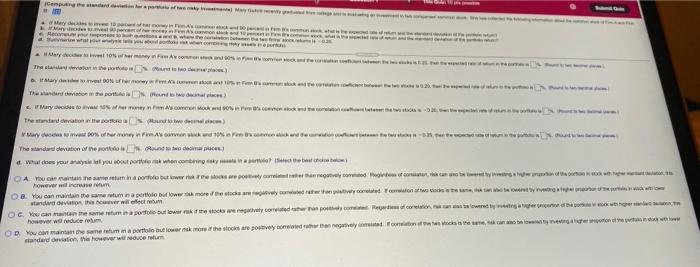

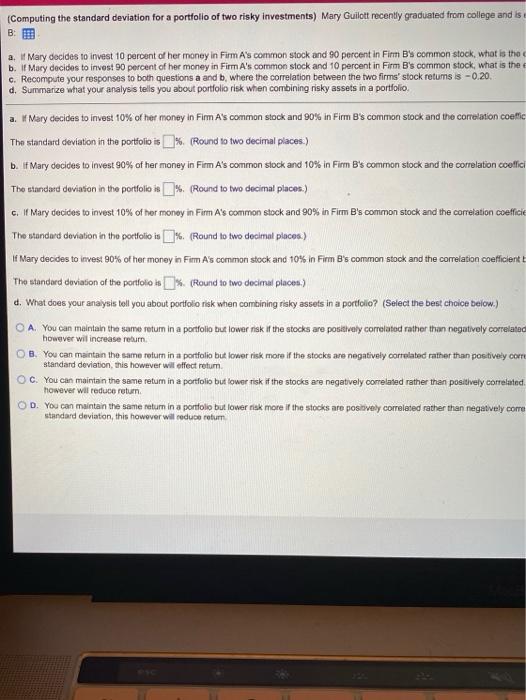

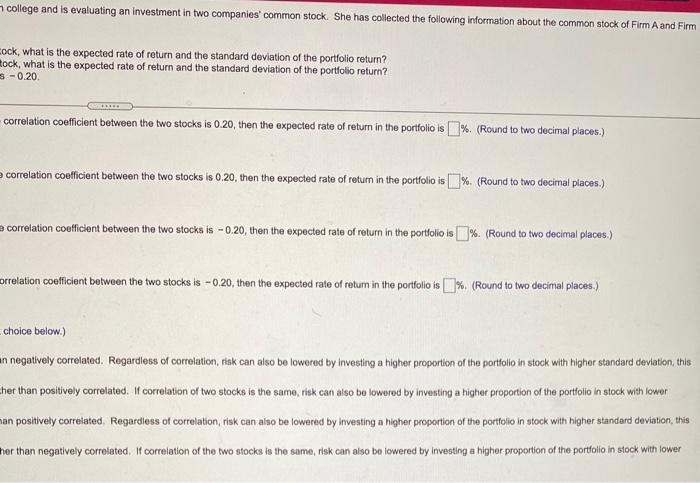

Chandi ... MA . wylos hermany income Theo y de estos y no se Mary to score incontro The word die Var desde o harmony FA kwa watu The mandard deviation of the root decepce What your ways of you cou por when combina che CA Y Gametumia prowwe to report any converge however will crease OB you can maintain the same tum in a portfolio Blower more commons ten te and the one will be Occan mancane wametumia pro budowarki wengively correo Recording however we reducere OD Y maranthe same ratum in sport but wernis motheses are pooled the games were standard deviation, this howeveducere (Computing the standard deviation for a portfolio of two risky investments, Mary Guilott recently graduated from college and is B: E a. I Mary decides to invest 10 percent of her money in Firm A's common stock and 90 percent in Fim By common stock, what is the b. if Mary decides to invest 90 percent of her money in Firm A's common stock and 10 percent in Firm B's common stock, what is the c. Recompute your responses to both questions a and b, where the correlation between the two firms' stock retums is -0.20 d. Summarize what your analysis tells you about portfolio risk when combining risky assets in a portfolio a. Mary decides to invest 10% of her money in Fim A's common stock and 90% in Firm B's common stock and the correlation coefic The standard deviation in the portfolio is 3% Round to two decimal places.) b. if Mary decides to invest 90% of her money in Fim A's common stock and 10% in Firm B's common stock and the correlation coeffici The standard deviation in the portfolio i %. (Round to two decimal places.) C. Mary decides to invest 10% of her money in Firm A's common stock and 90% in Firm B's common stock and the correlation coefficie The standard deviation in the portfolio is % (Round to two decimal places.) of Mary decides to invest 90% of her money in Fim A's common stock and 10% in Firm B's common stock and the correlation coefficient The standard deviation of the portfolio is % (Round to two decimal places) d. What does your analysis tell you about portfolio risk when combining risky assets in a portfolio? (Select the best choice below) CA. You can maintain the same retum in a portfolio but lower risk in the stocks are positively correlated rather than negatively correlated B. You can maintain tho samo return in a portfolio but lower risk more if the stocks are negatively correlated rather than positively corre standard deviation, this however wil effect return OC. You can maintain the same retum in a portfolio but lower risk if the stocks are negatively correlated rather than positively correlated however wil reduce return OD. You can maintain the same return in a portfolio but lower risk more if the stocks are positively correlated rather than negatvely como standard deviation, this however will reduce retum college and is evaluating an investment in two companies' common stock. She has collected the following information about the common stock of Firm A and Fim cock, what is the expected rate of return and the standard deviation of the portfolio return? Rock, what is the expected rate of return and the standard deviation of the portfolio return? 3-0.20 correlation coefficient between the two stocks is 0.20, then the expected rate of return in the portfolio is 3%. (Round to two decimal places.) correlation coefficient between the two stocks is 0.20, then the expected rate of return in the portfolio is %. (Round to two decimal places.) e correlation coefficient between the two stocks is -0.20, then the expected rate of return in the portfolio is % (Round to two decimal places.) Borrelation coefficient between the two stocks is -0.20, then the expected rate of return in the portfolio is % (Round to two decimal places.) choice below.) in negatively correlated. Regardless of correlation, risk can also be lowered by investing a higher proportion of the portfolio in stock with higher standard deviation, this her than positively correlated. If correlation of two stocks is the same, risk can also be lowered by investing a higher proportion of the portfolio in stock with lower han positively correlated. Regardless of correlation, risk can also be lowered by Investing a higher proportion of the portfolio in stock with higher standard deviation, this her than negatively correlated. If correlation of the two stocks is the same, risk can also be lowered by