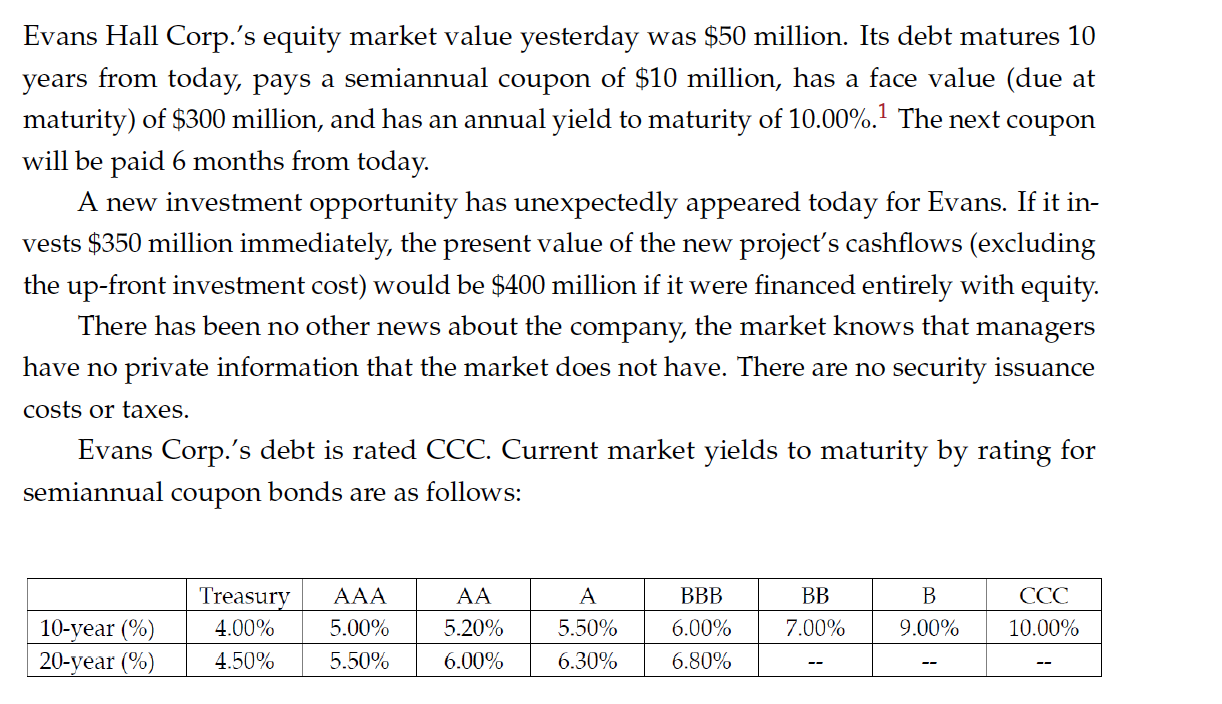

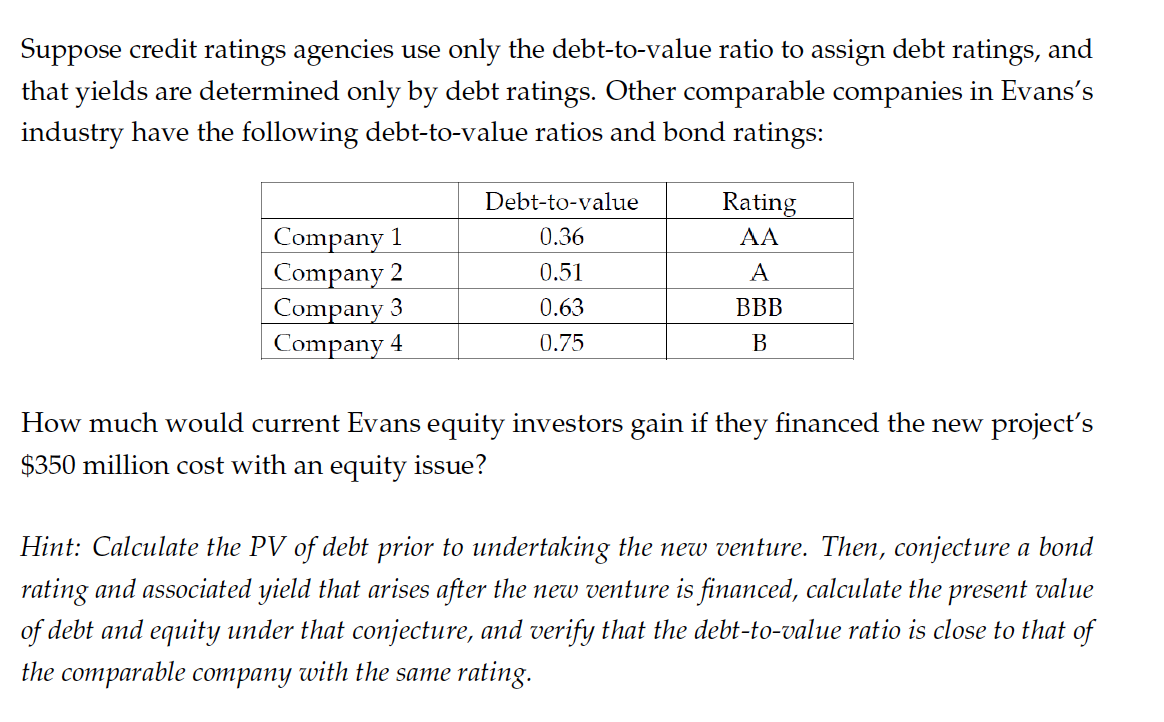

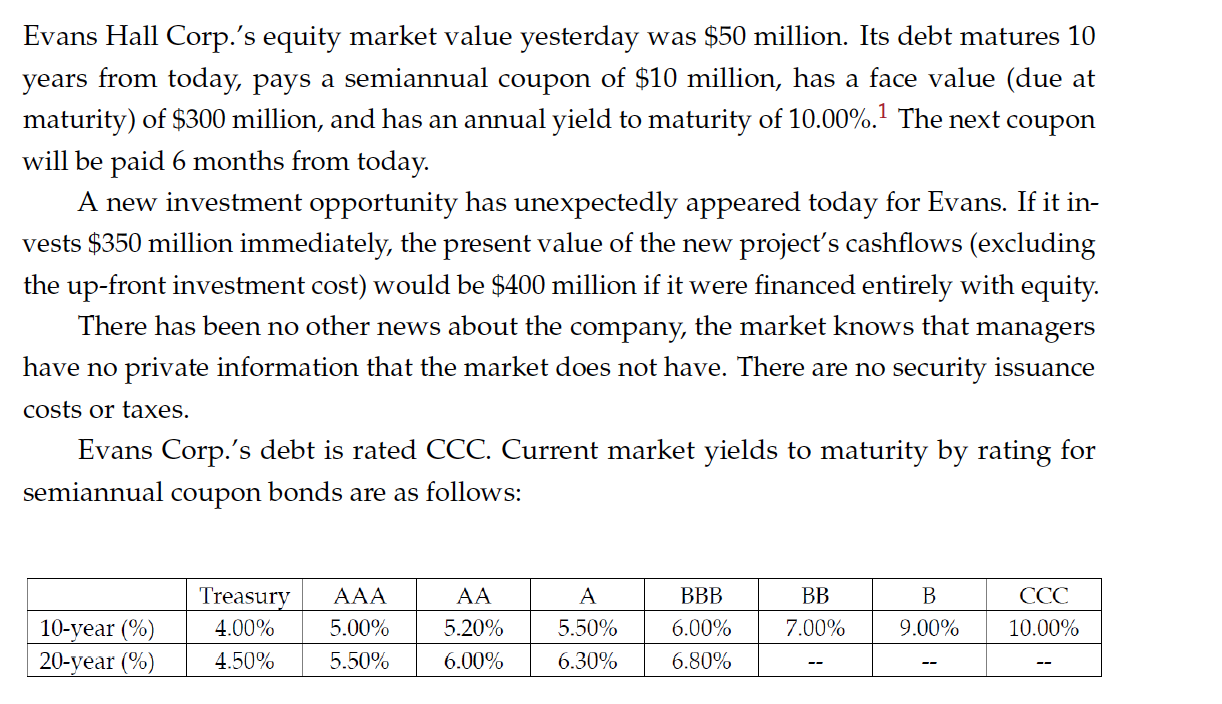

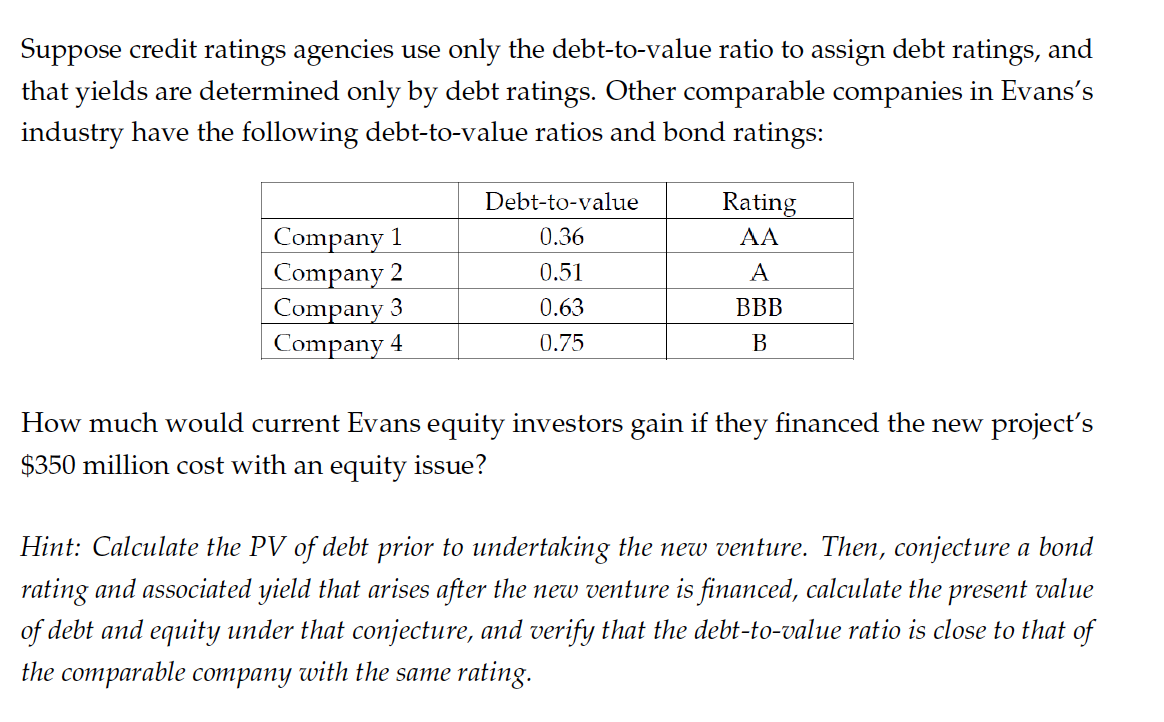

Evans Hall Corp.'s equity market value yesterday was $50 million. Its debt matures 10 years from today, pays a semiannual coupon of $10 million, has a face value (due at maturity) of $300 million, and has an annual yield to maturity of 10.00%.1 The next coupon will be paid 6 months from today. A new investment opportunity has unexpectedly appeared today for Evans. If it in- vests $350 million immediately, the present value of the new project's cashflows (excluding the up-front investment cost) would be $400 million if it were financed entirely with equity. There has been no other news about the company, the market knows that managers have no private information that the market does not have. There are no security issuance costs or taxes. Evans Corp.'s debt is rated CCC. Current market yields to maturity by rating for semiannual coupon bonds are as follows: BB B Treasury 4.00% 4.50% AAA 5.00% 5.50% AA 5.20% 6.00% 10-year (%) 20-year (%) A 5.50% 6.30% BBB 6.00% 6.80% CCC 10.00% 7.00% 9.00% Suppose credit ratings agencies use only the debt-to-value ratio to assign debt ratings, and that yields are determined only by debt ratings. Other comparable companies in Evans's industry have the following debt-to-value ratios and bond ratings: Rating AA Company 1 Company 2 Company 3 Company 4 Debt-to-value 0.36 0.51 0.63 0.75 B How much would current Evans equity investors gain if they financed the new project's $350 million cost with an equity issue? Hint: Calculate the PV of debt prior to undertaking the new venture. Then, conjecture a bond rating and associated yield that arises after the new venture is financed, calculate the present value of debt and equity under that conjecture, and verify that the debt-to-value ratio is close to that of the comparable company with the same rating. Evans Hall Corp.'s equity market value yesterday was $50 million. Its debt matures 10 years from today, pays a semiannual coupon of $10 million, has a face value (due at maturity) of $300 million, and has an annual yield to maturity of 10.00%.1 The next coupon will be paid 6 months from today. A new investment opportunity has unexpectedly appeared today for Evans. If it in- vests $350 million immediately, the present value of the new project's cashflows (excluding the up-front investment cost) would be $400 million if it were financed entirely with equity. There has been no other news about the company, the market knows that managers have no private information that the market does not have. There are no security issuance costs or taxes. Evans Corp.'s debt is rated CCC. Current market yields to maturity by rating for semiannual coupon bonds are as follows: BB B Treasury 4.00% 4.50% AAA 5.00% 5.50% AA 5.20% 6.00% 10-year (%) 20-year (%) A 5.50% 6.30% BBB 6.00% 6.80% CCC 10.00% 7.00% 9.00% Suppose credit ratings agencies use only the debt-to-value ratio to assign debt ratings, and that yields are determined only by debt ratings. Other comparable companies in Evans's industry have the following debt-to-value ratios and bond ratings: Rating AA Company 1 Company 2 Company 3 Company 4 Debt-to-value 0.36 0.51 0.63 0.75 B How much would current Evans equity investors gain if they financed the new project's $350 million cost with an equity issue? Hint: Calculate the PV of debt prior to undertaking the new venture. Then, conjecture a bond rating and associated yield that arises after the new venture is financed, calculate the present value of debt and equity under that conjecture, and verify that the debt-to-value ratio is close to that of the comparable company with the same rating