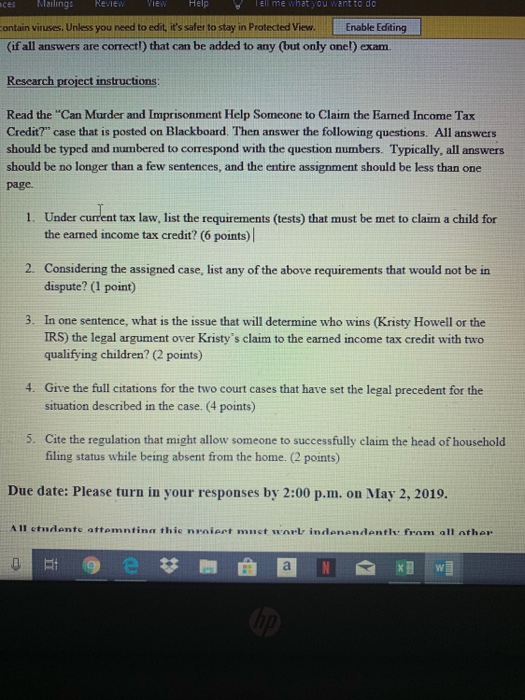

ces Mailings RevIeW Vw HelpTell me whatyou want to do ontain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing if all answers are correctl) that can be added to any (but only onel) exam Research project instructions Read the "Can Murder and Imprisonment Help Someone to Claim the Eamed Income Tax Credit?" case that is posted on Blackboard. Then answer the following questions. All answers should be typed and numbered to correspond with the question numbers. Typically, all answers should be no longer than a few sentences, and the entire assignment should be less than one page. I. Under current tax law, list the requirements (tests) that must be met to claim a child for the earned income tax credit? (6 points) 2. Considering the assigned case, list any of the above requirements that would not be in dispute? (1 point) 3. In one sentence, what is the issue that will determine who wins (Kristy Howell or the IRS) the legal argument over Kristy's claim to the earned income tax credit with two qualifying children? (2 points) 4. Give the full citations for the two court cases that have set the legal precedent for the situation described in the case. (4 points) Cite the regulation that might allow someone to successfully claim the head of household filing status while being absent from the home. (2 points) 5. Due date: Please turn in your responses by 2:00 p.m. on May 2, 2019. ces Mailings RevIeW Vw HelpTell me whatyou want to do ontain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing if all answers are correctl) that can be added to any (but only onel) exam Research project instructions Read the "Can Murder and Imprisonment Help Someone to Claim the Eamed Income Tax Credit?" case that is posted on Blackboard. Then answer the following questions. All answers should be typed and numbered to correspond with the question numbers. Typically, all answers should be no longer than a few sentences, and the entire assignment should be less than one page. I. Under current tax law, list the requirements (tests) that must be met to claim a child for the earned income tax credit? (6 points) 2. Considering the assigned case, list any of the above requirements that would not be in dispute? (1 point) 3. In one sentence, what is the issue that will determine who wins (Kristy Howell or the IRS) the legal argument over Kristy's claim to the earned income tax credit with two qualifying children? (2 points) 4. Give the full citations for the two court cases that have set the legal precedent for the situation described in the case. (4 points) Cite the regulation that might allow someone to successfully claim the head of household filing status while being absent from the home. (2 points) 5. Due date: Please turn in your responses by 2:00 p.m. on May 2, 2019