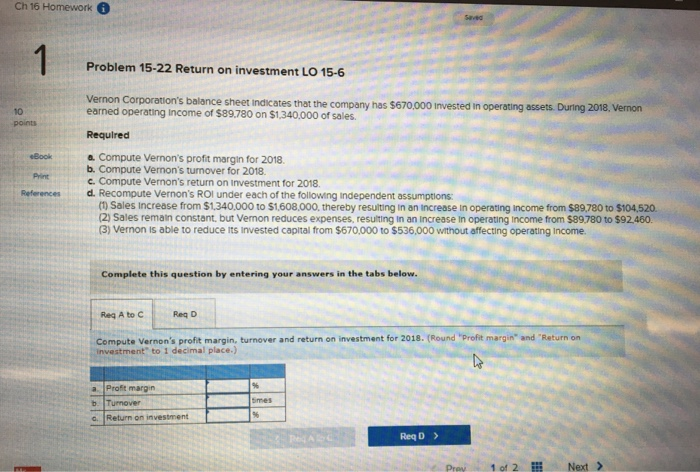

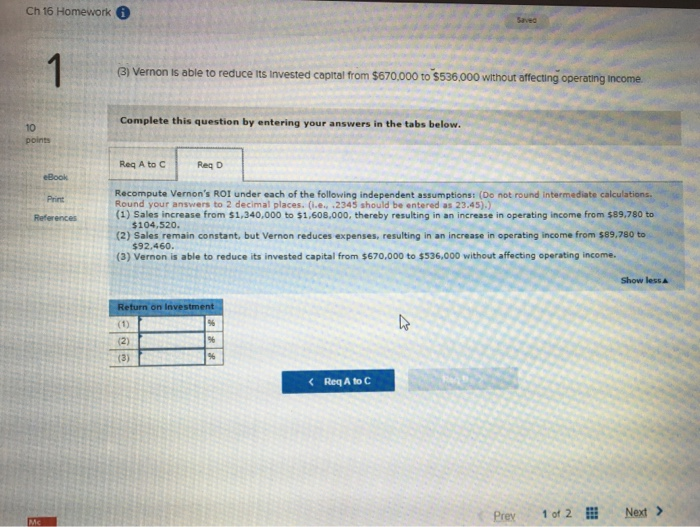

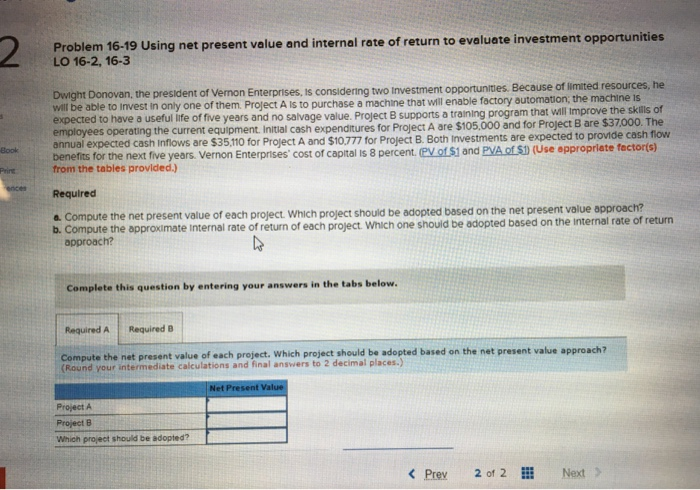

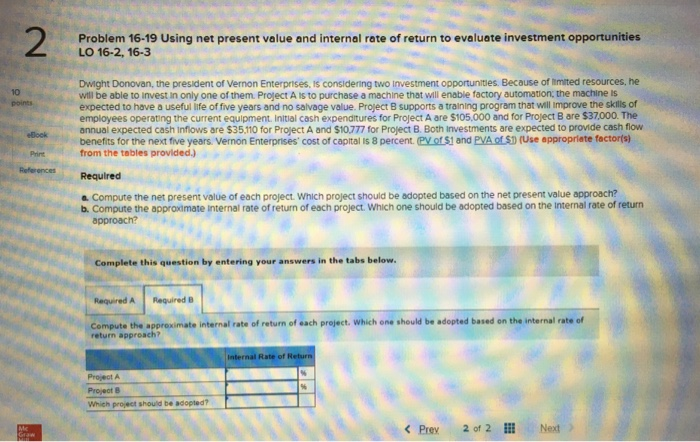

Ch 16 Homework 6 Problem 15-22 Return on investment LO 15-6 10 points Vernon Corporation's balance sheet indicates that the company has $670,000 Invested in operating assets. During 2018, Vernon earned operating Income of $89.780 on $1,340.000 of sales. Required Book Compute Vernon's profit margin for 2018 b. Compute Vernon's turnover for 2018 c. Compute Vernon's return on investment for 2018. Print Referencesd. Recompute Vernon's ROI under each of the following independent assumptions (D Sales increase from $1,340.000 to $1608.000, thereby resuilting in an increase in operating income from $89,780 to $104,520 (2) Sales remain constant, but Vemon reduces expenses, resulting in an increase in operating income from $89780 to $92 460. (3) Vernon is able to reduce its invested capital from $670,000 to $536,000 without affecting operating income Complete this question by entering your answers in the tabs below. Req A to C Req D Compute Vernon's profit margin, turnover and return on investment for 2018. (Round "Profit margin" and Return on investment to 1 decimal place.) a. Proft margin b. Turnover c' Return on investment times Req D> , Prey 1012 Next > Ch 16 Homework Saved (3) Vernon is able to reduce its invested captal from $670.000 to $536,000 without affecting operating income. Complete this question by entering your answers in the tabs below. 10 points Req A to C Req D eBook Print References Recompute Vernon's ROI under each of the following independent assumptions: (Do not round intermediate calculations Round your answers to 2 decimal places. (.e .2345 should be entered as 23.45).) (1) Sales increase from S1,340,000 to $1,608,000, thereby resulting in an increase in operating income from $89,780 to $104,520. (2) Sales remain constant, but Vernon reduces expenses, resulting in an increase in operating income from $89,780 to (3) Vernon is able to reduce its invested capital from $670,000 to $536,000 without affecting operating income. $92.460 Show lesSA Req A to C Prey 1 of 2Next > Problem 16-19 Using net present value and internal rate of return to evaluate investment opportunities LO 16-2, 16-3 Dwight Donovan, the president of Venon Enterprises, is considering two investment opportunities. Because of limited r will be able to Invest in only one of them. Project A is to purchase a machine that will enable factory automation, the machine is