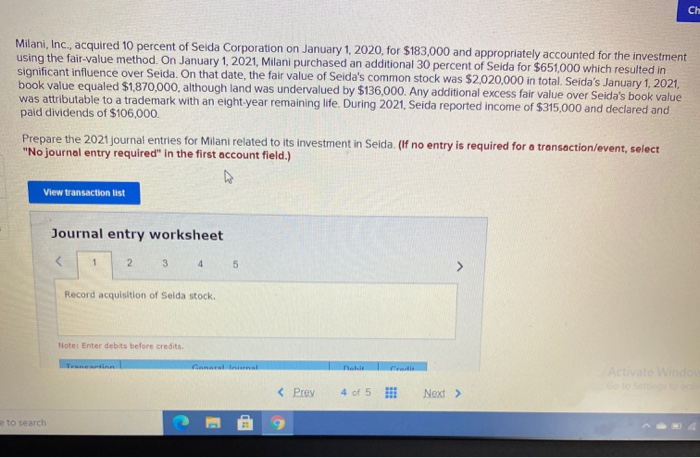

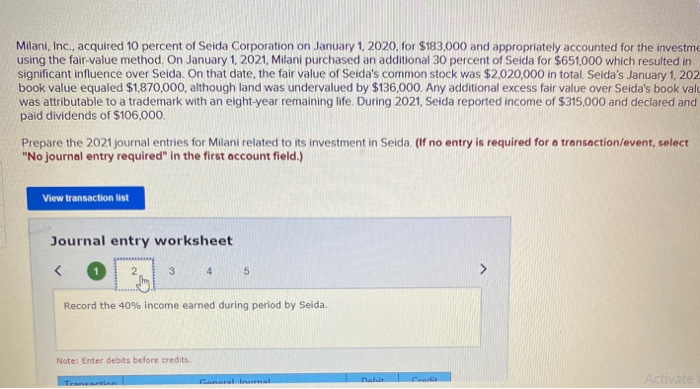

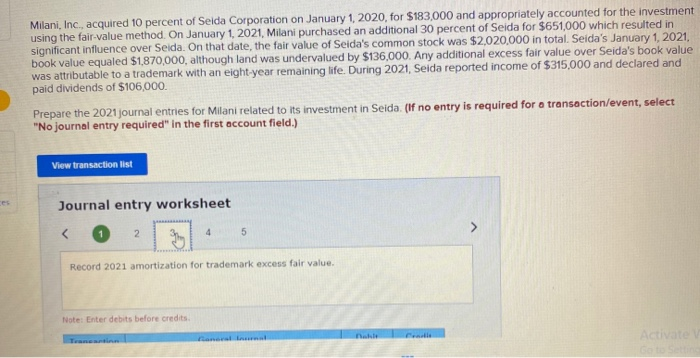

Ch Milani, Inc., acquired 10 percent of Selda Corporation on January 1, 2020, for $183,000 and appropriately accounted for the investment using the fair-value method. On January 1, 2021, Milani purchased an additional 30 percent of Seida for $651,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,020,000 in total. Seida's January 1, 2021. book value equaled $1,870,000, although land was undervalued by $136,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $315,000 and declared and paid dividends of $106,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 Record acquisition of Selda stock, Note Enter debits before credits Corte Activate Windo e to search 9 Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $183,000 and appropriately accounted for the investme using the fair-value method On January 1, 2021, Milani purchased an additional 30 percent of Seida for $651,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,020,000 in total. Seida's January 1, 202 book value equaled $1,870,000, although land was undervalued by $136,000. Any additional excess fair value over Seida's book valu was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $315,000 and declared and paid dividends of $106,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 3 4 5 Record the 40% income earned during period by Seida. Note: Enter debits before credits nahit Activate Tranet Milani, Inc., acquired 10 percent of Seida Corporation on January 1, 2020, for $183,000 and appropriately accounted for the investment using the fair value method On January 1, 2021, Milani purchased an additional 30 percent of Seida for $651,000 which resulted in significant influence over Seida. On that date, the fair value of Seida's common stock was $2,020,000 in total. Seida's January 1, 2021, book value equaled $1,870,000, although land was undervalued by $136,000. Any additional excess fair value over Seida's book value was attributable to a trademark with an eight-year remaining life. During 2021, Seida reported income of $315,000 and declared and paid dividends of $106,000. Prepare the 2021 journal entries for Milani related to its investment in Seida. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet