Answered step by step

Verified Expert Solution

Question

1 Approved Answer

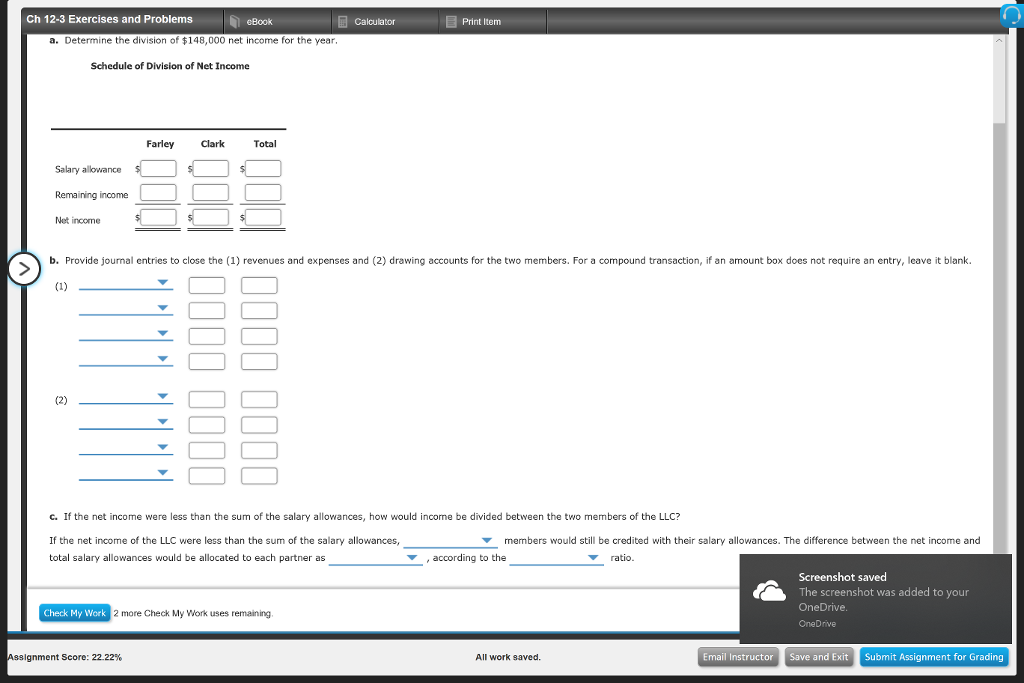

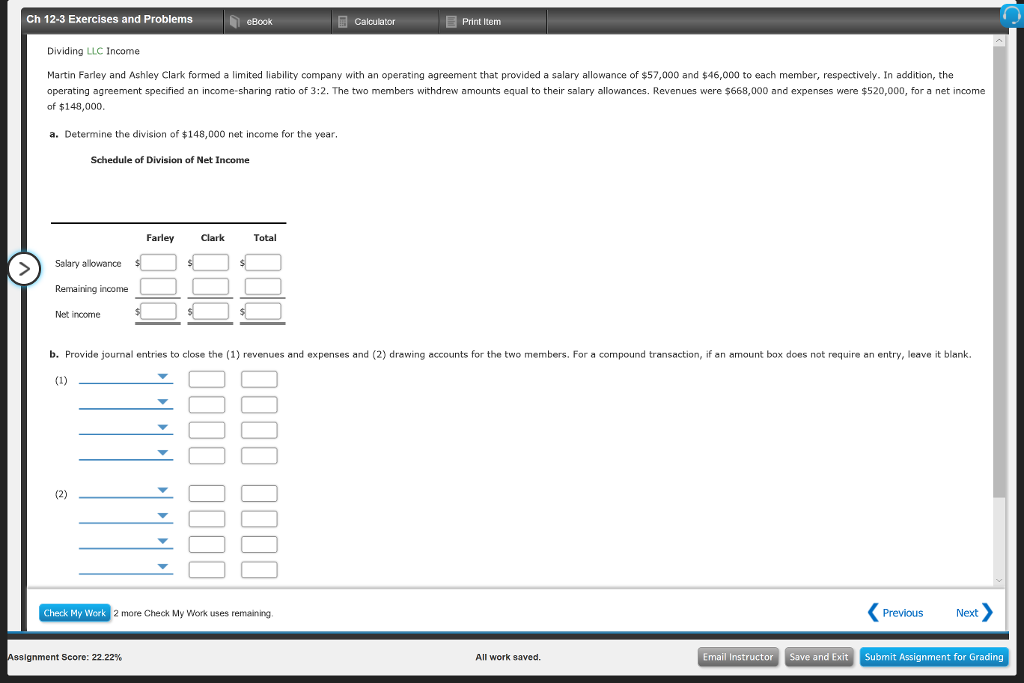

Ch 12-3 Exercises and Problems Print Item eBook Calculator a. Determine the division of $148,000 net income for the year Schedule of Division of Net

Ch 12-3 Exercises and Problems Print Item eBook Calculator a. Determine the division of $148,000 net income for the year Schedule of Division of Net Income Farley Clark Total Salary allowance Remaining income Net income b. Provide journal entries to close the (1) revenues and expenses and (2) drawing accounts for the two members. For a compound transaction, if an amount box does not require an entry, leave it blank c. If the net income were less than the sum of the salary allowances, how would income be divided between the two members of the LLC? If the net income of the LLC were less than the sum of the salary allowances, total salary allowances would be allocated to each partner as members would still be credited with their salary allowances. The difference between the net income and , according to the ratio Screenshot saved The screenshot was added to your OneDrive Check My Work 2 more Check My Work uses remaining OneDrive Ignment Score: 22.22 All work saved. Email Instructor Save and Exit Submit Assignment for Grading

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started