Answered step by step

Verified Expert Solution

Question

1 Approved Answer

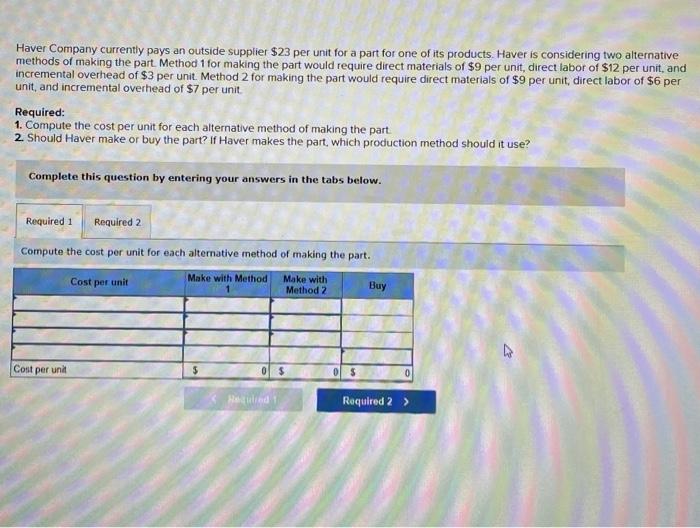

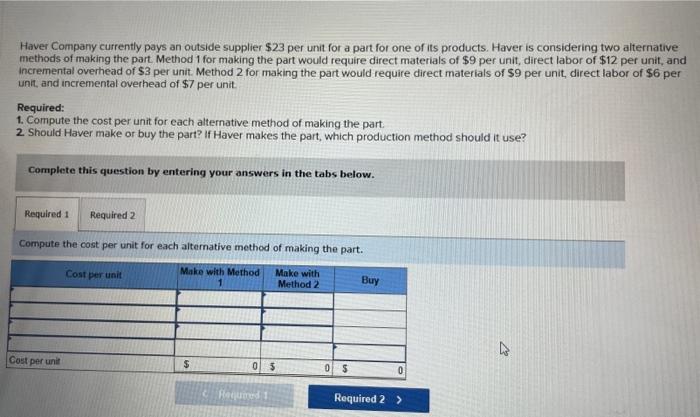

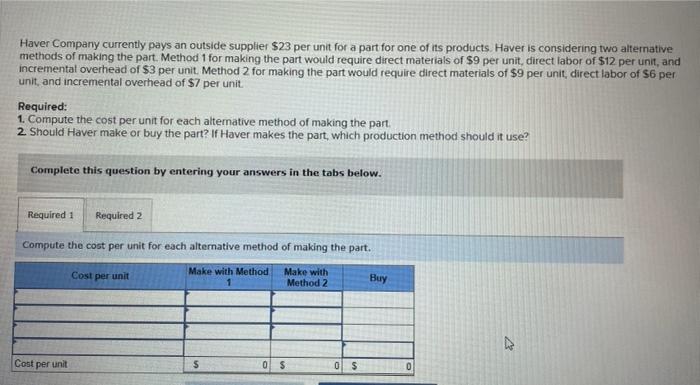

ch 23. #2 please answer clearly according to the boxes:) Haver Company currently pays an outside supplier $23 per unit for a part for one

ch 23. #2 please answer clearly according to the boxes:)

