Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ch.17 q 2 Ch 17: Assignment - Multinational Financial Management Suppose an American investor is given the current exchange rates in the following table. The

ch.17 q 2

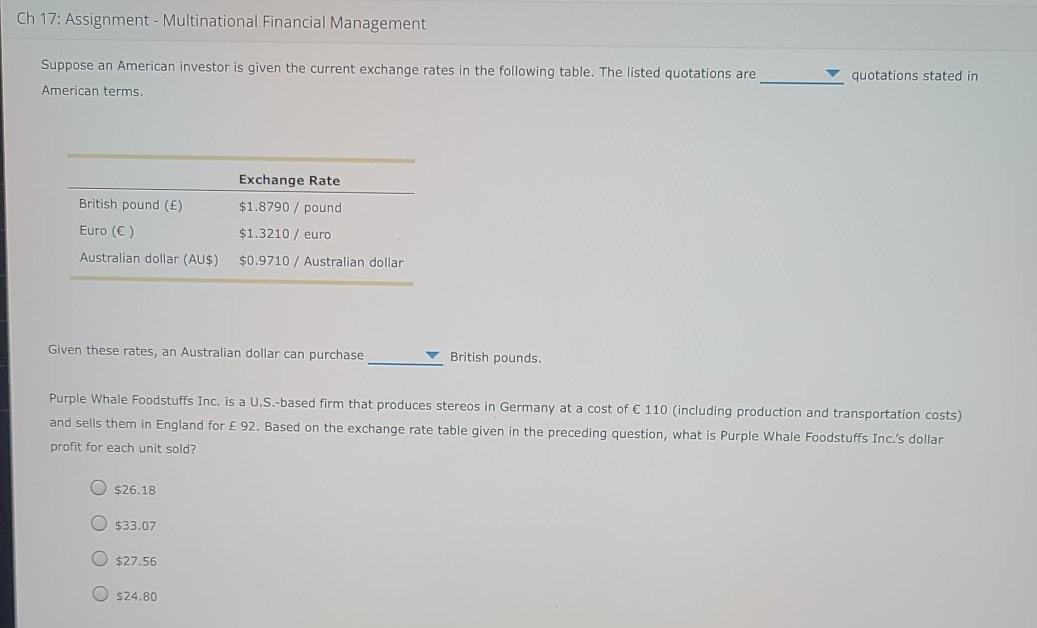

Ch 17: Assignment - Multinational Financial Management Suppose an American investor is given the current exchange rates in the following table. The listed quotations are quotations stated in American terms. Exchange Rate British pound (E) $1.8790 / pound Euro () $1.3210 / euro Australian dollar (AU$) $0.9710 / Australian dollar Given these rates, an Australian dollar can purchase British pounds. Purple Whale Foodstuffs Inc. is a U.S.-based firm that produces stereos in Germany at a cost of C 110 (including production and transportation costs) and sells them in England for 92. Based on the exchange rate table given in the preceding question, what is Purple Whale Foodstuffs Inc.'s dollar profit for each unit sold? O $26.18 O $33.07 O $27.56 O $24.80Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started