Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ch 19 q 4 Wildhorse inc had a bad year in 2024. For the first time in its history, it operated at a loss. The

ch 19 q 4

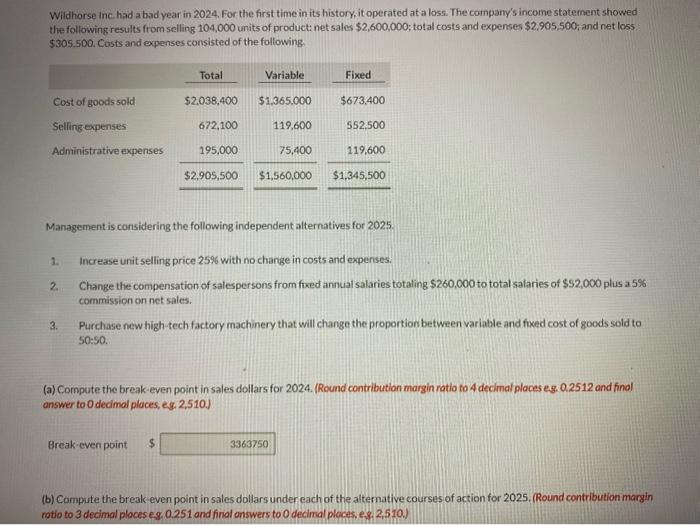

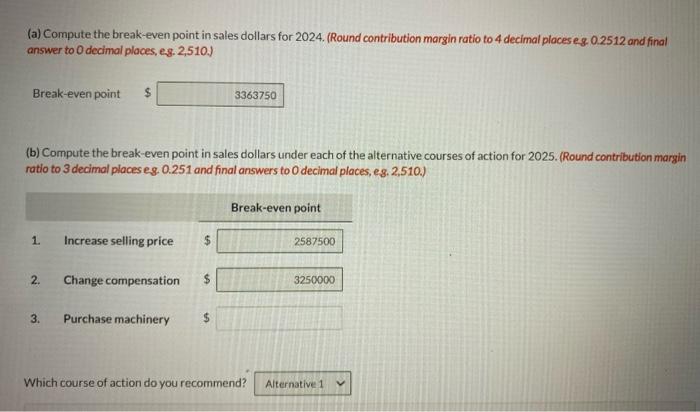

Wildhorse inc had a bad year in 2024. For the first time in its history, it operated at a loss. The company's income staternent showed the following results from selling 104,000 units of product net sales $2,600,000; total costs and expenses $2,905,500; and net los5 $305,500. Costs and expenses consisted of the following. Management is considering the following independent alternatives for 2025. 1. Increase unit selling price 25% with no change in costs and expenses. 2. Change the compensation of salespersons from foxed annual salaries totaling $260,000 to total salaries of $52,000 plus a.5\% commission on net sales. 3. Purchase new high-tech factory machinery that will change the proportion between variable and foxed cost of goods sold to 50:50. (a) Compute the break-even point in sales dollars for 2024. (Round contribution margin ratio to 4 decimal places eg. 0.2512 and final answer to 0 decimal places, eg. 2,510.) Break-even point (b) Compute the break even point in sales dollars under each of the altemative courses of action for 2025, (Round contribution margin rotio to 3 decimal placese 8,0.251 and final onswers to 0 decimal ploces, e.8. 2,510.) (a) Compute the break-even point in sales dollars for 2024 . (Round contribution margin ratio to 4 decimal places eg. 0.2512 and final answer to 0 decimal places, es. 2,510.) Break-even point (b) Compute the break-even point in sales dollars under each of the alternative courses of action for 2025. (Round contribution margin ratio to 3 decimal placeseg. 0.251 and final answers to 0 decimal places, eg. 2,510.) Which course of action do you recommend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started