Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ch 7 Q 8,9 Required information [The following information applies to the questions displayed below.] New Deli is in the process of closing its operations.

Ch 7 Q 8,9

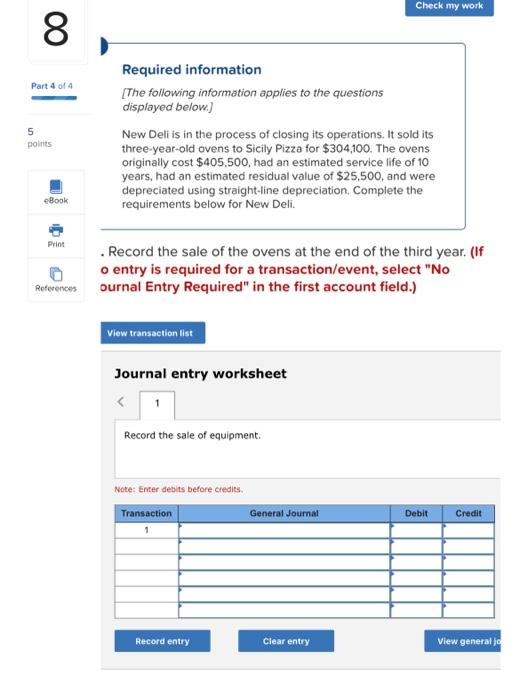

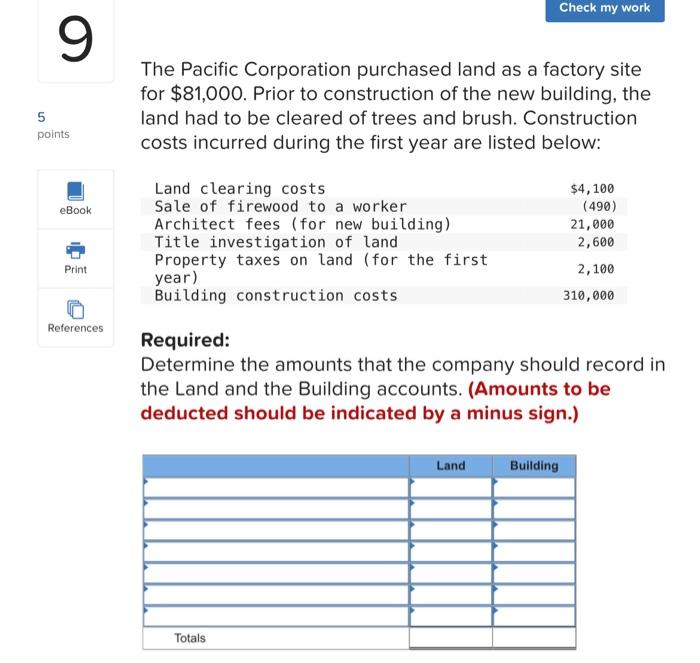

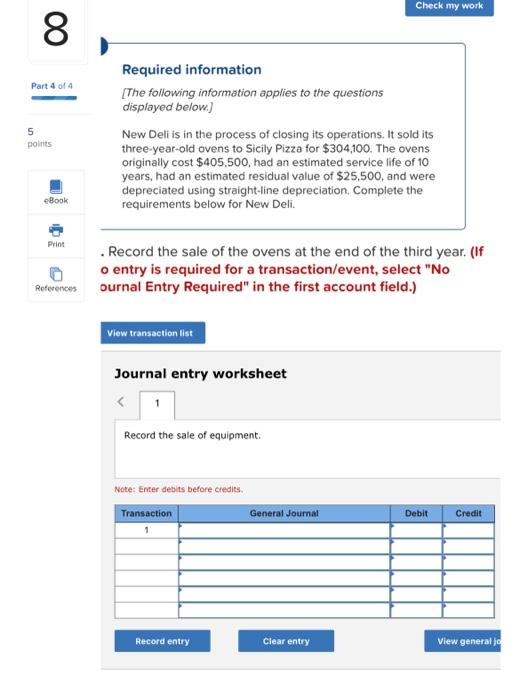

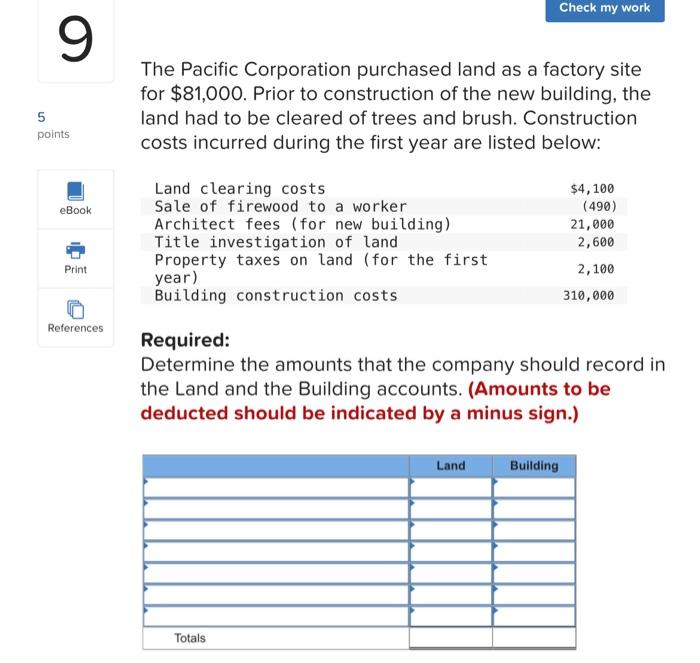

Required information [The following information applies to the questions displayed below.] New Deli is in the process of closing its operations. It sold its three-year-old ovens to Sicily Pizza for $304,100. The ovens originally cost $405,500, had an estimated service life of 10 years, had an estimated residual value of $25,500, and were depreciated using straight-line depreciation. Complete the requirements below for New Deli. . Record the sale of the ovens at the end of the third year. (If o entry is required for a transaction/event, select "No ournal Entry Required" in the first account field.) Journal entry worksheet Record the sale of equipment. Note: Enter debits before credies. The Pacific Corporation purchased land as a factory site for $81,000. Prior to construction of the new building, the land had to be cleared of trees and brush. Construction costs incurred during the first year are listed below: Required: Determine the amounts that the company should record in the Land and the Building accounts. (Amounts to be deducted should be indicated by a minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started