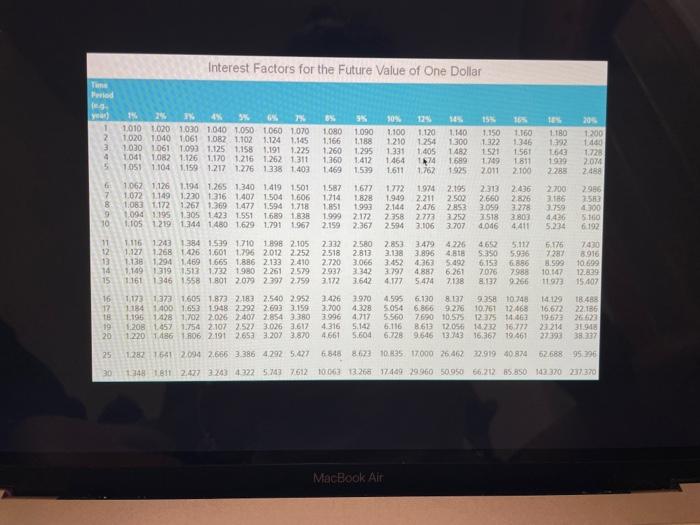

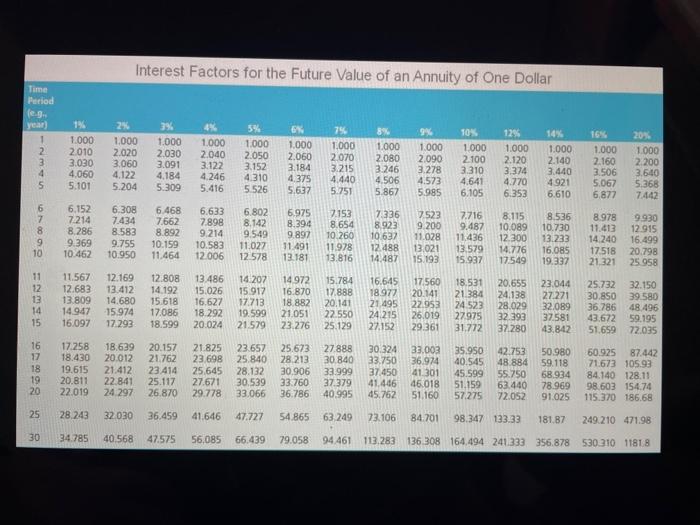

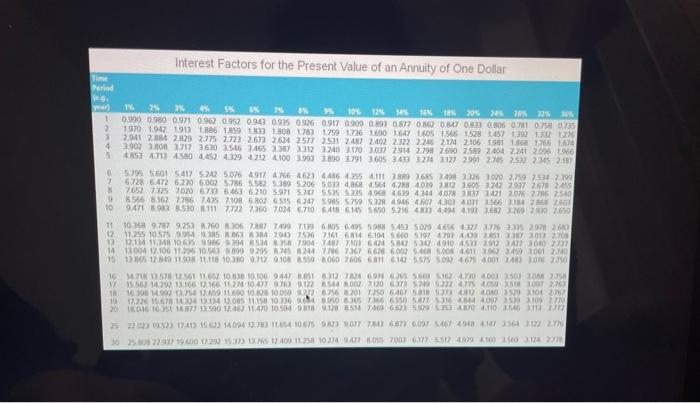

Ch 07: End of Chapter Problems. The Time Value of Money ack to Assignment Average/2 Antemps 28. Problem 7-28 book Problem 7-25 You contribute $1,000 annually to a retirement account for seven years and stop making payments at the age of 45. Your twin brother (or sister whichever appies) opens an account at age 45 and controutes $1,000 a year until retirement at age 65 (20 years). You both can 9 percent on your investments. How much can each of you withdraw for 15 years that is, ages 66 through 80) rom the retirement accounts? Use Aspendix A. Aopenda C, and Apendix to answer the question, Round your answers to the nearest deltar You can withdraw Your twin can withdraw Grade i Now Save & Continue Interest Factors for the Future Value of One Dollar Time Period 1 2 3 1090 1.150 1 12% 6% 7 8 1010 1020 1030 1040 1050 1060 1070 1080 1020 1040 1061 1082 1.102 1.124 1.145 1.166 1.030 1061 1.092 1.125 1.158 1.191.225 1.260 1.041 10821.126 1.170 1.216 1262 1311 1360 1051 1104 1159 1.217 1.276 1338 1403 1469 30% 1.100 1.210 1.331 1464 1.611 L180 1.392 1.188 1.295 1.412 1.529 1.120 1.254 1.405 1974 1.762 1.140 1.300 1482 1689 1925 1322 1521 1149 2011 1.160 1346 1561 1811 2.100 204 1.200 1.460 1.728 2014 2488 1999 2285 fu 2.700 1.062 1126 1.194 1.265 1.340 1.419 1.501 1.072 1149 1.220 1.316 1.407 1504 1606 1.083 1172 1.267 1.369 1.477 1.594 1.718 1094 195 1305 1423 1.551 1689 1838 1.105 1219 1344 1480 1.629 1.791 1967 1.587 1.714 1851 1999 2.159 1.677 1828 1993 2.172 2.367 1.772 1.949 2.144 2358 2.594 1974 2.211 2.476 2777 3.106 2.195 2.502 2.853 3.257 3.707 2313 2,660 3.059 7518 4.046 2.436 2.826 3.278 3803 4411 3.759 4426 5.234 2986 2.583 4300 5.160 6.192 11 12 1.116 12431384 1.539 1710 1898 2.105 1.127 1268 1426 1.601 1.796 2.012 2.252 1.138 1.291 1.469 1665 1.886 2.133 2.410 1.149 1319 1.513 1.732 1980 2.261 2.579 1161 1346 1558 1801 2.079 2397 2.759 2332 2.518 2.720 2.937 3.172 2580 2.813 3.066 3342 3.642 2.8533.479 3.138 3.896 3.452 4363 3.797 4.887 4.177 5.474 4226 4.818 51492 6.261 7.138 460 S350 6.153 7076 5.112 5.936 6.886 7988 6.176 11 1999 10.147 11973 7430 8910 10.699 12.829 15.402 14 15 16 17 3970 1,173 1373 1605 1.873 2.183 2.540 2.952 1184 1400 1653 1948 2292 2.693 3.159 1.195 1428 1.702 2.026 2007 