Answered step by step

Verified Expert Solution

Question

1 Approved Answer

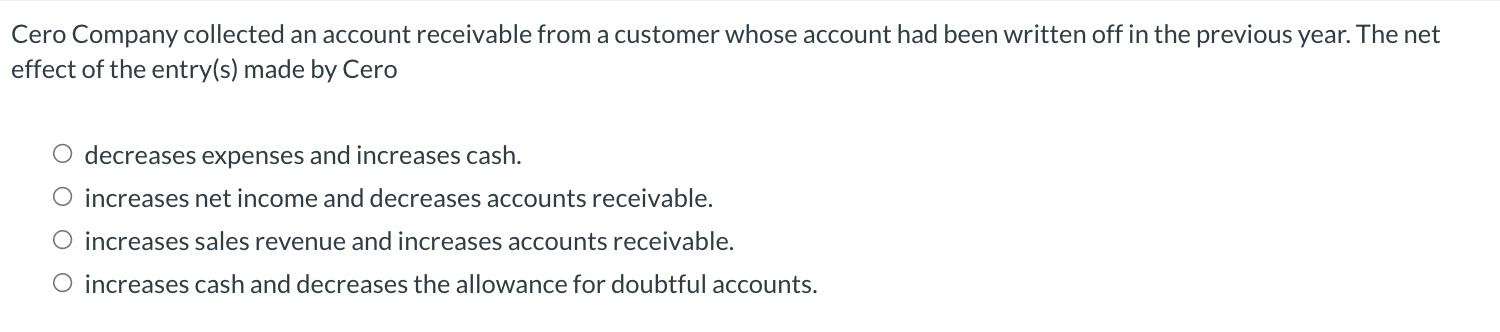

Cero Company collected an account receivable from a customer whose account had been written off in the previous year. The net effect of the entry(s)

