Question

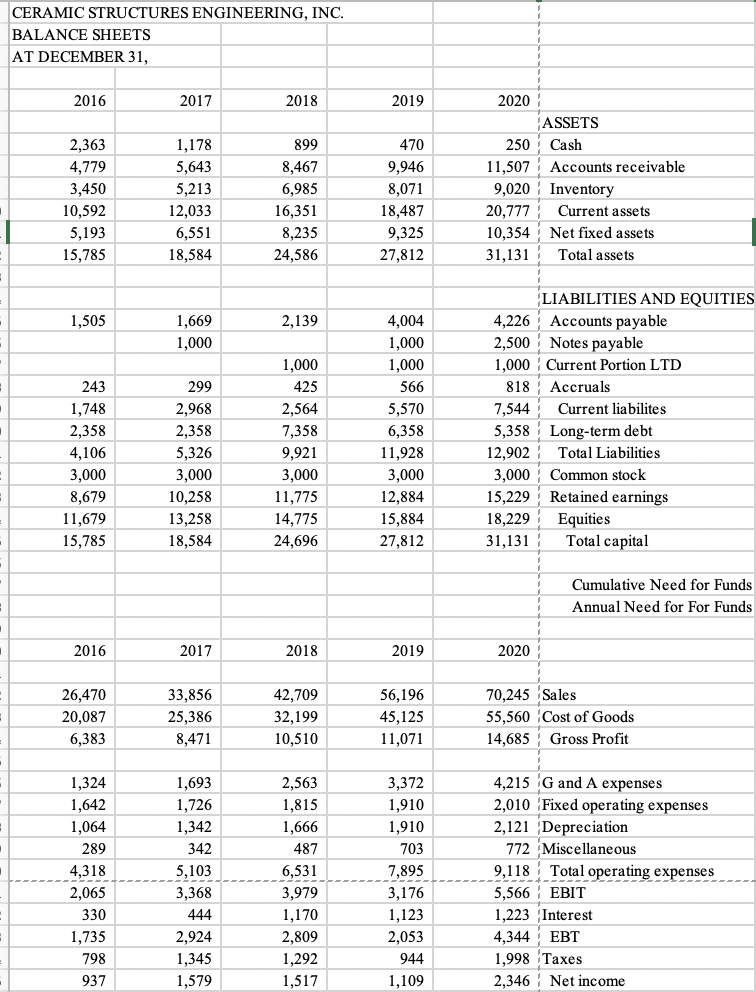

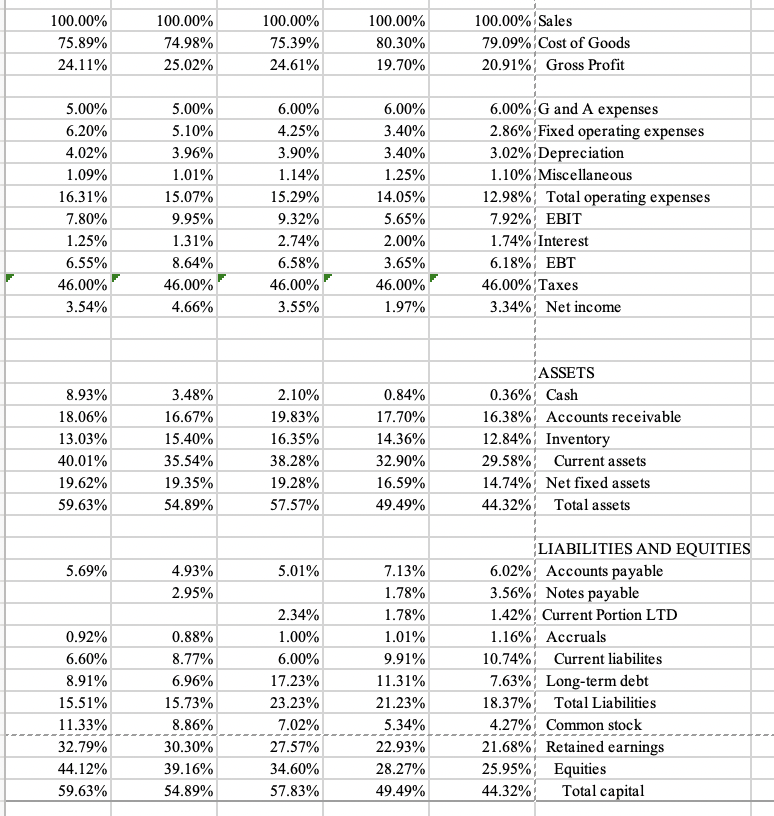

Ceramic Structures has experienced rapid growth over the past several years. Sales are expected to grow at 15% per year for the next three years.

Ceramic Structures has experienced rapid growth over the past several years. Sales are expected to grow at 15% per year for the next three years. Sales growth has been fueled by aggressive pricing as well as increased use of ceramics in high performance engines.

