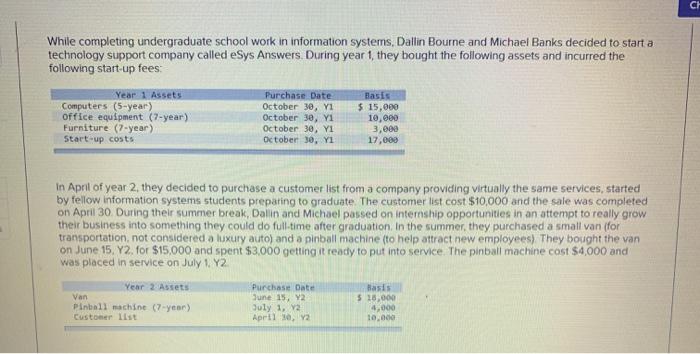

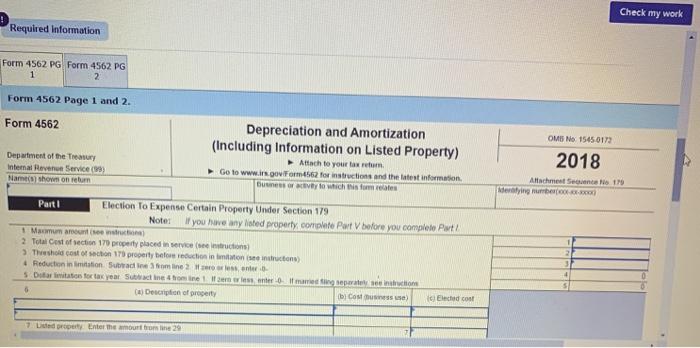

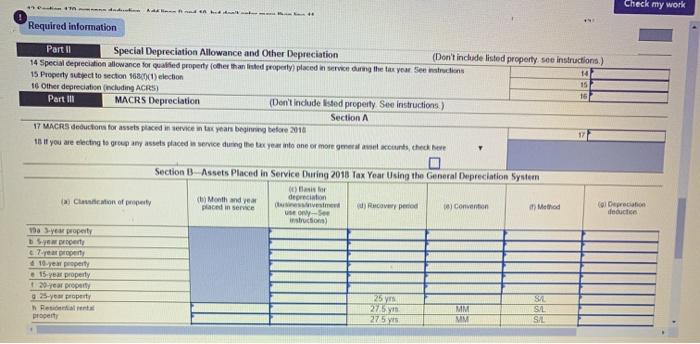

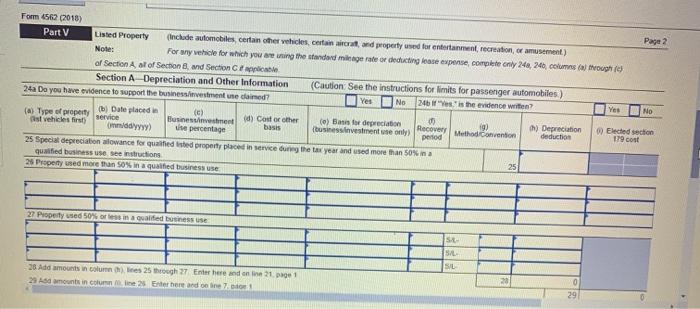

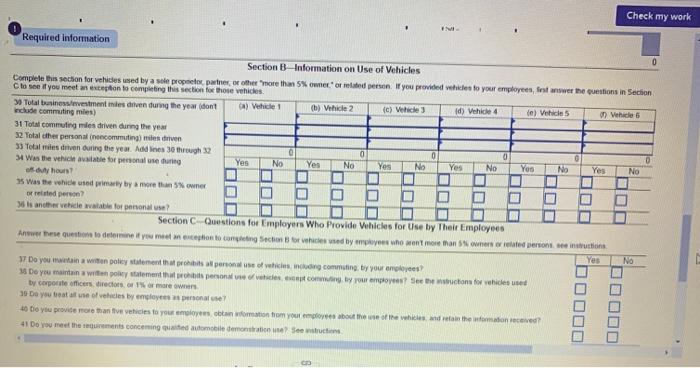

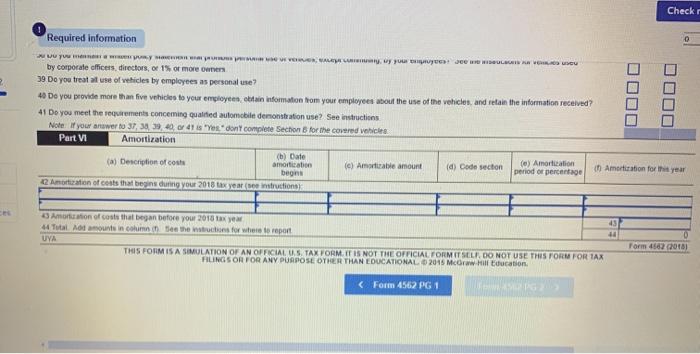

CH While completing undergraduate school work in information systems, Dallin Bourne and Michael Banks decided to start a technology support company called eSys Answers During year 1, they bought the following assets and incurred the following start-up fees Year 1 Assets Computers (5-year) office equipment (7-year) Furniture (7-year) Start-up costs Purchase Date October 30, YA October 30, Y1 October 30, 71 October 30, Y1 Basis $ 15,000 10,000 3,000 17,000 In April of year 2. they decided to purchase a customer list from a company providing virtually the same services, started by fellow information systems students preparing to graduate The customer list cost $10,000 and the sale was completed on April 30 During their summer break, Dalin and Michael passed on internship opportunities in an attempt to really grow their business into something they could do full-time after graduation in the summer, they purchased a small van (for transportation, not considered a luxury auto) and a pinball machine (to help attract new employees) They bought the van on June 15, Y2 for $15,000 and spent $3.000 getting it ready to put into service. The pinball machine cost $4,000 and was placed in service on July 1 Y2 Year 2 Assets van Pinball machine (7-year) Customer list Purchase Date June 15, Y2 July 1, V2 April, Y2 $ 18,000 4,000 10,000 Check my work Required information Form 4562 PG Form 4562 PG Form 4562 Page 1 and 2. Form 4562 OMIS No 15450172 Department of the Treaty Internal Revenue Service (3) Name() shown on rebom Depreciation and Amortization (Including Information on Listed Property) Attach to your tax return Go to www.its govForm4562 for instructions and the latest information Business or active to which this formats 2018 Altachment Sect19 Mening bero. Parti Election To Expense Certain Property Under Section 179 Note: you have any lated property.complete Port V before you complete Put! 1 Maumum amount 2 Total Cost of section 17 properly placed in servicios Threshold cost of section 17 property before reduction in mostractions) . Reduction in motion sur le line 2 S.Dariation for tax your Sutine bonne femme mangepast 0 Description of property by CoM) Elected cool 7. Led property Enter the amount bromine 29 - A Check my work Required information Part II Special Depreciation Allowance and Other Depreciation (Don't include listed property see instructions) 14 Special depreciation allowance for qualified property (other than shed properly placed in service during the tax your Seestructions 14 15 Property subject to section 1681) election 16 Other depreciation (including ACRS) 16 Part II MACRS Depreciation (Don't include listed property Sie instructions.) Section A 17 MACRS deductions for assets placed in service in tax years being before 2013 10 it you are electing to group any assets placed service dunng the wax year into one or more get it sounds, check here 15 Section B Assets Placed in Service During 2018 Tax Year Using the General Depreciation System Cooperly Month and year placed in service depreciation vestment - 5 struction ROW period Convention Method Cal Depreciation douch 100 year property DS 7. pro 19. property 15. property g 25-year property Retina property 27. 