Investing a higher proportion of the portfolio in stock with lower Chandi ... MA . wylos hermany income Theo y de estos y no se Mary to score incontro The word die Var desde o harmony FA kwa watu The mandard deviation of the root decepce What your ways of you cou por when combina che CA Y Gametumia prowwe to report any converge however will crease OB you can maintain the same tum in a portfolio Blower more commons ten te and the one will be Occan mancane wametumia pro budowarki wengively correo Recording however we reducere OD Y maranthe same ratum in sport but wernis motheses are pooled the games were standard deviation, this howeveducere (Computing the standard deviation for a portfolio of two risky investments, Mary Guilott recently graduated from college and is B: E a. I Mary decides to invest 10 percent of her money in Firm A's common stock and 90 percent in Fim By common stock, what is the b. if Mary decides to invest 90 percent of her money in Firm A's common stock and 10 percent in Firm B's common stock, what is the c. Recompute your responses to both questions a and b, where the correlation between the two firms' stock retums is -0.20 d. Summarize what your analysis tells you about portfolio risk when combining risky assets in a portfolio a. Mary decides to invest 10% of her money in Fim A's common stock and 90% in Firm B's common stock and the correlation coefic The standard deviation in the portfolio is 3% Round to two decimal places.) b. if Mary decides to invest 90% of her money in Fim A's common stock and 10% in Firm B's common stock and the correlation coeffici The standard deviation in the portfolio i %. (Round to two decimal places.) C. Mary decides to invest 10% of her money in Firm A's common stock and 90% in Firm B's common stock and the correlation coefficie The standard deviation in the portfolio is % (Round to two decimal places.) of Mary decides to invest 90% of her money in Fim A's common stock and 10% in Firm B's common stock and the correlation coefficient The standard deviation of the portfolio is % (Round to two decimal places) d. What does your analysis tell you about portfolio risk when combining risky assets in a portfolio? (Select the best choice below) CA. You can maintain the same retum in a portfolio but lower risk in the stocks are positively correlated rather than negatively correlated B. You can maintain tho samo return in a portfolio but lower risk more if the stocks are negatively correlated rather than positively corre standard deviation, this however wil effect return OC. You can maintain the same retum in a portfolio but lower risk if the stocks are negatively correlated rather than positively correlated however wil reduce return OD. You can maintain the same return in a portfolio but lower risk more if the stocks are positively correlated rather than negatvely como standard deviation, this however will reduce retum college and is evaluating an investment in two companies' common stock. She has collected the following information about the common stock of Firm A and Fim cock, what is the expected rate of return and the standard deviation of the portfolio return? Rock, what is the expected rate of return and the standard deviation of the portfolio return? 3-0.20 correlation coefficient between the two stocks is 0.20, then the expected rate of return in the portfolio is 3%. (Round to two decimal places.) correlation coefficient between the two stocks is 0.20, then the expected rate of return in the portfolio is %. (Round to two decimal places.) e correlation coefficient between the two stocks is -0.20, then the expected rate of return in the portfolio is % (Round to two decimal places.) Borrelation coefficient between the two stocks is -0.20, then the expected rate of return in the portfolio is % (Round to two decimal places.) choice below.) in negatively correlated. Regardless of correlation, risk can also be lowered by investing a higher proportion of the portfolio in stock with higher standard deviation, this her than positively correlated. If correlation of two stocks is the same, risk can also be lowered by investing a higher proportion of the portfolio in stock with lower han positively correlated. Regardless of correlation, risk can also be lowered by Investing a higher proportion of the portfolio in stock with higher standard deviation, this her than negatively correlated. If correlation of the two stocks is the same, risk can also be lowered by Investing a higher proportion of the portfolio in stock with lower