Asset growth has been financed by internal funds as well as the increased use of debt. At the end of 2018, the debt was restructured with a new 10% seven-year loan with principal payments of $1 million per year. In addition a $1.5 million working capital line was negotiated in 2017. It was increased to $2.5 million in 2019 and $3.5 million in 2020. Interest is charged at prime + 1%. (For class, we will use 9%.)

Cash balances will be kept around $250,000 and the credit line will average $2 million.

1. Prepare pro-forma statements for Ceramic and determine their need for funds for the years 2021-2023.

2. Why is there a need for funds when Ceramic is generating a profit?

3. If expected sales growth fell to 8% per year, what would be Ceramics need for funds?

4. What would happen to Ceramics need for funds if accounts receivable increased to 25% of sales?

CERAMIC STRUCTURES ENGINEERING, INC. BALANCE SHEETS AT DECEMBER 31, 2016 2017 2018 2,363 1,178 899 4,779 5,643 8,467 3,450 5,213 6,985 10,592 12,033 16,351 5,193 6,551 8,235 15,785 18,584 24,586 1,505 1,669 2,139 1,000 1,000 243 299 425 1,748 2,968 2,564 2,358 2,358 7,358 4,106 5,326 9,921 3,000 3,000 3,000 8,679 10,258 11,775 11,679 13,258 14,775 15,785 18,584 24,696 2016 2017 2018 26,470 33,856 42,709 20,087 25,386 32,199 6,383 8,471 10,510 1,324 1,693 2,563 1,642 1,726 1,815 1,064 1,342 1,666 289 342 487 4,318 5,103 6,531 2,065 3,368 3,979 330 444 1,170 1,735 2,924 2,809 798 1,345 1,292 937 1,579 1,517 2019 470 9,946 8,071 18,487 9,325 27,812 4,004 1,000 1,000 566 5,570 6,358 11,928 3,000 12,884 15,884 27,812 2019 56,196 45,125 11,071 3,372 1,910 1,910 703 7,895 3,176 1,123 2,053 944 1,109 2020 250 11,507 9,020 20,777 10,354 31,131 4,226 Accounts payable 2,500 Notes payable 1,000 Current Portion LTD 818 Accruals 7,544 Current liabilites 5,358 Long-term debt 12,902 Total Liabilities 3,000 Common stock 15,229 Retained earnings 18,229 Equities 31,131 Total capital Cumulative Need for Funds Annual Need for For Funds 2020 70,245 Sales 55,560 Cost of Goods 14,685 Gross Profit 4,215 G and A expenses 2,010 Fixed operating expenses 2,121 Depreciation 772 Miscellaneous 9,118 Total operating expenses 5,566 EBIT 1,223 Interest 4,344 EBT 1,998 Taxes 2,346 Net income ASSETS Cash Accounts receivable Inventory Current assets Net fixed assets Total assets LIABILITIES AND EQUITIES 100.00% 75.89% 24.11% 5.00% 6.20% 4.02% 1.09% 16.31% 7.80% 1.25% 6.55% 46.00% 3.54% 8.93% 18.06% 13.03% 40.01% 19.62% 59.63% 5.69% 0.92% 6.60% 8.91% 15.51% 11.33% 32.79% 44.12% 59.63% 100.00% 74.98% 25.02% 5.00% 5.10% 3.96% 1.01% 15.07% 9.95% 1.31% 8.64% 46.00% 4.66% 3.48% 16.67% 15.40% 35.54% 19.35% 54.89% 4.93% 2.95% 0.88% 8.77% 6.96% 15.73% 8.86% 30.30% 39.16% 54.89% 100.00% 75.39% 24.61% 6.00% 4.25% 3.90% 1.14% 15.29% 9.32% 2.74% 6.58% 46.00% 3.55% 2.10% 19.83% 16.35% 38.28% 19.28% 57.57% 5.01% 2.34% 1.00% 6.00% 17.23% 23.23% 7.02% 27.57% 34.60% 57.83% 100.00% 80.30% 19.70% 6.00% 3.40% 3.40% 1.25% 14.05% 5.65% 2.00% 3.65% 46.00% 1.97% 0.84% 17.70% 14.36% 32.90% 16.59% 49.49% 7.13% 1.78% 1.78% 1.01% 9.91% 11.31% 21.23% 5.34% 22.93% 28.27% 49.49% 100.00% Sales 79.09% Cost of Goods 20.91% Gross Profit 6.00% G and A expenses 2.86% Fixed operating expenses 3.02% Depreciation 1.10% Miscellaneous 12.98% Total operating expenses 7.92% EBIT 1.74% Interest 6.18% EBT 46.00% Taxes 