expected to have a useful life of five years and no salvage value. Project B supports a training program employees operating the current equipment. Initial cash expenditures for Project A are $105,000 and for Project B are $37000 annual expected cash Inflows are $35,110 for Project A and $10,77 benefits for the next five years. Vernon Enterprises cost of capital Is 8 percent. (PV of S1 and PVA of S0 (Use approprlate fe that will improve the skills of . The 77 for Project B. Both Investments are expected to provide cash flow ctorts) Book Prire from the tables provlded.) Required a. Compute the net present value of each project. Which project should be adopted based on the net present value approach? b. Compute the approximate internal rate of return of each project. which one should be adopted based on the internal rate of return approach? Complete this question by entering your answers in the tabs below. Required A Required 8 Compute the net present value of each project, which project should be adopted based on the net present value approach? (Round your intermediate calculations and final answers to 2 decimal places.) Project A Project B Which project should be adopted? K Prev2 of 2012 EE Next Problem 16-19 Using net present value and internal rate of return to evaluate investment opportunities LO 16-2, 16-3 10 wil be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation, the machine is expected to have a useful life of five years and no salvage value. Project B supports a training program that will improve the skils of employees operating the current equipment. Initial cash expenditures for Project A are $105,000 and for Project B are $37,000. The annual expected cash Inflows are $35,110 for Project A and $10,777 for Project B. Both investments are expected to provide cash flow benefits for the next five years Vernon Enterprises' cost of captal is 8 percent. (PV of S1 and PVA of SD (Use appropriate factorfs) from the tables provided.) Print References Required a Compute the net present value of each project. Which project should be adopted based on the net present value approach? b. Compute the approximate internal rate of return of each project. Which one should be adopted based on the internal rate of return approach? Complete this question by entering your answers in the tabs below. the approximate internal rate of return of each project. Which one should be adopted based on the internal rate of Compute return approach? Internal Rate of Return Projeot 8 Which project should be adopted? Prev 2 of 2 Next