Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ch 0 3 - Video Lesson - Financial Statements, Cash Flow, and Taxes uperating income ( tBII ) Less interest Earnings before taxes ( EBT

Ch Video Lesson Financial Statements, Cash Flow, and Taxes

uperating income tBII

Less interest

Earnings before taxes EBT

Taxes

Net income

$$

Total dividends

$

$

Addition to retained earnings

$

$

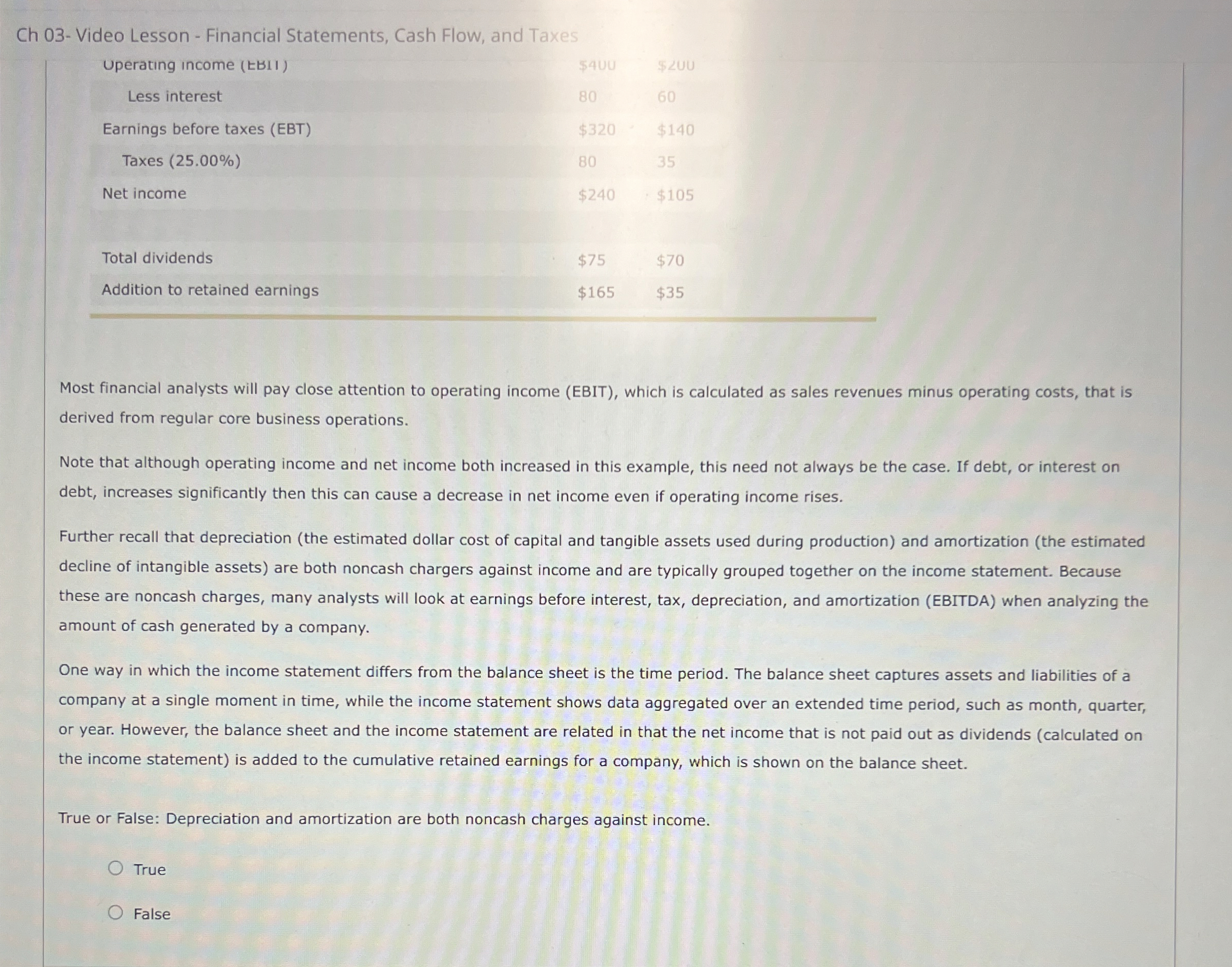

Most financial analysts will pay close attention to operating income EBIT which is calculated as sales revenues minus operating costs, that is derived from regular core business operations.

Note that although operating income and net income both increased in this example, this need not always be the case. If debt, or interest on debt, increases significantly then this can cause a decrease in net income even if operating income rises.

Further recall that depreciation the estimated dollar cost of capital and tangible assets used during production and amortization the estimated decline of intangible assets are both noncash chargers against income and are typically grouped together on the income statement. Because these are noncash charges, many analysts will look at earnings before interest, tax, depreciation, and amortization EBITDA when analyzing the amount of cash generated by a company.

One way in which the income statement differs from the balance sheet is the time period. The balance sheet captures assets and liabilities of a company at a single moment in time, while the income statement shows data aggregated over an extended time period, such as month, quarter, or year. However, the balance sheet and the income statement are related in that the net income that is not paid out as dividends calculated on the income statement is added to the cumulative retained earnings for a company, which is shown on the balance sheet.

True or False: Depreciation and amortization are both noncash charges against income.

True

False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started