Answered step by step

Verified Expert Solution

Question

1 Approved Answer

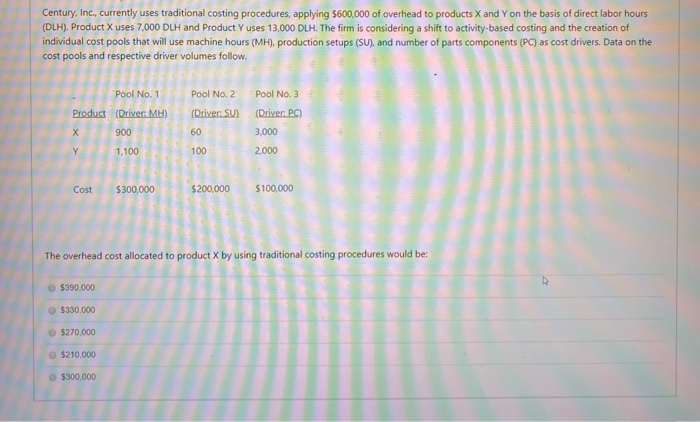

Century, Inc., currently uses traditional costing procedures, applying $600,000 of overhead to products X and Y on the basis of direct labor hours (DLH). Product

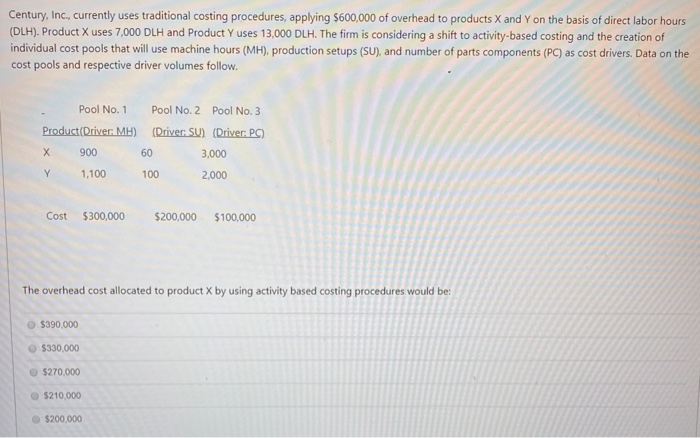

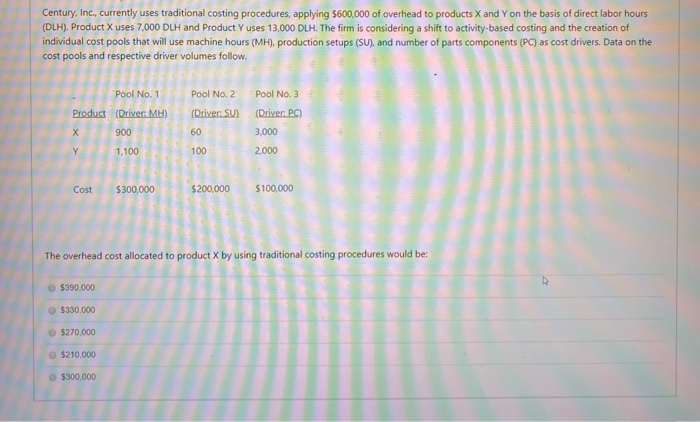

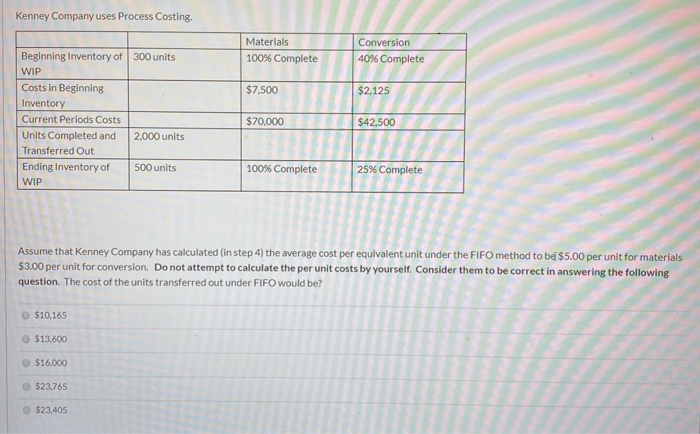

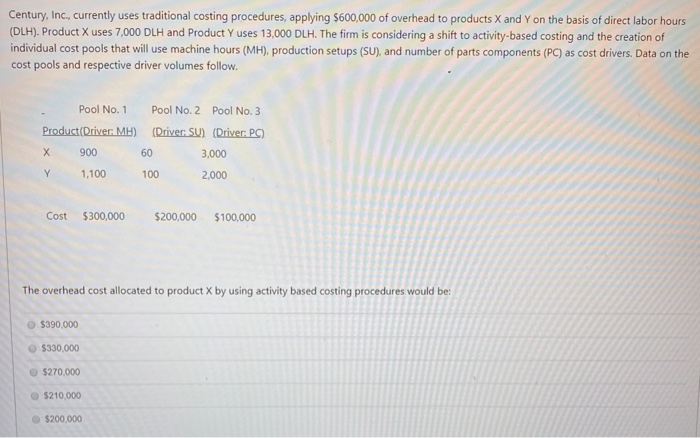

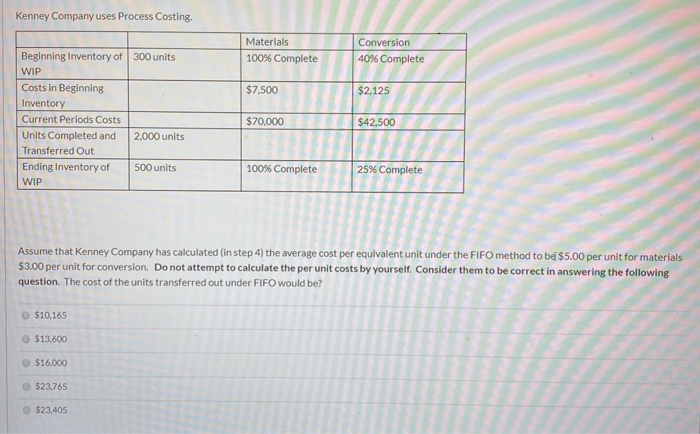

Century, Inc., currently uses traditional costing procedures, applying $600,000 of overhead to products X and Y on the basis of direct labor hours (DLH). Product X uses 7,000 DLH and Product Y uses 13,000 DLH. The firm is considering a shift to activity-based costing and the creation of individual cost pools that will use machine hours (MH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow. Pool No. 1 Pool No. 2 Pool No. 3 Product (Driver: MH) (Driver: SU) (Driver: PC) 900 60 3,000 Y 1,100 100 2,000 Cost $300,000 $200,000 $100,000 The overhead cost allocated to product X by using activity based costing procedures would be: $390.000 $330.000 $270.000 $210,000 $200,000 Century, Inc., currently uses traditional costing procedures, applying $600,000 of overhead to products X and Y on the basis of direct labor hours (DLH). Product X uses 7,000 DLH and Product Yuses 13,000 DLH. The firm is considering a shift to activity-based costing and the creation of individual cost pools that will use machine hours (MH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow Pool No. 1 Pool No. 2 Pool No. 3 Product (Driver: MB) (Driver S) (Driver: PC) 3,000 900 60 Y 1,100 100 2,000 $10.00 Cost $300,000 $200,000 $100,000 The overhead cost allocated to product X by using traditional costing procedures would be: $390.000 $330,000 $270,000 $210,000 $300,000 Kenney Company uses Process Costing. Materials 100% Complete Conversion 40% Complete $7,500 $2,125 Beginning Inventory of 300 units WIP Costs in Beginning Inventory Current Periods Costs Units Completed and 2,000 units Transferred Out Ending Inventory of 500 units WIP $70,000 $42,500 100% Complete 25% Complete Assume that Kenney Company has calculated (in step 4) the average cost per equivalent unit under the FIFO method to be $5.00 per unit for materials $3.00 per unit for conversion. Do not attempt to calculate the per unit costs by yourself. Consider them to be correct in answering the following question. The cost of the units transferred out under FIFO would be? $10,165 $13,600 $16.000 $23,765 $23,405