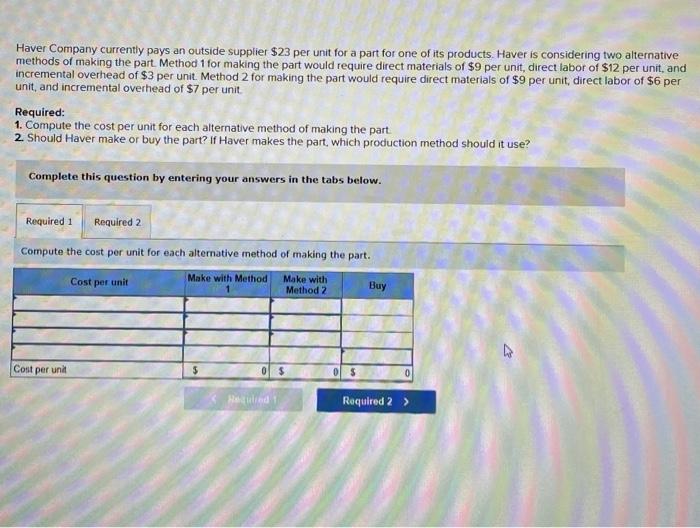

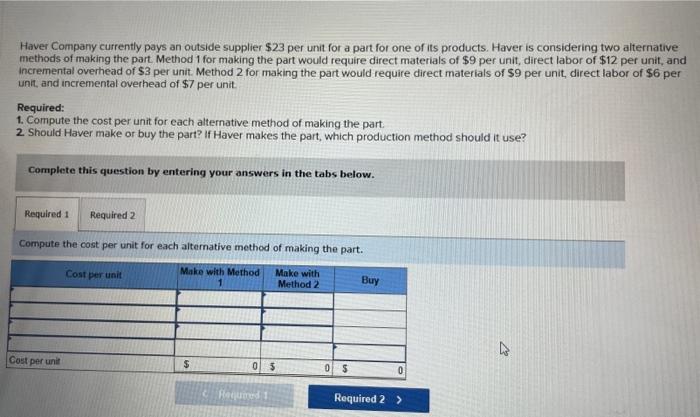

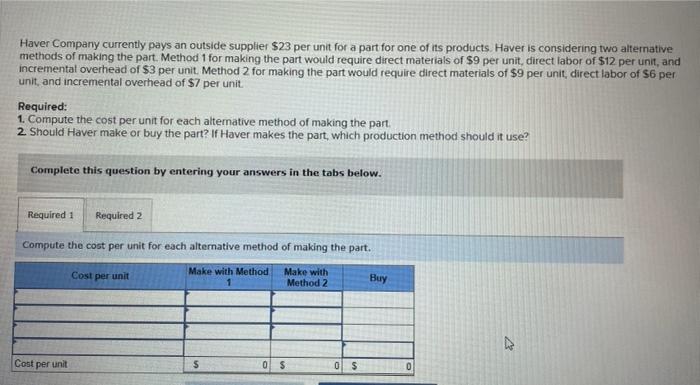

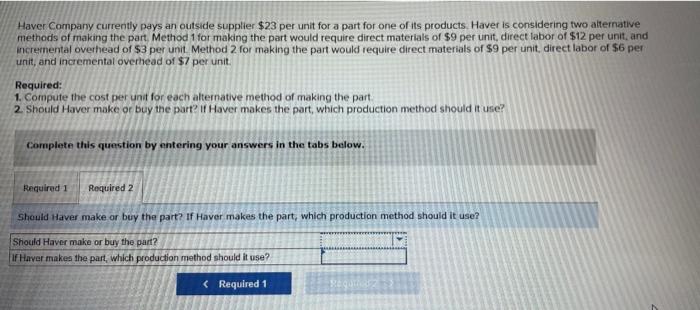

Haver Company currently pays an outside supplier $23 per unit for a part for one of its products. Haver is considering two alternative methods of making the part. Method 1 for making the part would require direct materials of $9 per unit, direct labor of $12 per unit, and incremental overhead of $3 per unit. Method 2 for making the part would require direct materials of $9 per unit, direct labor of $6 per unit, and incremental overhead of $7 per unit Required: 1. Compute the cost per unit for each alternative method of making the part 2. Should Haver make or buy the part? If Haver makes the part, which production method should it use? Complete this question by entering your answers in the tabs below. Compute the cost per unit for each alternative method of making the part. Haver Company currently pays an outside supplier $23 per unit for a part for one of its products. Haver is considering two alternative methods of making the part. Method 1 for making the part would require direct materials of $9 per unit, direct labor of $12 per unit, and incremental overhead of $3 per unit. Method 2 for making the part would require direct materials of $9 per unit, direct labor of $6 per unit, and incremental overhead of $7 per unit Required: 1. Compute the cost per unit for each alternative method of making the part 2. Should Haver make or buy the part? If Haver makes the part, which production method should it use? Complete this question by entering your answers in the tabs below. Compute the cost per unit for each alternative method of making the part. Haver Company currently pays an outside supplier $23 per unit for a part for one of its products. Haver is considering two alternative methods of making the part. Method 1 for making the part would require direct materials of $9 per unit, direct labor of $12 per unit, and incremental overhead of $3 per unit. Method 2 for making the part would require direct materials of $9 per unit, direct labor of $6 per unit, and incremental overhead of $7 per unit. Required: 1. Compute the cost per unit for each alternative method of making the part. 2. Should Haver make or buy the part? If Haver makes the part, which production method should it use? Complete this question by entering your answers in the tabs below. Compute the cost per unit for each alternative method of making the part. Haver Company currently pays an outside supplier $23 per unit for a part for one of its products. Haver is considering two alternative methods of making the part. Method 1 for making the part would require direct materials of $9 per unit, direct labor of $12 per unit, and incremnental overhead of $3 per unit Method 2 for making the part would require direct materials of $9 per unit, direct labor of $6 per unit, and incremental overhead of $7 per unit. Required: 1. Compute the cost per unit for each alternative method of making the part 2. Should Haver make or buy the part? If Haver makes the part, which production method should it use? Complete this question by entering your answers in the tabs below. Should Haver make or buy the part? If Haver makes the part, which production method should it use

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started