Answered step by step

Verified Expert Solution

Question

1 Approved Answer

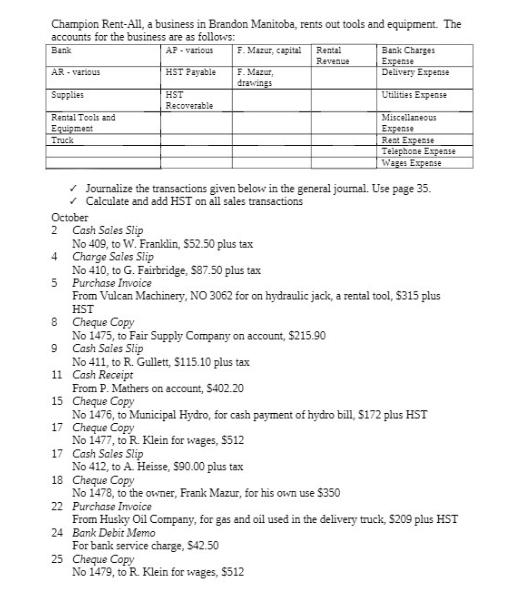

Champion Rent-All, a business in Brandon Manitoba, rents out tools and equipment. The accounts for the business are as follows: Bank AP - various

Champion Rent-All, a business in Brandon Manitoba, rents out tools and equipment. The accounts for the business are as follows: Bank AP - various AR-various Supplies Rental Tools and Equipment Truck 5 HST Payable HST Recoverable F. Mazur, capital F. Mazur, drawings 17 Cash Sales Slip No 409, to W. Franklin, $52.50 plus tax Charge Sales Slip Journalize the transactions given below in the general journal. Use p Calculate and add HST on all sales transactions October 2 4 No 410, to G. Fairbridge, $87.50 plus tax Purchase Invoice 8 Cheque Copy No 1475, to Fair Supply Company on account, $215.90 9 Cash Sales Slip 11 No 411, to R. Gullett, $115.10 plus tax Cash Receipt From P. Mathers on account, $402.20 Rental Revenue No 1477, to R. Klein for wages, $512 Cash Sales Slip From Vulcan Machinery, NO 3062 for on hydraulic jack, a rental tool, $315 plus HST No 412, to A. Heisse, $90.00 plus tax Bank Charges Expense Delivery Expense Utilities Expense Miscellaneous Expense Rent Expense 15 Cheque Copy No 1476, to Municipal Hydro, for cash payment of hydro bill, $172 plus HST Cheque Copy 17 18 Cheque Copy No 1478, to the owner, Frank Mazur, for his own use $350 22 Purchase Invoice 24 25 Cheque Copy Telephone Expense Wages Expense No 1479, to R. Klein for wages, $512 page 35. From Husky Oil Company, for gas and oil used in the delivery truck, $209 plus HST Bank Debit Memo For bank service charge, $42.50

Step by Step Solution

★★★★★

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer Cash Sale Slip No 409 Received payment for rental tool Debit Cash or Bank Account Credit Rent...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started