Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ceramics, Inc. (CI), a company that manufactures bath tiles, is interested in measuring inventory effectiveness. Last year the cost of goods sold at CI

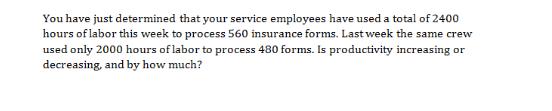

Ceramics, Inc. (CI), a company that manufactures bath tiles, is interested in measuring inventory effectiveness. Last year the cost of goods sold at CI was $200,000 on sales of $250,000. The average inventory in dollars was $12,000. At the end of the year, CI had outstanding receivables of $30,000 and payables of $20,000. a) Calculate the inventory turnover for CI. b) Calculate the days of inventory. Assume that CI operates 6 days per week and 52 weeks per year. c) Calculate the weeks of inventory. Assume 52 weeks per year. d) What is the cash-to-cash cycle time at CI? e) Assume it is December 31, and CI has exactly $12,000 in inventory. (Note, there is a formatting error in the book where part e) is not labeled properly.) CI has a forecast of $11,000 in sales for January and $9,000 in February. How many days of forecast can be met with the current inventory given there are 23 work days in January and 21 in February? (Use specifics, not averages.) You have just determined that your service employees have used a total of 2400 hours of labor this week to process 560 insurance forms. Last week the same crew used only 2000 hours of labor to process 480 forms. Is productivity increasing or decreasing, and by how much?

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Inventory turnover Cost of Goods Sold Average Inventory Inventory turnover 200000 12000 1667 b Day...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started