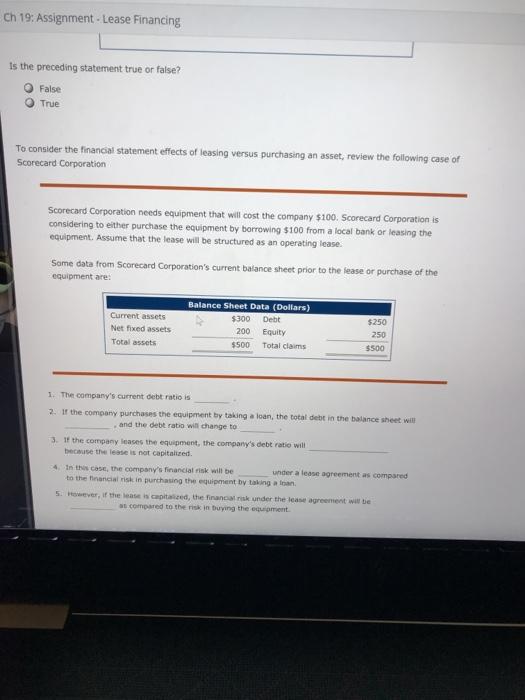

Ch 19: Assignment - Lease Financing more 3. Effects of leasing on financial statements Leasing is often referred to as off-balance-sheet financing because of the way that the transaction is treated and reported in financial statements. . Which of the following statements best describes the characteristics of off-balance-sheet financing? Only the leased liabilities but not the leased assets under the lease contract appear directly on the firm's balance sheet. Only the leased asset but not the leased liabilities under the lease contract appears directly on the firm's balance sheet Both the leased assets and the leased liabilities under the lease contract appear directly on the firm's balance sheet. Neither the leased assets nor the leased liabilities under the lease contract appear directly on the firm's balance sheet Consider the following statement on capital teases: 17 a lease term is more than 80% of the asset's life and the leased property is transferred from the lessor to the lessee, then the fase must be capitalized and disclosed on a firm's balance sheet. Is the preceding statement true or false? False True To consider the financial statement effects of leasing versus purchasing on a review the following care of Scorecard Corporation Scorecard Corporationes equipment that will cost the company $100. Scorecard Corporations considering to the purchase the sent by borrowing 5100 from a local bank on the equipment Assume that these will be structured as an operating lease Ch 19: Assignment - Lease Financing is the preceding statement true or false? False True To consider the financial statement effects of leasing versus purchasing an asset, review the following case of Scorecard Corporation Scorecard Corporation needs equipment that will cost the company $100. Scorecard Corporation is considering to either purchase the equipment by borrowing $100 from a local bank or leasing the equipment. Assume that the lease will be structured as an operating lease. Same data from Scarecard Corporation's current balance sheet prior to the lease or purchase of the equipment are: Balance Sheet Data (Dollars) $300 Debt 200 Equity $500 Total claims Current assets Net fixed assets Total assets $250 250 $500 1. The company's current debt ratio is 2. If the company purchases the equipment by taking a loan, the total debt in the balance sheet will and the debt ratio will change to 3. If the company cases the equipment, the company's debt ratio will because the case is not capitalized 4. In this case, the company's financial risk will be under a lease agreement as compared to the financial risk in purchasing the equipment by taking a loan 5. Rever, if the least is capitaned, the financiarsk under the lease agreement will be compared to the risk in buying the equipment