Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CH4 1. Define cash and cash equivalents - Discussion page 184 - 2. You will need to be able to do a bank reconciliation. Study

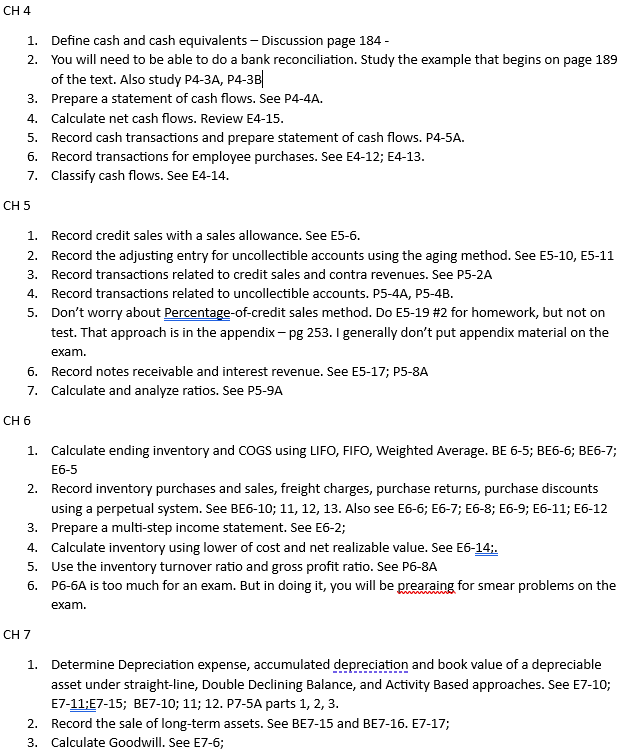

CH4 1. Define cash and cash equivalents - Discussion page 184 - 2. You will need to be able to do a bank reconciliation. Study the example that begins on page 189 of the text. Also study P4-3A, P4-3B 3. Prepare a statement of cash flows. See P4-4A. 4. Calculate net cash flows. Review E4-15. 5. Record cash transactions and prepare statement of cash flows. P4-5A. 6. Record transactions for employee purchases. See E4-12; E4-13. 7. Classify cash flows. See E4-14. 5 1. Record credit sales with a sales allowance. See E5-6. 2. Record the adjusting entry for uncollectible accounts using the aging method. See E5-10, E5-11 3. Record transactions related to credit sales and contra revenues. See P5-2A 4. Record transactions related to uncollectible accounts. P5-4A, P5-4B. 5. Don't worry about Percentage-of-credit sales method. Do E5-19 \#2 for homework, but not on test. That approach is in the appendix - pg 253. I generally don't put appendix material on the exam. 6. Record notes receivable and interest revenue. See E5-17; P5-8A 7. Calculate and analyze ratios. See P5-9A CH6 1. Calculate ending inventory and COGS using LIFO, FIFO, Weighted Average. BE 6-5; BE6-6; BE6-7; E6-5 2. Record inventory purchases and sales, freight charges, purchase returns, purchase discounts using a perpetual system. See BE6-10; 11, 12, 13. Also see E6-6; E6-7; E6-8; E6-9; E6-11; E6-12 3. Prepare a multi-step income statement. See E6-2; 4. Calculate inventory using lower of cost and net realizable value. See E6-14; 5. Use the inventory turnover ratio and gross profit ratio. See P68A 6. P6-6A is too much for an exam. But in doing it, you will be prearaing for smear problems on the exam. 7 1. Determine Depreciation expense, accumulated depreciation and book value of a depreciable asset under straight-line, Double Declining Balance, and Activity Based approaches. See E7-10; E7-11;E7-15; BE7-10; 11; 12. P7-5A parts 1, 2, 3. 2. Record the sale of long-term assets. See BE7-15 and BE7-16. E7-17; 3. Calculate Goodwill. See E7-6

CH4 1. Define cash and cash equivalents - Discussion page 184 - 2. You will need to be able to do a bank reconciliation. Study the example that begins on page 189 of the text. Also study P4-3A, P4-3B 3. Prepare a statement of cash flows. See P4-4A. 4. Calculate net cash flows. Review E4-15. 5. Record cash transactions and prepare statement of cash flows. P4-5A. 6. Record transactions for employee purchases. See E4-12; E4-13. 7. Classify cash flows. See E4-14. 5 1. Record credit sales with a sales allowance. See E5-6. 2. Record the adjusting entry for uncollectible accounts using the aging method. See E5-10, E5-11 3. Record transactions related to credit sales and contra revenues. See P5-2A 4. Record transactions related to uncollectible accounts. P5-4A, P5-4B. 5. Don't worry about Percentage-of-credit sales method. Do E5-19 \#2 for homework, but not on test. That approach is in the appendix - pg 253. I generally don't put appendix material on the exam. 6. Record notes receivable and interest revenue. See E5-17; P5-8A 7. Calculate and analyze ratios. See P5-9A CH6 1. Calculate ending inventory and COGS using LIFO, FIFO, Weighted Average. BE 6-5; BE6-6; BE6-7; E6-5 2. Record inventory purchases and sales, freight charges, purchase returns, purchase discounts using a perpetual system. See BE6-10; 11, 12, 13. Also see E6-6; E6-7; E6-8; E6-9; E6-11; E6-12 3. Prepare a multi-step income statement. See E6-2; 4. Calculate inventory using lower of cost and net realizable value. See E6-14; 5. Use the inventory turnover ratio and gross profit ratio. See P68A 6. P6-6A is too much for an exam. But in doing it, you will be prearaing for smear problems on the exam. 7 1. Determine Depreciation expense, accumulated depreciation and book value of a depreciable asset under straight-line, Double Declining Balance, and Activity Based approaches. See E7-10; E7-11;E7-15; BE7-10; 11; 12. P7-5A parts 1, 2, 3. 2. Record the sale of long-term assets. See BE7-15 and BE7-16. E7-17; 3. Calculate Goodwill. See E7-6 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started