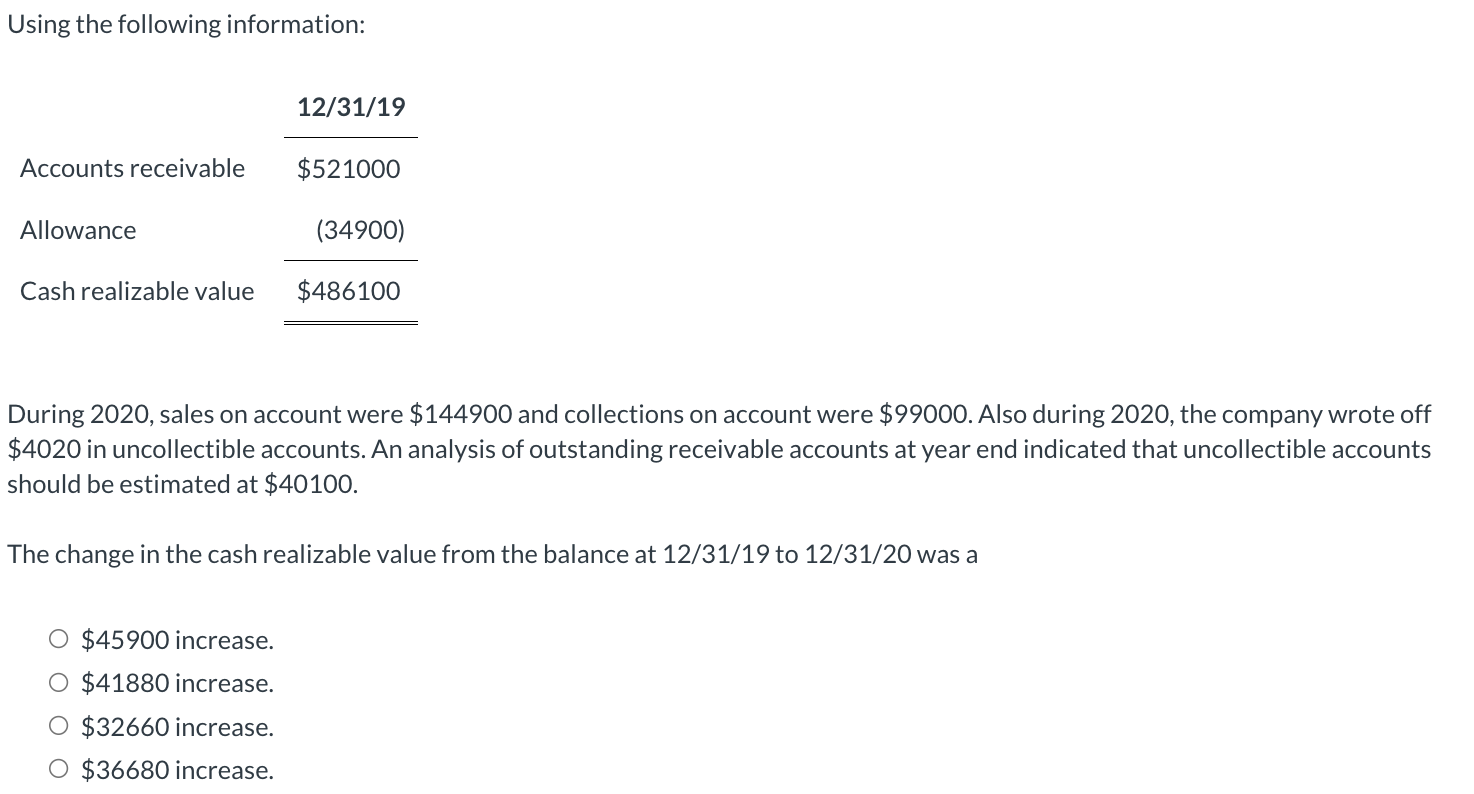

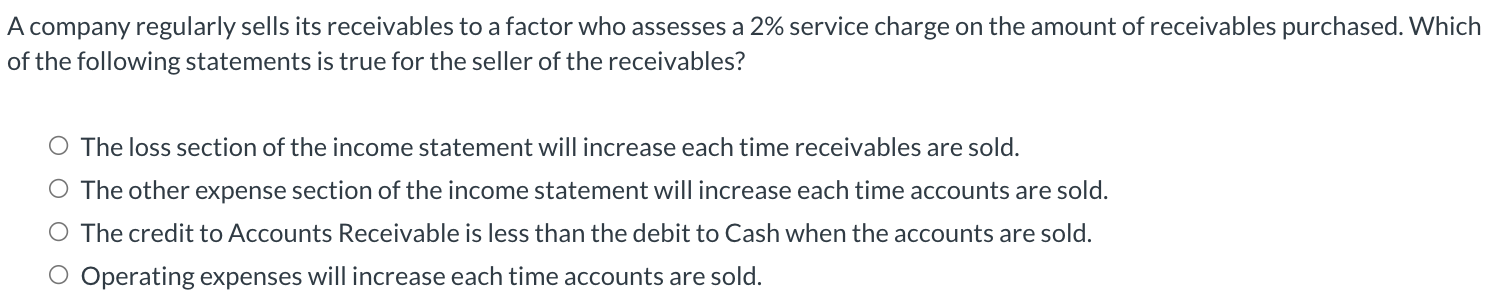

Cero Company collected an account receivable from a customer whose account had been written off in the previous year. The net effect of the entry(s) made by Cero decreases expenses and increases cash. increases net income and decreases accounts receivable. increases sales revenue and increases accounts receivable. increases cash and decreases the allowance for doubtful accounts. Using the following information: During 2020 , sales on account were $144900 and collections on account were $99000. Also during 2020 , the company wrote off $4020 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that uncollectible accounts should be estimated at $40100. The change in the cash realizable value from the balance at 12/31/19 to 12/31/20 was a $45900 increase. $41880 increase. $32660 increase. $36680 increase. company regularly sells its receivables to a factor who assesses a 2% service charge on the amount of receivables purchased. Which f the following statements is true for the seller of the receivables? The loss section of the income statement will increase each time receivables are sold. The other expense section of the income statement will increase each time accounts are sold. The credit to Accounts Receivable is less than the debit to Cash when the accounts are sold. Operating expenses will increase each time accounts are sold

Cero Company collected an account receivable from a customer whose account had been written off in the previous year. The net effect of the entry(s) made by Cero decreases expenses and increases cash. increases net income and decreases accounts receivable. increases sales revenue and increases accounts receivable. increases cash and decreases the allowance for doubtful accounts. Using the following information: During 2020 , sales on account were $144900 and collections on account were $99000. Also during 2020 , the company wrote off $4020 in uncollectible accounts. An analysis of outstanding receivable accounts at year end indicated that uncollectible accounts should be estimated at $40100. The change in the cash realizable value from the balance at 12/31/19 to 12/31/20 was a $45900 increase. $41880 increase. $32660 increase. $36680 increase. company regularly sells its receivables to a factor who assesses a 2% service charge on the amount of receivables purchased. Which f the following statements is true for the seller of the receivables? The loss section of the income statement will increase each time receivables are sold. The other expense section of the income statement will increase each time accounts are sold. The credit to Accounts Receivable is less than the debit to Cash when the accounts are sold. Operating expenses will increase each time accounts are sold Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started