Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Certainty Equivalent Approach (Answer All Please) Another procedure to evaluate project risk is the certainty equivalent approach. This approach is based on the premise that

Certainty Equivalent Approach (Answer All Please)

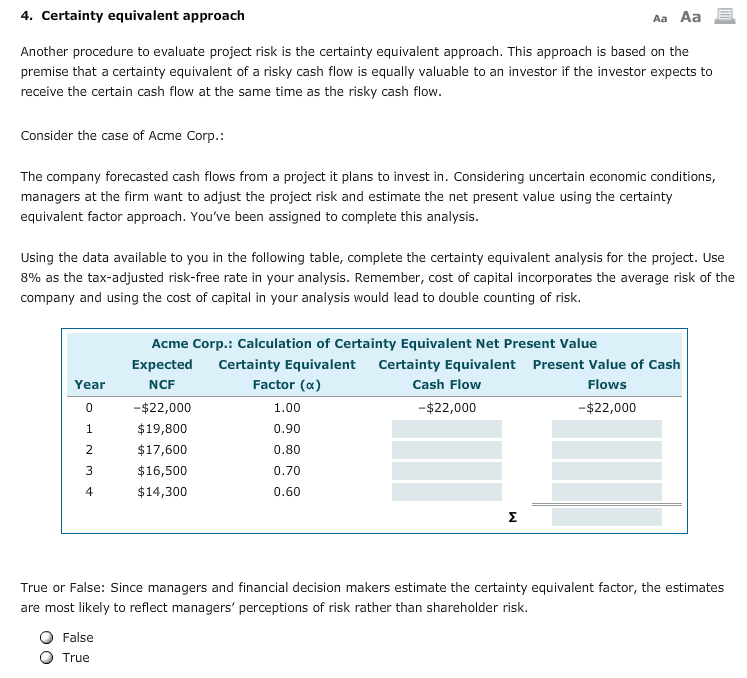

Another procedure to evaluate project risk is the certainty equivalent approach. This approach is based on the premise that a certainty equivalent of a risky cash flow is equally valuable to an investor if the investor expects to receive the certain cash flow at the same time as the risky cash flow. Consider the case of Acme Corp.: The company forecasted cash flows from a project it plans to invest in. Considering uncertain economic conditions, managers at the firm want to adjust the project risk and estimate the net present value using the certainty equivalent factor approach. You've been assigned to complete this analysis. Using the data available to you in the following table, complete the certainty equivalent analysis for the project. Use 8% as the tax-adjusted risk-free rate in your analysis. Remember, cost of capital incorporates the average risk of the company and using the cost of capital in your analysis would lead to double counting of risk. True or False: Since managers and financial decision makers estimate the certainty equivalent factor, the estimates are most likely to reflect managers' perceptions of risk rather than shareholder risk. False TrueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started