Century, Inc., currently uses traditional costing procedures, applying $600,000 of overhead to products X and Y on the basis of direct labor hours (DLH). Product X uses 7,000 DLH and Product Y uses 13,000 DLH. The firm is considering a shift to activity-based costing and the creation of individual cost pools that will use machine hours (MH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow. Pool No. 1 Pool No. 2 Pool No. 3 Product (Driver: MH) (Driver: SU) (Driver: PC) 900 60 3,000 Y 1,100 100 2,000 Cost $300,000 $200,000 $100,000 The overhead cost allocated to product X by using activity based costing procedures would be: $390.000 $330.000 $270.000 $210,000 $200,000 Century, Inc., currently uses traditional costing procedures, applying $600,000 of overhead to products X and Y on the basis of direct labor hours (DLH). Product X uses 7,000 DLH and Product Yuses 13,000 DLH. The firm is considering a shift to activity-based costing and the creation of individual cost pools that will use machine hours (MH), production setups (SU), and number of parts components (PC) as cost drivers. Data on the cost pools and respective driver volumes follow Pool No. 1 Pool No. 2 Pool No. 3 Product (Driver: MB) (Driver S) (Driver: PC) 3,000 900 60 Y 1,100 100 2,000 $10.00 Cost $300,000 $200,000 $100,000 The overhead cost allocated to product X by using traditional costing procedures would be: $390.000 $330,000 $270,000 $210,000 $300,000 Kenney Company uses Process Costing. Materials 100% Complete Conversion 40% Complete $7,500 $2,125 Beginning Inventory of 300 units WIP Costs in Beginning Inventory Current Periods Costs Units Completed and 2,000 units Transferred Out Ending Inventory of 500 units WIP $70,000 $42,500 100% Complete 25% Complete Assume that Kenney Company has calculated (in step 4) the average cost per equivalent unit under the FIFO method to be $5.00 per unit for materials $3.00 per unit for conversion. Do not attempt to calculate the per unit costs by yourself. Consider them to be correct in answering the following question. The cost of the units transferred out under FIFO would be? $10,165 $13,600 $16.000 $23,765 $23,405

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started