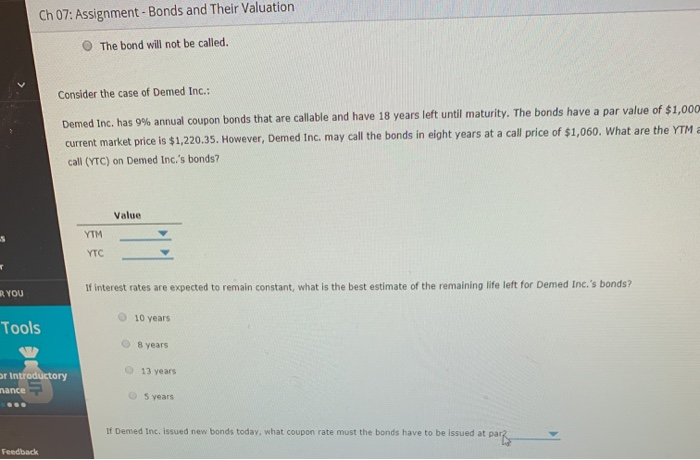

CENGAGE UNLIMITED 5. Bond yields Browse Catalog investors receive varies based on market conditions. This percentage return is referred to Coupon payments are fired, but the percento 13 the band's old. Partner Offers M Print Options Yield to maturity (YT) is the rate of return expected from a bond held until its maturity date. However, the YTM equals the expected rate of return under certain assumptions. Which of the following is one of those assumptions? College Success Career Center The band has an early redemtion feature ECOMMENDED FOR YOU The bond will not be called Study Tools Consider the case of Deed Int Demet Inc. has o c upen bonds that are collable and have 10 years of maturity. The bonds have a par value of 1,000, and their current ma 1.220.35. However, Demed ing. may call the bonds in eight years at a cal price of $1,060. What are the YTH and the yield to call (YTC) on Demed Inc.'s bonds? sudy Tools for Introductory orporate Finance 7 Help Give feedback If interest rates we expected to remain constant what is the best estimate of the remaining elent for and insbond Ch 07: Assignment - Bonds and Their Valuation The bond will not be called. Consider the case of Demed Inc.: Demed Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000 current market price is $1,220.35. However, Demed Inc. may call the bonds in eight years at a call price of $1,060. What are the YTM a call (YTC) on Demed Inc.'s bonds? Value YTM YTC RYOU If interest rates are expected to remain constant, what is the best estimate of the remaining life left for Demed Inc.'s bonds? 10 years Tools 8 years 13 years or introductory nance 5 years If Demed Inc. issued new bonds today, what coupon rate must the bonds have to be issued at par Feedback CENGAGE UNLIMITED 5. Bond yields Browse Catalog investors receive varies based on market conditions. This percentage return is referred to Coupon payments are fired, but the percento 13 the band's old. Partner Offers M Print Options Yield to maturity (YT) is the rate of return expected from a bond held until its maturity date. However, the YTM equals the expected rate of return under certain assumptions. Which of the following is one of those assumptions? College Success Career Center The band has an early redemtion feature ECOMMENDED FOR YOU The bond will not be called Study Tools Consider the case of Deed Int Demet Inc. has o c upen bonds that are collable and have 10 years of maturity. The bonds have a par value of 1,000, and their current ma 1.220.35. However, Demed ing. may call the bonds in eight years at a cal price of $1,060. What are the YTH and the yield to call (YTC) on Demed Inc.'s bonds? sudy Tools for Introductory orporate Finance 7 Help Give feedback If interest rates we expected to remain constant what is the best estimate of the remaining elent for and insbond Ch 07: Assignment - Bonds and Their Valuation The bond will not be called. Consider the case of Demed Inc.: Demed Inc. has 9% annual coupon bonds that are callable and have 18 years left until maturity. The bonds have a par value of $1,000 current market price is $1,220.35. However, Demed Inc. may call the bonds in eight years at a call price of $1,060. What are the YTM a call (YTC) on Demed Inc.'s bonds? Value YTM YTC RYOU If interest rates are expected to remain constant, what is the best estimate of the remaining life left for Demed Inc.'s bonds? 10 years Tools 8 years 13 years or introductory nance 5 years If Demed Inc. issued new bonds today, what coupon rate must the bonds have to be issued at par Feedback