Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ch 02: Assignment - Risk and Return: Part I Investors are willing to make investments because they expect a return from doing so. As the

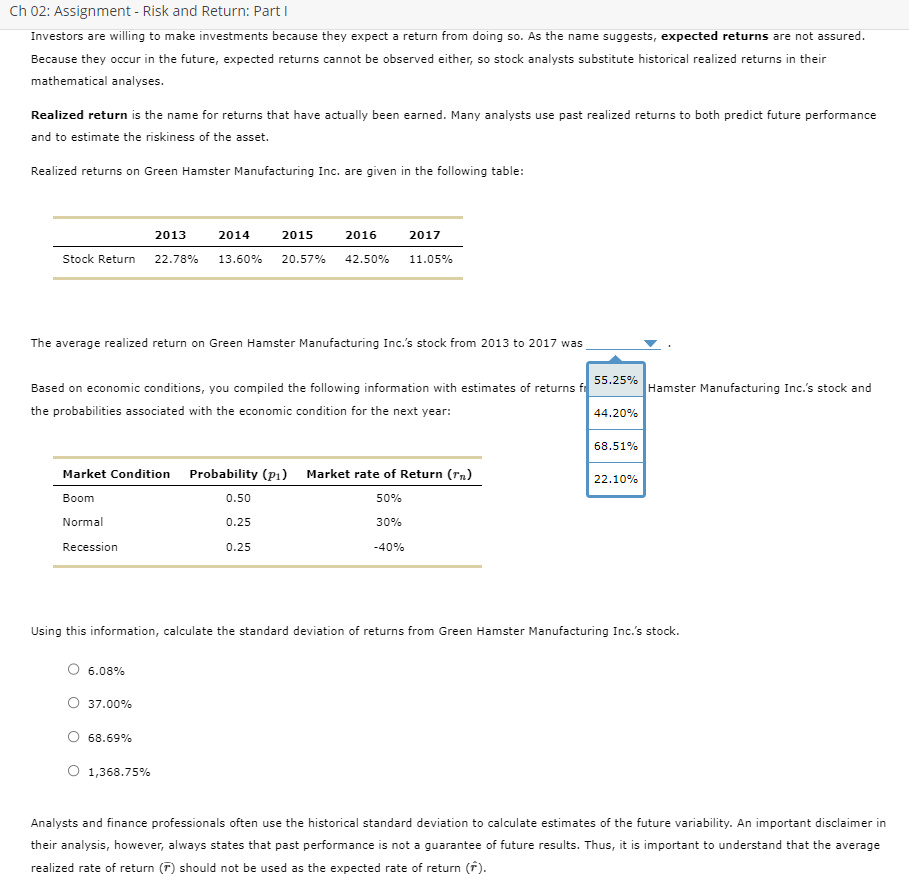

Ch 02: Assignment - Risk and Return: Part I Investors are willing to make investments because they expect a return from doing so. As the name suggests, expected returns are not assured. Because they occur in the future, expected returns cannot be observed either, so stock analysts substitute historical realized returns in their mathematical analyses. Realized return is the name for returns that have actually been earned. Many analysts use past realized returns to both predict future performance and to estimate the riskiness of the asset. Realized returns on Green Hamster Manufacturing Inc. are given in the following table: The average realized return on Green Hamster Manufacturing Inc.'s stock from 2013 to 2017 was Based on economic conditions, you compiled the following information with estimates of returns f 55.25% the probabilities associated with the economic condition for the next year: Hamster Manufacturing Inc.'s stock and 44.20% 68.51% 22.10% Using this information, calculate the standard deviation of returns from Green Hamster Manufacturing Inc.'s stock. 6.08% 37.00% 68.69% 1,368.75% Analysts and finance professionals often use the historical standard deviation to calculate estimates of the future variability. An important disclaimer in their analysis, however, always states that past performance is not a guarantee of future results. Thus, it is important to understand that the average realized rate of return (r) should not be used as the expected rate of return (r^)

Ch 02: Assignment - Risk and Return: Part I Investors are willing to make investments because they expect a return from doing so. As the name suggests, expected returns are not assured. Because they occur in the future, expected returns cannot be observed either, so stock analysts substitute historical realized returns in their mathematical analyses. Realized return is the name for returns that have actually been earned. Many analysts use past realized returns to both predict future performance and to estimate the riskiness of the asset. Realized returns on Green Hamster Manufacturing Inc. are given in the following table: The average realized return on Green Hamster Manufacturing Inc.'s stock from 2013 to 2017 was Based on economic conditions, you compiled the following information with estimates of returns f 55.25% the probabilities associated with the economic condition for the next year: Hamster Manufacturing Inc.'s stock and 44.20% 68.51% 22.10% Using this information, calculate the standard deviation of returns from Green Hamster Manufacturing Inc.'s stock. 6.08% 37.00% 68.69% 1,368.75% Analysts and finance professionals often use the historical standard deviation to calculate estimates of the future variability. An important disclaimer in their analysis, however, always states that past performance is not a guarantee of future results. Thus, it is important to understand that the average realized rate of return (r) should not be used as the expected rate of return (r^) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started