3.34% Net income ASSETS 0.36% Cash 16.38% Accounts receivable 12.84% Inventory 29.58% Current assets 14.74% Net fixed assets 44.32% Total assets 6.02% Accounts payable 3.56% Notes payable 1.42% Current Portion LTD 1.16% Accruals 10.74% Current liabilites 7.63% Long-term debt 18.37% Total Liabilities 4.27% Common stock 21.68% Retained earnings 25.95% Equities 44.32% Total capital LIABILITIES AND EQUITIES CERAMIC STRUCTURES ENGINEERING, INC. BALANCE SHEETS AT DECEMBER 31, 2016 2017 2018 2,363 1,178 899 4,779 5,643 8,467 3,450 5,213 6,985 10,592 12,033 16,351 5,193 6,551 8,235 15,785 18,584 24,586 1,505 1,669 2,139 1,000 1,000 243 299 425 1,748 2,968 2,564 2,358 2,358 7,358 4,106 5,326 9,921 3,000 3,000 3,000 8,679 10,258 11,775 11,679 13,258 14,775 15,785 18,584 24,696 2016 2017 2018 26,470 33,856 42,709 20,087 25,386 32,199 6,383 8,471 10,510 1,324 1,693 2,563 1,642 1,726 1,815 1,064 1,342 1,666 289 342 487 4,318 5,103 6,531 2,065 3,368 3,979 330 444 1,170 1,735 2,924 2,809 798 1,345 1,292 937 1,579 1,517 2019 470 9,946 8,071 18,487 9,325 27,812 4,004 1,000 1,000 566 5,570 6,358 11,928 3,000 12,884 15,884 27,812 2019 56,196 45,125 11,071 3,372 1,910 1,910 703 7,895 3,176 1,123 2,053 944 1,109 2020 250 11,507 9,020 20,777 10,354 31,131 4,226 Accounts payable 2,500 Notes payable 1,000 Current Portion LTD 818 Accruals 7,544 Current liabilites 5,358 Long-term debt 12,902 Total Liabilities 3,000 Common stock 15,229 Retained earnings 18,229 Equities 31,131 Total capital Cumulative Need for Funds Annual Need for For Funds 2020 70,245 Sales 55,560 Cost of Goods 14,685 Gross Profit 4,215 G and A expenses 2,010 Fixed operating expenses 2,121 Depreciation 772 Miscellaneous 9,118 Total operating expenses 5,566 EBIT 1,223 Interest 4,344 EBT 1,998 Taxes 2,346 Net income ASSETS Cash Accounts receivable Inventory Current assets Net fixed assets Total assets LIABILITIES AND EQUITIES 100.00% 75.89% 24.11% 5.00% 6.20% 4.02% 1.09% 16.31% 7.80% 1.25% 6.55% 46.00% 3.54% 8.93% 18.06% 13.03% 40.01% 19.62% 59.63% 5.69% 0.92% 6.60% 8.91% 15.51% 11.33% 32.79% 44.12% 59.63% 100.00% 74.98% 25.02% 5.00% 5.10% 3.96% 1.01% 15.07% 9.95% 1.31% 8.64% 46.00% 4.66% 3.48% 16.67% 15.40% 35.54% 19.35% 54.89% 4.93% 2.95% 0.88% 8.77% 6.96% 15.73% 8.86% 30.30% 39.16% 54.89% 100.00% 75.39% 24.61% 6.00% 4.25% 3.90% 1.14% 15.29% 9.32% 2.74% 6.58% 46.00% 3.55% 2.10% 19.83% 16.35% 38.28% 19.28% 57.57% 5.01% 2.34% 1.00% 6.00% 17.23% 23.23% 7.02% 27.57% 34.60% 57.83% 100.00% 80.30% 19.70% 6.00% 3.40% 3.40% 1.25% 14.05% 5.65% 2.00% 3.65% 46.00% 1.97% 0.84% 17.70% 14.36% 32.90% 16.59% 49.49% 7.13% 1.78% 1.78% 1.01% 9.91% 11.31% 21.23% 5.34% 22.93% 28.27% 49.49% 100.00% Sales 79.09% Cost of Goods 20.91% Gross Profit 6.00% G and A expenses 2.86% Fixed operating expenses 3.02% Depreciation 1.10% Miscellaneous 12.98% Total operating expenses 7.92% EBIT 1.74% Interest 6.18% EBT 46.00% Taxes 3.34% Net income ASSETS 0.36% Cash 16.38% Accounts receivable 12.84% Inventory 29.58% Current assets 14.74% Net fixed assets 44.32% Total assets 6.02% Accounts payable 3.56% Notes payable 1.42% Current Portion LTD 1.16% Accruals 10.74% Current liabilites 7.63% Long-term debt 18.37% Total Liabilities 4.27% Common stock 21.68% Retained earnings 25.95% Equities 44.32% Total capital LIABILITIES AND EQUITIES

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started