Answered step by step

Verified Expert Solution

Question

1 Approved Answer

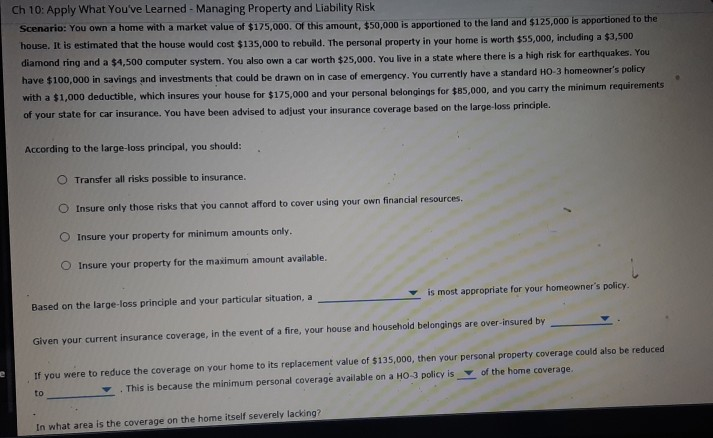

Ch 10: Apply What You've Learned - Managing Property and Liability Risk Scenario: You own a home with a market value of $175,000. Of this

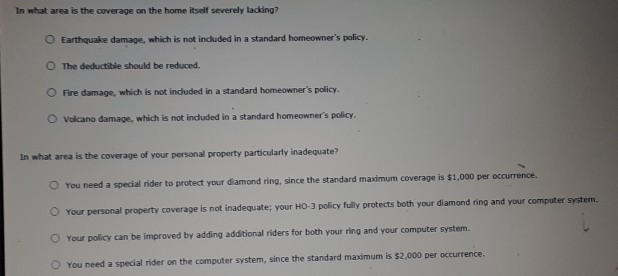

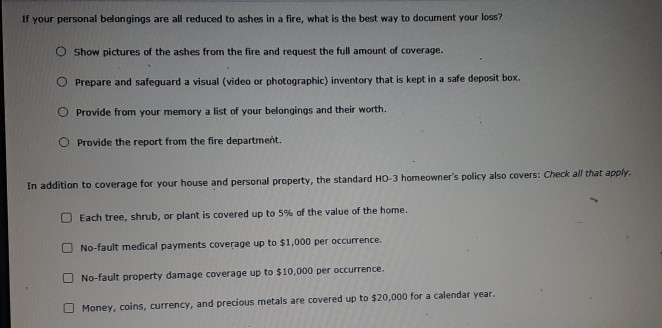

Ch 10: Apply What You've Learned - Managing Property and Liability Risk Scenario: You own a home with a market value of $175,000. Of this amount, $50,000 is apportioned to the land and $125,000 is apportioned to the house. It is estimated that the house would cost $135,000 to rebuild. The personal property in your home is worth $55,000, including a $3,500 diamond ring and a $4,500 computer system. You also own a car worth $25,000. You live in a state where there is a high risk for earthquakes. You have $100,000 in savings and investments that could be drawn on in case of emergency. You currently have a standard HO 3 homeowners policy with a $1,000 deductible, which insures your house for $175,000 and your personal belongings for $85,000, and you carry the minimum requirements of your state for car insurance. You have been advised to adjust your insurance coverage based on the large-loss principle. According to the large-loss principal, you should: O Transfer all risks possible to insurance. O Insure only those risks that you cannot afford to cover using your own financial resources Insure your property for minimum amounts only. O Insure your property for the maximum amount available. is most appropriate for your homeowner's policy. Based on the large-loss principle and your particular situation, a Glven your current insurance coverage, in the event of a fire, your house and household belongings are over insured by If you were to reduce the coverage on your home to its replacement value of $135,000, then your personal property coverage could also be reduced of the home coverage. to . This is because the minimum personal coverage available on a HO-3 policy is In what area is the coverage on the home itself severely lacking? In what area is the coverage on the home itself severely lacking? O Earthquake damage, which is not included in a standard homeowner's policy. The deductible should be reduced. O Fire damage, which is not included in a standard homeowner's policy. O Volcano damage, which is not induded in a standard homeowner's policy. In what area is the coverage of your personal property particularly inadequate? You need a special rider to protect your diamond ring, since the standard maximum coverage is $1,000 per occurrence, Your personal property coverage is not inadequate; your HO-3 policy fully protects both your diamond ring and your computer system. Your policy can be improved by adding additional riders for both your ring and your computer system. You need a special rider on the computer system, since the standard maximum is $2,000 per occurrence. If your personal belongings are all reduced to ashes in a fire, what is the best way to document your loss? O Show pictures of the ashes from the fire and request the full amount of coverage. O Prepare and safeguard a visual (video or photographic) inventory that is kept in a safe deposit box O Provide from your memory a list of your belongings and their worth. O Provide the report from the fire department. In addition to coverage for your house and personal property, the standard HO-3 homeowner's policy also covers: Check all that apply. O Each tree, shrub, or plant is covered up to 5% of the value of the home. O No-fault medical payments coverage up to $1,000 per occurrence. No-fault property damage coverage up to $10,000 per occurrence. O Money, coins, currency, and precious metals are covered up to $20,000 for a calendar year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started