275 yrs MM MM SAL SL SAL Form 4562 (2018) Page 2 Part V Listed Property Inchade automobiles, certain the vehicles, certain and property wned for entertainment, recreation, or amusement) Note: For any vehicle for which you are using the standard mileage rate ordeducting late expense complete only 24, 24, comes through of Section A al of Section and Section Coplicable Section A Depreciation and Other Information (Caution: See the instructions for limits for passenger automobiles) 24a Do you have evidence to support the businessivement une med? Yes No 2 is the evidence with Yes NO (a) Type of property Date placed in (e) Asl vehicles first service Businessinvestment Cost of other (o) Bait depreciation 19) mddyyyy) () Depreciation Elected section basis Recovery e percentage business investment use only) period Method Convention deduction 119 cont 25 Special depreciation allowance for qualified sted property invice in the tax year and used more than 50na qualified business use. See instructions 25 25 Property used more than 50% in a qualified business use 27 Property used 50% on alfed business SE SAL SIL 26 Add amounts in Column lines 25 through 27 Ene here and online 21 page 1 29 Amounts in Column line 25 Enter here and one 29 Check my work Required information 0 Section B-Information on Use of Vehicles Complete this section for vehicles used by a sole proper partner or other more than 5% owner or related person. If you provided Vehicles to your employees, swer the questions in Section Cto see if you meet exception to completing this section for those vehicles Total business wivestment les diven during the year dont A) Vehicle (b) Vehicle 2 c) Vehicle nude commuting miles) Id) Vehicle 4 fe) Vehicles Vehicles 31 Total commuting me driven during the year 32 Total other personal commuting) miles driven 33 Total miles driven during the year. Addins 30 through 32 0 34 Was the vehichavaatle for personal use during Yes No Yes No Yes No Yes No Yos No Yes No duty hours Was the vehicle se primary by more than 5% une or related person 35 is another vehicle watable for personal use? Section C Questions for Employers Who Provide Vehicles for Use by Their Employees Anwwel hese question to determine if you need an exception to conting Section Breed by yes no more than Serielated persons induction Yes NO 37 Do you mean a ten polietilen hat his personal use of vehicles incong commuting by your employees 3. Do you maintain a written pokey statement that his personal de Comey your employees? See the moutons for vehicles used by corporate officers, directors or 1 or more owners 30 Do you treat e vehicles by emless personal use? Do you provide more than five vehicles to your molesta formation from your employees about the use of the whicles and find the formation received 41 Do you meet the requirements concering quite automobile demonstration Seri DO DOO DOD DO DO0 DO000 DODDO Checkr 2 Required information - your worra Jee BULI. CU by corporate officers, directors, of 1% or more owners 39 Do you treat al use of vehicles by employees as personal use? 4 Do you provide more than five vehicles to your employees obtain information from your employees about the use of the vehicles, and retain the information received 41 Do you meet the requirements concering qualified automobile demonstration use? See instructions Note your answer to 37 38 39 40 41 is 'Yes con complete Section for the covered vehicles Part VI Amortization (b) Date (a) Description of com amortization (e) Amortable amount (d) Code section (o) Amortization begin period of percentage Anotation of costs that begins during your 2018 tax yearstructions UDD UDOO Amortization for this year Amon of costs that began before your 2018 year Tutal Arts in column see the res for where to report UYA THIS FORM IS A SIMULATION OF AN OFFICIALUS TAX FORM. IT IS NOT THE OFFICIAL FORMITSELF, DO NOT USE THIS FORM FOR 1AX FILINGSOR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2015 McOww.ulf Education Form 4802016) ( Form 4562 PG 1