2.854 3.380 1:208 1457 1754 2107 2.527 3.026 3.617 1.220 1.486 TR06 2.191 2653 3.207 3.870 2.426 3.700 3996 4.316 4661 4.328 4717 5.142 5.604 4.595 6.130 8.137 9.358 10.748 5054 6866 9.276 10.761 12.468 5.560 170 10.1 12375 14.067 5.116 8.613 12.0561473216.777 6.728 9.646 13:43 16,367 19.461 14129 16.672 19.623 23214 27393 26623 3194 38.337 19 20 25 1.282 16612.094 2.666 3.386 4 292 5.427 818 8673 10.83517000 26.46222919 40874 62.688 95 296 1481.811 2.477 343 4322 523 761210062 13.266174092996050950 56.212 55.850 342370 227.370 30 MacBook Air Interest Factors for the Future Value of an Annuity of One Dollar Time Period (en. year) 1 2 3 4 5 -NM 1% 1.000 2010 3.030 4,060 5.101 2% 1.000 2.020 3,060 4.122 5.204 3% 1.000 2.030 3.091 4.184 5.309 4% 1.000 2.040 3.122 4.246 5.416 5% 1.000 2.050 3.152 4.310 5.526 EX 1.000 2.060 3.184 4 375 5.637 75 1.000 2.070 3.215 4.440 5.751 8% 1.000 2.080 3.246 4.506 5.867 94 1.000 2.090 3.278 4.573 5.985 10% 1.000 2.100 3310 4.641 6.105 12% 1.000 2.120 3,374 4.770 6.353 1.000 2.140 3.440 4.921 6.610 16% 1.000 2.160 3.506 5.067 6877 20% 1.000 2.200 3.640 5.368 7.442 6 7 8 9 10 6.152 7.214 8.286 9.369 10.462 6.308 7.434 8.583 9.755 10.950 6.468 7.662 8.892 10.159 11,464 6.633 7.898 9.214 10.583 12.006 6.802 8.142 9.549 11.027 12.578 6.975 8.394 9.897 11.491 13.181 7.153 8.654 10.260 11.978 13.816 7336 8.923 10.632 12.488 14.487 7.523 9.200 11.028 13.021 15.193 7.716 9.487 11.436 13.579 15.937 8.115 10.089 12.300 14.776 17549 8.536 10.730 13.233 16.085 19.337 8.978 11.413 14.240 17518 21.321 9.930 12915 16.499 20.798 25 958 11 12 13 14 15 11.567 12.169 12.683 13.412 13.809 14.680 14 947 15.974 16.097 17.293 12.808 14.192 15.618 17.086 18.599 13.486 15.026 16.627 18.292 20.024 14.202 15 912 17.713 19.599 21.579 14 972 16.870 18 882 21.051 23.276 15.784 17.888 20.141 22.550 25.129 16.645 18.977 21.495 24 215 27.152 17560 20.141 22.953 26.019 29.361 18.531 21.384 24 523 27.975 31.772 20.655 24.138 28.029 32.393 37.280 23.044 27.271 32.089 37.581 43.842 25.732 30.850 36.786 43.672 51.659 32.150 39.580 48.496 59.195 72.035 16 17 18 19 20 17.258 18.430 19.615 20.811 22.019 18.639 20.012 21.412 22.841 24.297 20.157 21.762 23.414 25.117 26.870 21.825 23.698 25.645 27.671 29.778 23.657 25.840 28.132 30.539 33.066 25.673 28.213 30.906 33.760 36.786 27.888 30.840 33.999 37.379 40.995 30.324 33.750 37.450 41.446 45.762 33.003 36.974 41 301 46.018 51.160 35.950 40.545 45.599 51.159 57.275 42.753 48.884 55.750 63.440 72.052 50.980 59.118 68.934 78.969 91.025 60.925 87.442 71673 105.93 84.140 128.11 98.603 154.74 115.370 186.68 25 28.243 32.030 36.459 41.646 47.727 54.865 63,249 73.106 84.701 98.347 133.33 181.87 249.210 471.98 30 34.785 40.568 47.575 56,085 66.439 79.058 94461 113.283 136 308 164.494 241.333 356.878 53031011818 Interest Factors for the Present Value of an Annuity of One Doltar Period MI 1 0 2 IN 4 3% 7 % 10% 12% 18 19 20 21 22 0.990.0.980 0971 0.962 0.952 0.943 0.05 0.926 0.917 0.909 0.893 07 08 0.847 0831 0.806 0.7 0.75 0.735 2 1970 1942 1943 1886 185 1883 188 1789 1.759 1736 1.600 1.647 1605 1.566 1529 145 1392 1.122 1270 2 2.941 2884 2.829 2.775 2.723 2.673 26M2.577 2531 2.487 2.402 2.222 2246 217 2.106 1987 1968 1766 + 2002 3.08 3.717 3630 3.546 3465 387 312 1240 3.170 3.037 2.914 2.798 2.600 2.500 2.404 2241 2.075 1966 5 4350 471 4452 4.329 4.212 4100 30932890 1791 3605 3433 1714 3127 2991 2.75 2.5 2.45 2.181 5.795 50 5412 5242 5.076 4917 46 46214456 455 4111 8803655 3498 306 3070 2.75 2.531790 2 6.728 6,472 6270 6.002 5.786 5582 5.30 5.206 5033 486845644.28 2019 212 1.605 1242 2917 2678 2:43 870527325 7020 6.733 6 463 5210 5.971 5.147 5535 254.968 469 414 4078 17 7421362780 2.500 8566 8162 27867435 7108 6.802 6515 67 5985 5750 578 2946 407 408 40 1506212601 10 9.471 892 50 11 7722 7360 70246.710 648 615 50 5.216 433 404 419 362 1200 2990 2650 1110358 9.787 9.25 8.20 8106 77 7400 709 6.05 6.695 59 5.453 50294656 172625 2.7 2.6 1211255 10.575 054 053200756 71616614 6.104 5.660 5.1974.703 14301 101 2.70 12 1 MB 10675086 2.295 2004 210 CM 530 491 49290 kn 14 13.00412100 11.00 10500109 9.295 245 246 737 608 6.007 408 5008 2.611 100 3150 3001 NO 15 865 12.809 110 11.118 10.350 9.712 9.108 550 000 7606 61 60 5575 5000 64001 A ON 2.250 1642157812561 10.30 10.106 0.447 T 1 70 69M205 S1070001150) 2.750 11556 14.292.13.166 12.166 112M 10477076) 9122564 000 212037 205722 775 000 100 2.0 114.902 13.54 12.000 11.600 10:30 10:0909 826 2016 6,467 401129 110 37 19 20 21 M 14 13 12 0 1 1 1 1 10 11 | 0 1 2 3 4 5 6 7 | 44 40 1 100 20 HILO 105 177 1600 12.462 11470.10.501 9.120 SM TO 60 5979 40 4110 SIT 2033 0.2 1713 12 14 16 12 3116610,675 903 977 70 630.007 1.667.564 122. Jo 25.8089 1.600 1.250 1.37 1400 1510M 2.477 055 700) 5524790 15