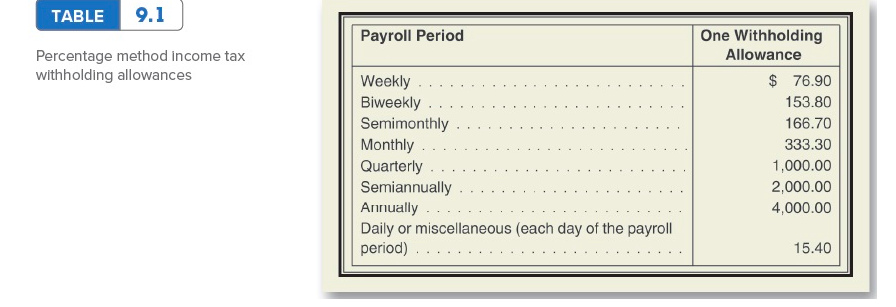

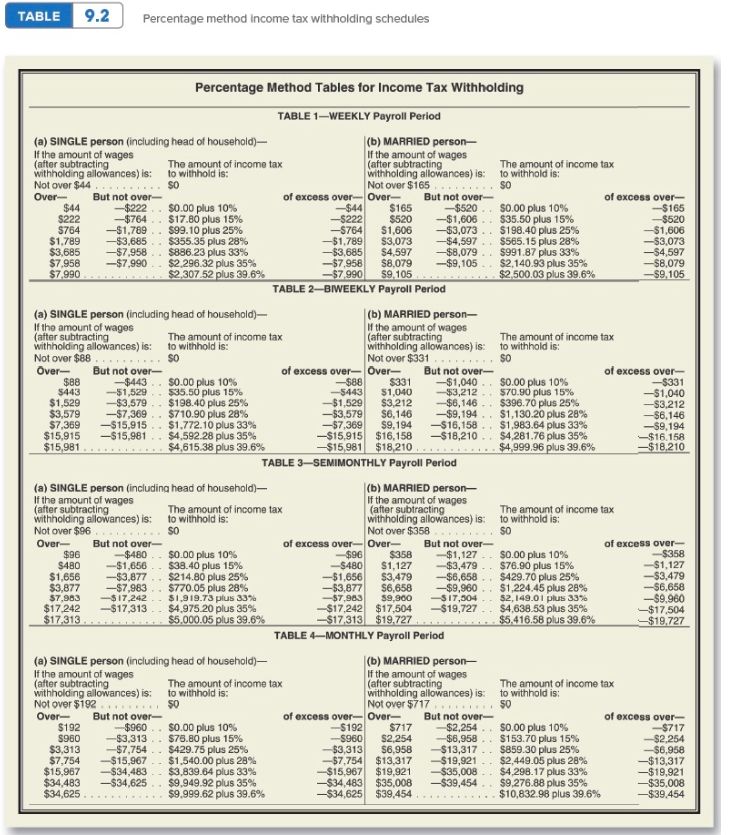

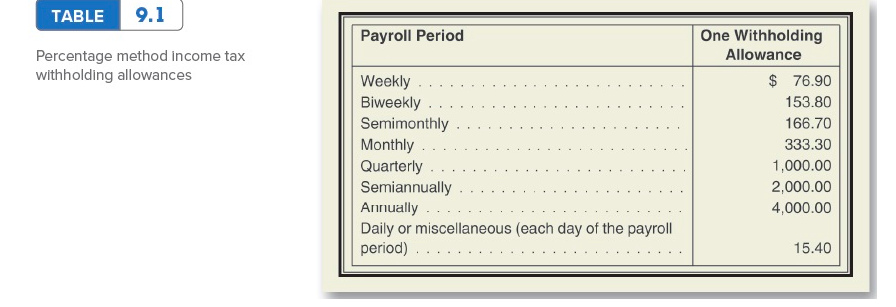

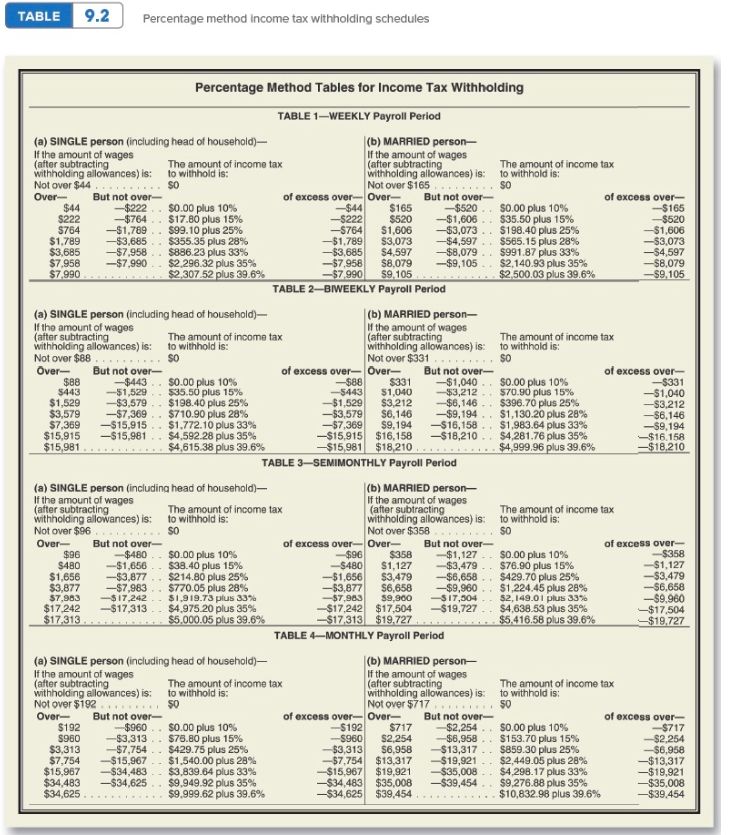

Challenge Problem 9-32 [LU 9-2 (1)] The San Bernardino County Fair hires about 150 people during fair time. Their wages range from $5.30 to $8.10. California has a state income tax of 9%. Sandy Denny earns $8.10 per hour; George Barney earns $5.30 per hour. They both worked 36 hours this week. Both are married; however, Sandy claims 2 exemptions and George claims 1 exemption. Assume a rate of 6.2% on $118,500 for Social Security and 1.45% for Medicare. a. What is Sandy's net pay after FIT, Social Security tax, state income tax, and Medicare have been taken out? Use the Table 9.1 and Table 9.2. (Round your answer to the nearest cent.) Sandy's net pay $ b. What is George's net pay after the same deductions? (Round your answer to the nearest cent.) George's net pay $ c. How much more is Sandy's net pay versus George's net pay? (Round your answer to the nearest cent.) Difference in net pay $ TABLE 9.1 Payroll Period Percentage method income tax withholding allowances Weekly .......... Biweekly ......... Semimonthly ........ Monthly ......... Quarterly. ................ ... . Semiannually ...................... Annually .......... Daily or miscellaneous (each day of the payroll period) ....................... One Withholding Allowance $ 76.90 153.80 166.70 333.30 1,000.00 2,000.00 4,000.00 15.40 TABLE 9.2 Percentage method income tax withholding schedules Percentage Method Tables for Income Tax Withholding TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $44..., Not over $165 ......... So Over But not over of excess over-Over- But not over- of excess over $44 -$222.. $0.00 plus 10% -$44 $165 -$520 .. $0.00 plus 10% -$165 $222 -$764 .. $17.80 plus 15% -$222 $520 -$1,606 .. $35.50 plus 15% -$520 $764 -$1,789 .. $99.10 plus 25% -S764 $1,606 -$3,073 . . $198.40 plus 25% -$1,606 $1,789 -$3,685 .. $355.35 plus 28% -$1,789 $3,073 -$4,597 .. $565.15 plus 28% -$3,073 $3,685 -$7.958 .. $886.23 plus 33% -$3,685 $4,597 -$8,079 .. $991.87 plus 33% -$4,597 $7.958 -$7,990 $2,296,32 plus 35% -$7.958 $8.079 -$9,105 $2,140.93 plus 35% -$8,079 $7.990 $2.307.52 plus 39.6% -$7.990 $9,105 . . $2.500.03 plus 39.6% -$9,105 TABLE 2-BIWEEKLY Payroll Period (a) SINGLE Person (including head of household) (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $88...... ... SO Not over $331 1. .SO Over But not over- of excess over-Over- But not over- of excess over- $88 -$443 .. $0.00 plus 10% $88 $331 -$1,040 .. $0.00 plus 10% -$331 $443 -$1,529 .. $35.50 plus 15% -5443 $1,040 $3,212 .. $70.90 plus 15% -$1,040 $1,529 -$3,579 .. $198.40 plus 25% -$1,529 $3,212 - $6,146 .. $396.70 plus 25% -$3.212 $3,579 -$7,369.. $710.90 plus 28% -$3,579 $6.146 $9,194.. $1,130.20 plus 28% -$6,146 $7,369 -$15,915 .. $1.772.10 plus 33% -$7,369 $9,194 -$16,158 . . $1,983.64 plus 33% -$9,194 $15,915 -$15,981 .. $4,592.28 plus 35% -$15,915 $16,158 -$18,210.. $4,281.76 plus 35% $16.158 $15,981..... . $4.615 38 plus 39.6% -$15,981 $18,210 ........ $4,999.96 plus 39.6% - $18,210 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) - (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $96. I SO Not over $358 ....... So Over But not over- of excess over-Over- But not over- of excess over- $96 -$480 .. $0.00 plus 10% $96 $358 -$1,127 .. $0.00 plus 10% -$358 $480 -$1,656 .. $38.40 plus 15% -$480 $1,127 -$3,479 .. $76.90 plus 15% -$1,127 $1,656 $3,877 .. $214.80 plus 25% -$1,656 $3,479 $6,658 .. $429.70 plus 25% -$3,479 $3,877 -$7,983 .. $770.05 plus 28% -$3,877 $6,658 -$9,960.. $1,224.45 plus 28% -$6,658 S7 983 -$17,242 - $1,919.73 plus 33% -57.983 99.900 S17,504 $2,149.01 plus 33% -$9.960 $17.242 -$17,313 .. $4.975 20 plus 35% -$17.242 $17.504 -$19,727 .. $4.638.53 plus 35% $17,504 $17,313 . . . . . . . . . . . . $5.000.05 plus 39.6% -$17,313 $19,727 .. ILL . 35.416.58 plus 39.6% >$19.727 TABLE 4-MONTHLY Payroll Period (a) SINGLE person (including head of household)- (b) MARRIED person- If the amount of wages If the amount of wages (after subtracting The amount of income tax (after subtracting The amount of income tax withholding allowances) is: to withhold is: withholding allowances) is: to withhold is: Not over $192 5 0 Not over $717 0 Over But not over- of excess over-Over But not over- of excess over- $192 $960.. $0.00 plus 10% -S192 $717 - $2,254 .. S0.00 plus 10% -$717 $960 -$3,313.. $75.80 plus 15% -$960 $2,254 - $6,958 . . $153.70 plus 15% -$2,254 $3,313 --$7,754 .. $429.75 plus 25% -$3,313 $6,958 -$13,317 .. $859.30 plus 25% -$6,958 $7,754 -$15,967 .. $1.540.00 plus 28% -$7,754 $13,317 -$19,921 .. $2,449.05 plus 28% -$13,317 $15.967 -$34,483 .. $3.839.64 plus 33% -$15.967 $19.921 -$35,008 .. $4,298.17 plus 33% -$19,921 $34,483 -$34,625 $9.949.92 plus 35% -$34,483 $35,008 -$39,454 .. $9,276.88 plus 35% -$35,008 $34,625 ............ $9.999.62 plus 39.6% -$34,625 $39,454 ............$10,832.98 plus 39.6% -$39.454