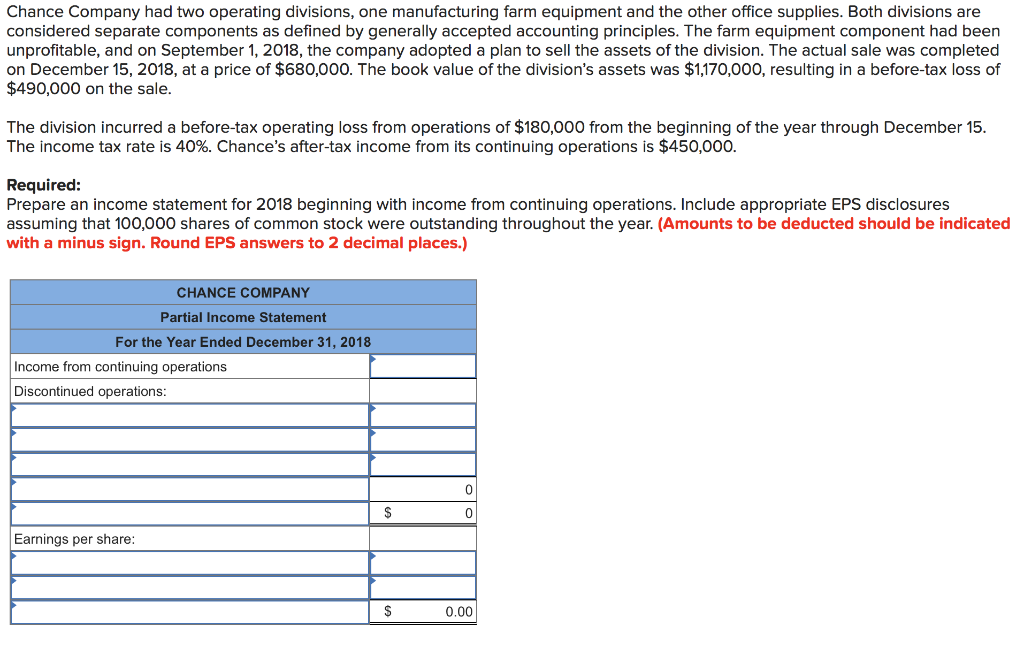

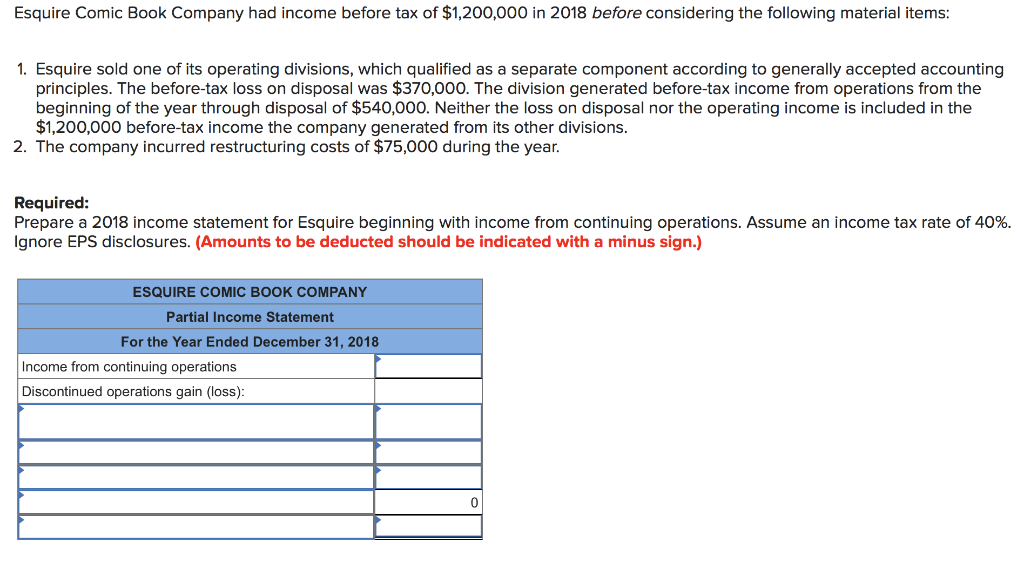

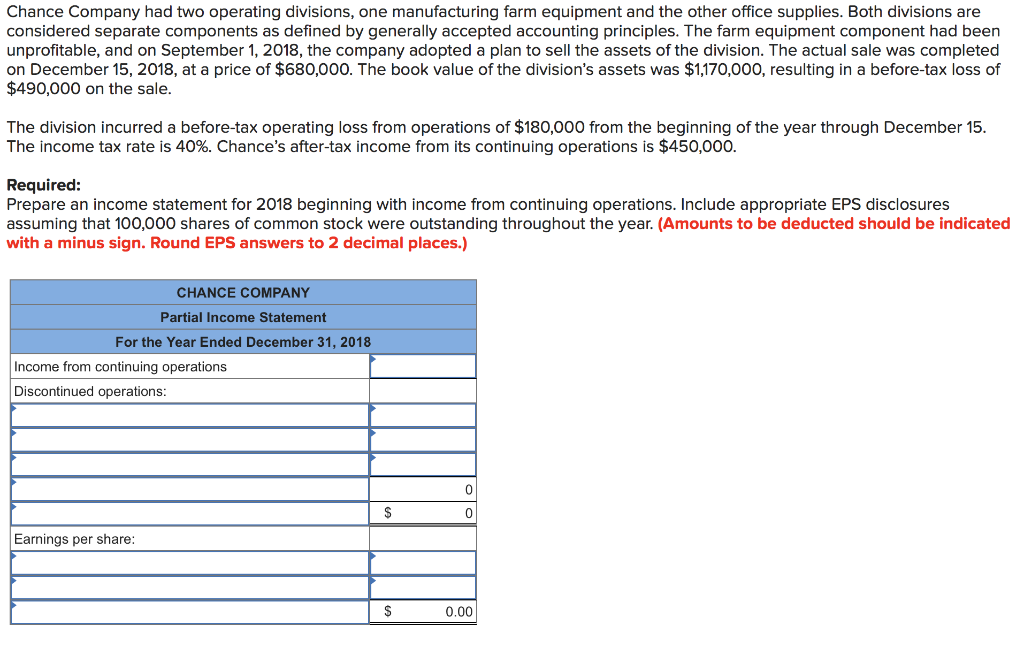

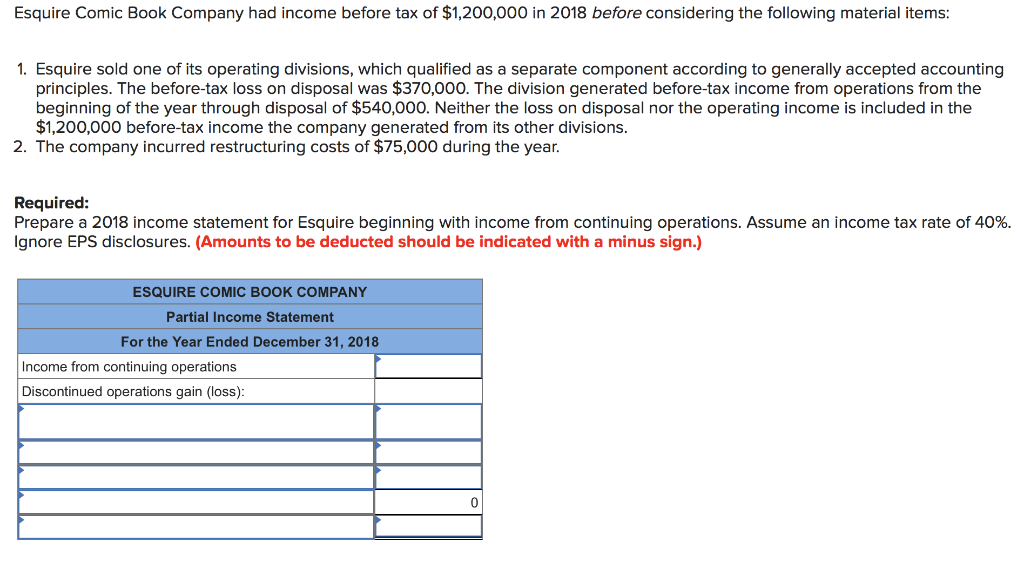

Chance Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are considered separate components as defined by generally accepted accounting principles. The farm equipment component had been unprofitable, and on September 1, 2018, the company adopted a plan to sell the assets of the division. The actual sale was completed on December 15, 2018, at a price of $680,000. The book value of the division's assets was $1,170,000, resulting in a before-tax loss of $490,000 on the sale. The division incurred a before-tax operating loss from operations of $180,000 from the beginning of the year through December 15. The income tax rate is 40%. Chance's after-tax income from its continuing operations is $450,000. Required: Prepare an income statement for 2018 beginning with income from continuing operations. Include appropriate EPS disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. (Amounts to be deducted should be indicated with a minus sign. Round EPS answers to 2 decimal places.) CHANCE COMPANY Partial Income Statement For the Year Ended December 31, 2018 Income from continuing operations Discontinued operations: 0 S Earnings per share: S 0.00 Esquire Comic Book Company had income before tax of $1,200,000 in 2018 before considering the following material items: 1. Esquire sold one of its operating divisions, which qualified as a separate component according to generally accepted accounting principles. The before-tax loss on disposal was $370,000. The division generated before-tax income from operations from the beginning of the year through disposal of $540,000. Neither the loss on disposal nor the operating income is included in the $1,200,000 before-tax income the company generated from its other divisions. 2. The company incurred restructuring costs of $75,000 during the year. Required: Prepare a 2018 income statement for Esquire beginning with income from continuing operations. Assume an income tax rate of 40% gnore EPS disclosures. (Amounts to be deducted shou ld be indicated with a minus sign.) ESQUIRE COMIC BOOK COMPANY Partial Income Statement For the Year Ended December 31, 2018 Income from continuing operations Discontinued operations gain (loss)